Bank of America chief Brian Moynihan recently sat down with high-brow US chat show host Charlie Rose, saying among other things that he’d love to hold onto the helm of the second-largest US bank, by assets, for the rest of his life, according to Bloomberg:

“It’s the best job there is,” Moynihan said yesterday in an interview scheduled for public television’s “Charlie Rose” program. “While there have been times when you sit there and say, ‘Jeez, this is a lot of pounding,’ you always keep your eye on the purpose you’re here. And that’s to help people with their financial lives — if you really keep focused on that, I could do this the rest of my life.”

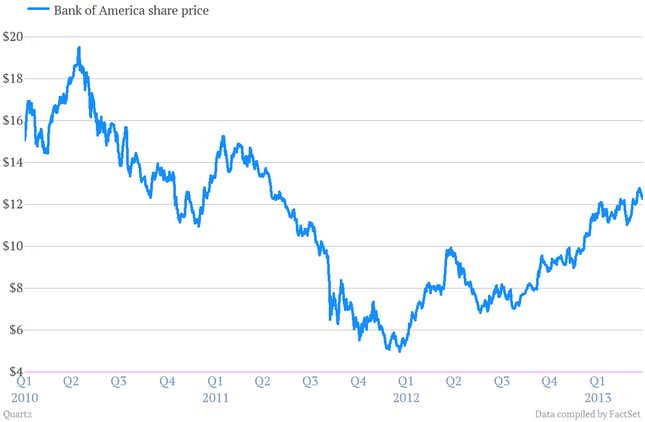

Shareholders may well feel differently. After all, since Moynihan took over Bank of America’s leadership on Jan. 1, 2010, the company’s shares are down roughly 19%.

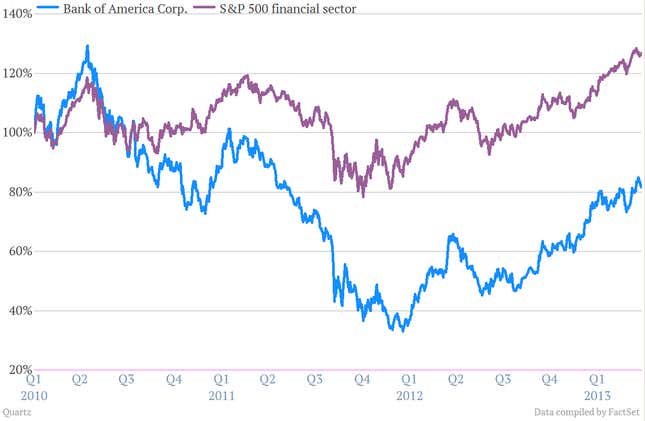

And that performance looks even worse when you compare it to competitors such as JP Morgan Chase, Wells Fargo, and Citigroup, whose shares are up 17%, 38%, and 25%, respectively, over the same period. Here’s a look at the stock prices—indexed to 100—through Tuesday’s close:

How about versus the financial sector more broadly? Same story. S&P 500 financials are up 27% during Moynihan’s tenure, compared to a 19% decline for BofA:

Now, in fairness, Mr. Moynihan is dealing with a lot of messes that were made before he took the top spot, such as BofA’s disastrous acquisition of dodgy mortgage lender Countrywide in the summer of 2008. Nearly five years later, Bank of America shareholders to continue to feel the pinch from those awful deals. In January BofA took charges of $2.7 billion related to a deal with government-owned mortgage giant Fannie Mae to settle disputes about bad mortgages it passed along to Fannie. And on top of that, there was the payment of $1.1 billion as part of a $8.5 billion multi-bank deal to settle government charges that they and other banks had wrongly foreclosed on homeowners in the aftermath of the financial crisis.

On the other hand, Moynihan was well within the inner circle at Bank of America as it made those terrible decisions during the boom years that preceded the crisis, holding key roles such as president of investment banking, general counsel and head of consumer banking before taking the top spot. So it’s not like he is completely uncontaminated by those strategic errors.