How?

It’s easy. The dollar.

The global flight to safety brought on by the results of the UK referendum—in which 52% voted to leave the EU—has driven up the value of the world’s ultimate safety asset, the US dollar. The greenback has surged against the pound, the euro, the Swiss franc, and the Australian and Canadian dollars. The Japanese yen—also viewed as a global safe haven asset—has risen by even more than the US dollar.

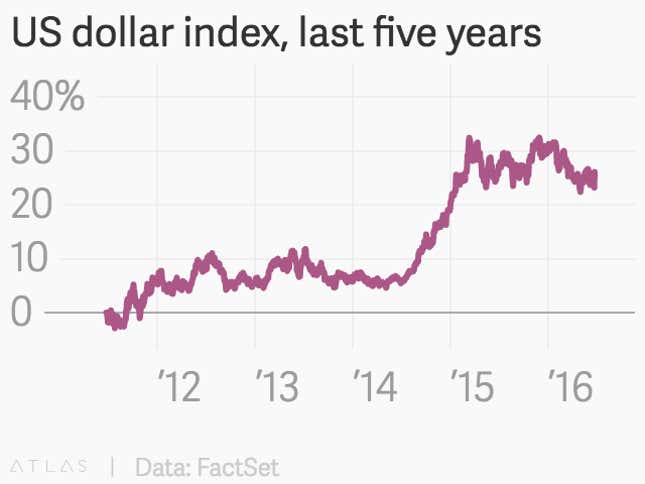

The surge today only adds to the strength of the US dollar, which has risen markedly over the last couple years, as US growth began to outpace that of Europe, and the Fed seemed to be closer to raising interest rates than central banks elsewhere. The US dollar index—which is somewhat weighted toward the euro—has risen roughly 20% over the last five years.

This can all seem very abstract, but it’s quite real for US manufacturers. The important, export-oriented sector has been hurt by the strength of the US dollar, resulting in some of the drags that we’ve seen recently in US job growth.

For the record, the strength of the dollar has been one of the main things that has kept the US Federal Reserve on hold. (If the Fed signaled it was ready to continue raising interest rates, it would strengthen the dollar more and further damage US exports.)

And after last night’s UK referendum results, the markets are seeing fewer and fewer reasons to expect the US central bank to lift interest rates any time soon.