China’s inflation rate dropped to 2.1% in March, a sharp drop from the previous month’s 3.2% and well below the government’s official target for the year. Despite the government’s efforts to stimulate the economy, Chinese consumers are refusing to spend as much money as the state wants them to.

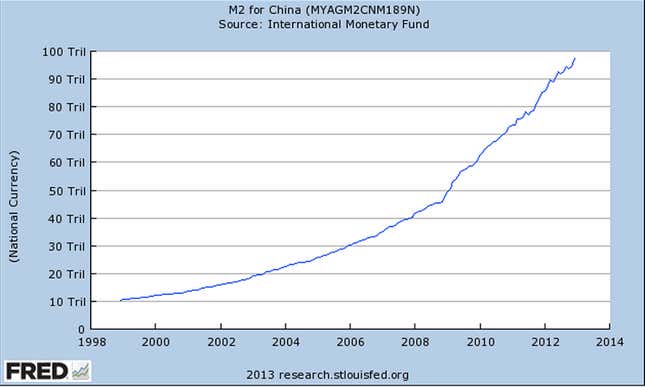

One main reason consumer prices fell so far: food prices declined. But more broadly, the inflation decline is surprising because China’s broad money supply is surging.

The drop in inflation is also a sign that China’s spending on infrastructure, which is powered by a massive credit boom, is not making its way into peoples’ pockets. Instead, money appears to be moving from government-backed banks to municipal governments to the state-owned enterprises that tend to pick up the lion’s share of new building work.

This government money-go-round burnishes GDP figures but does little to lift peoples’ living standards. China’s attempt to rebalance its economy by spurring consumer spending remains a far-off aspiration.