Europeans aren’t buying as many German goods as before. So now Germans must go shopping.

Germany’s export engine has been in need of a tune-up for a while. And the latest numbers out today showed German exports slipping 1.5% in February from the prior month and 2.8% from February 2012. This isn’t mystery, it’s geography. Most of Germany’s exports go to its European neighbors (although that share is shrinking). So with the rest of Europe mired in recession, demand for Germany’s high-quality manufactured goods has slipped.

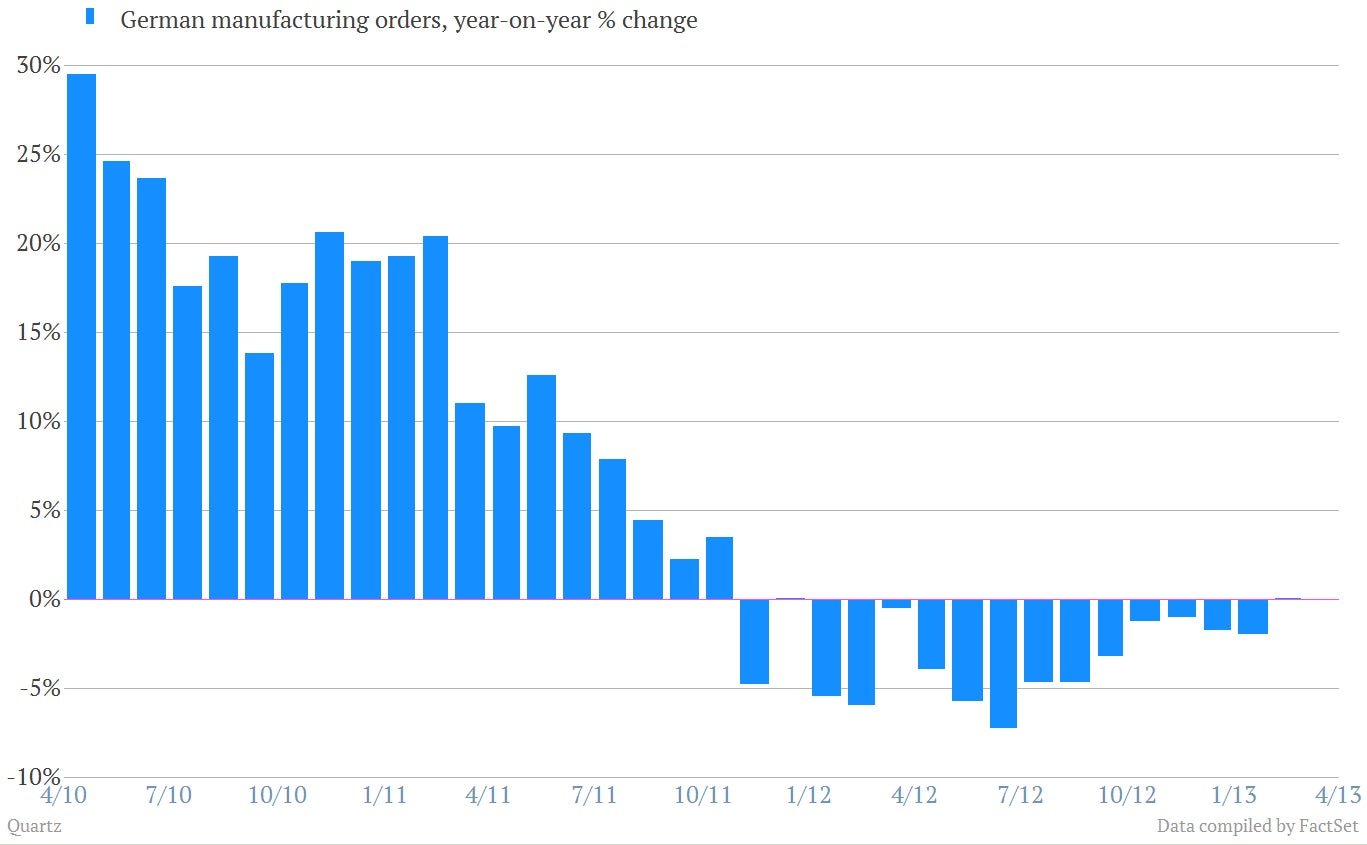

Germany’s export engine has been in need of a tune-up for a while. And the latest numbers out today showed German exports slipping 1.5% in February from the prior month and 2.8% from February 2012. This isn’t mystery, it’s geography. Most of Germany’s exports go to its European neighbors (although that share is shrinking). So with the rest of Europe mired in recession, demand for Germany’s high-quality manufactured goods has slipped.

Frankly, the weakness in German manufacturing has been visible for months.

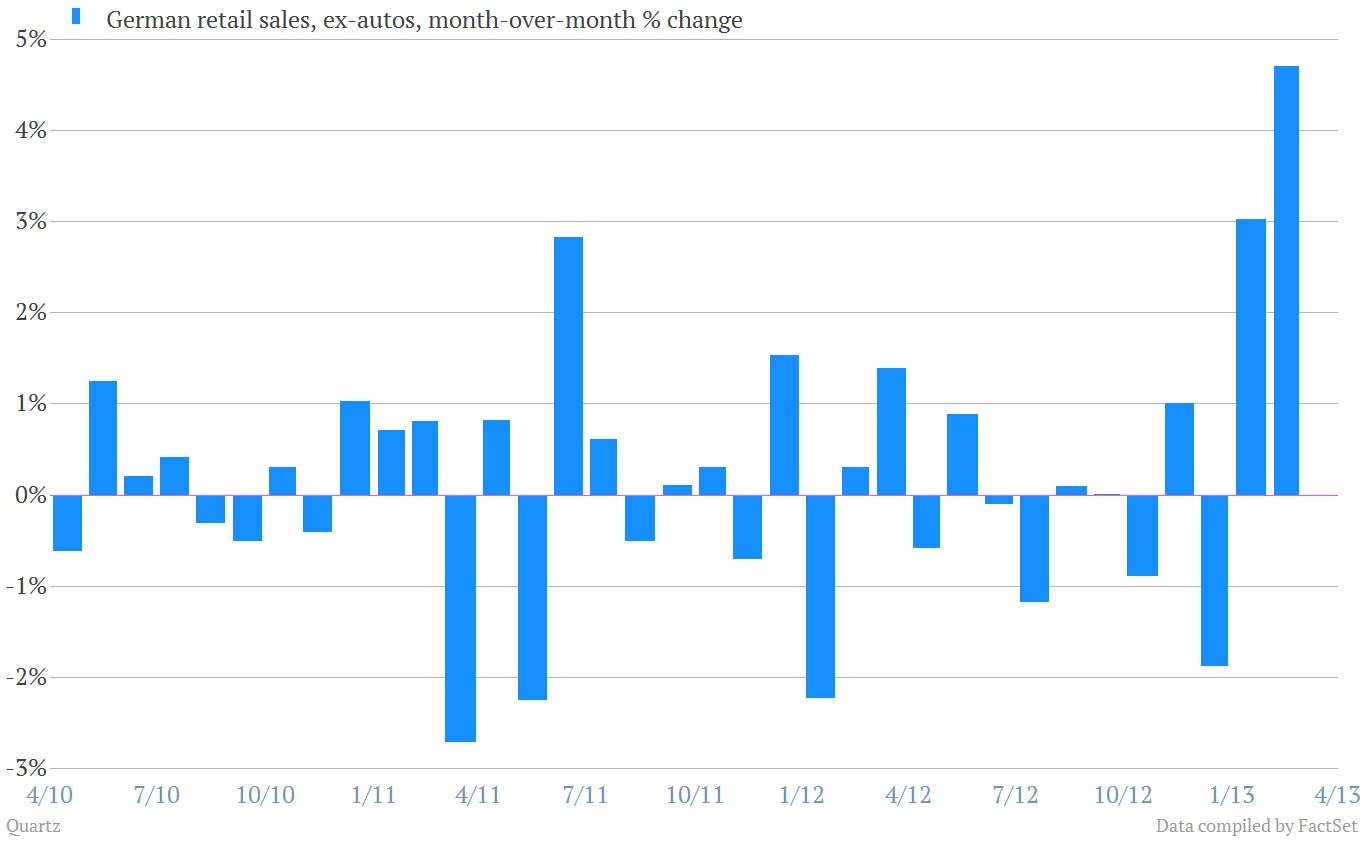

But interestingly, check out what’s been going on over the last couple months among Germany’s notoriously tight-fisted consumers. They’re spending.

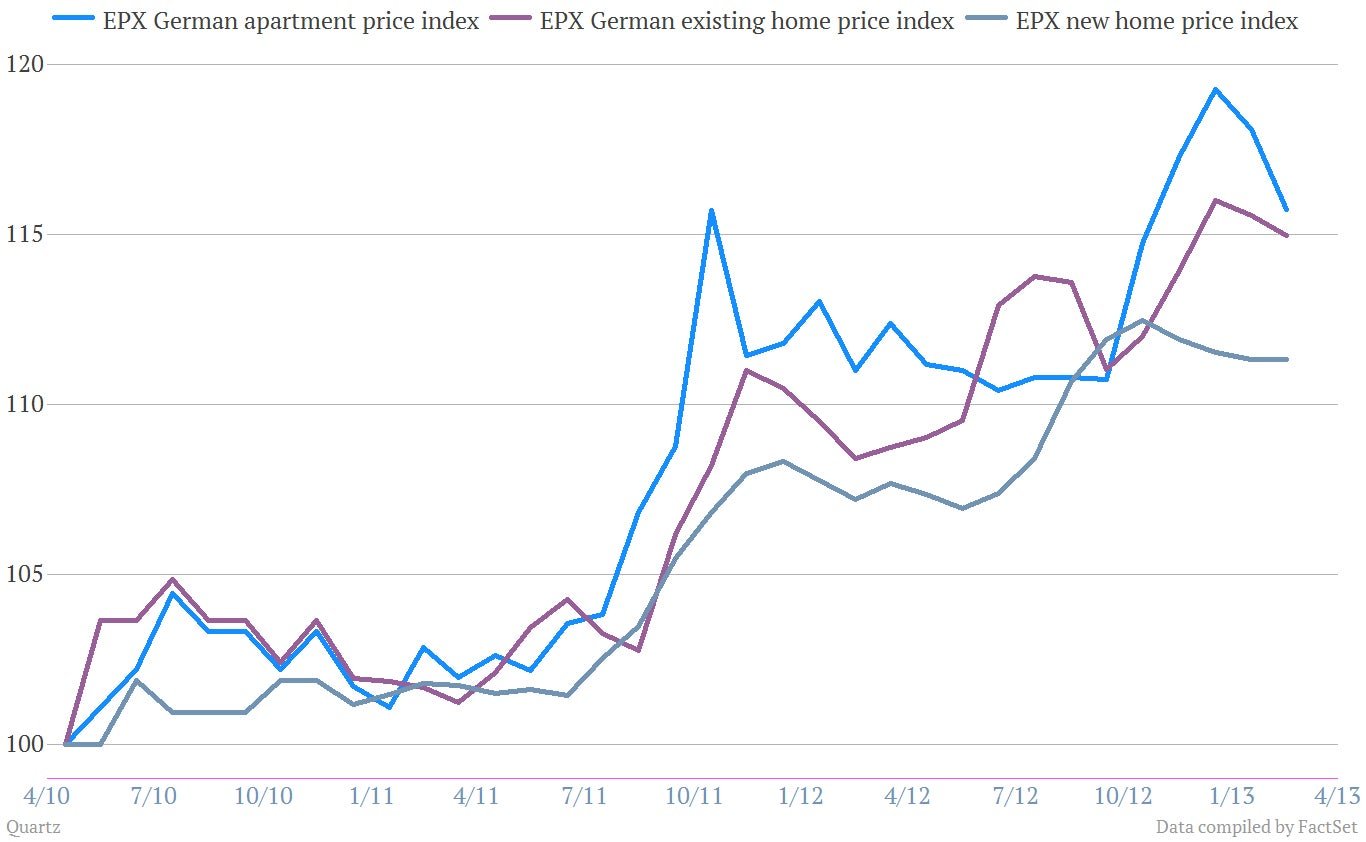

And the retail activity is following a sustained increase in German house and apartment prices. Here’s a look at the EPX indexes—indexed to 100—over the last three years…

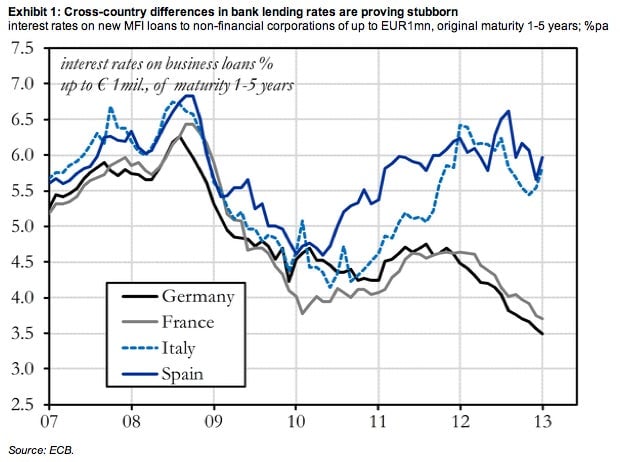

So, what is going on here? Well, a big part of it is likely the ridiculously low interest rates on German government debt. Unlike other European countries where awful recessions have made banks leery of lending and kept consumer and corporate interest rates high, German banks have been able to pass the benefits of low interest rates on to borrowers. Here’s a look at the differences between the troubled countries and the supposedly safe countries, in terms of lending rates to small companies, for example.

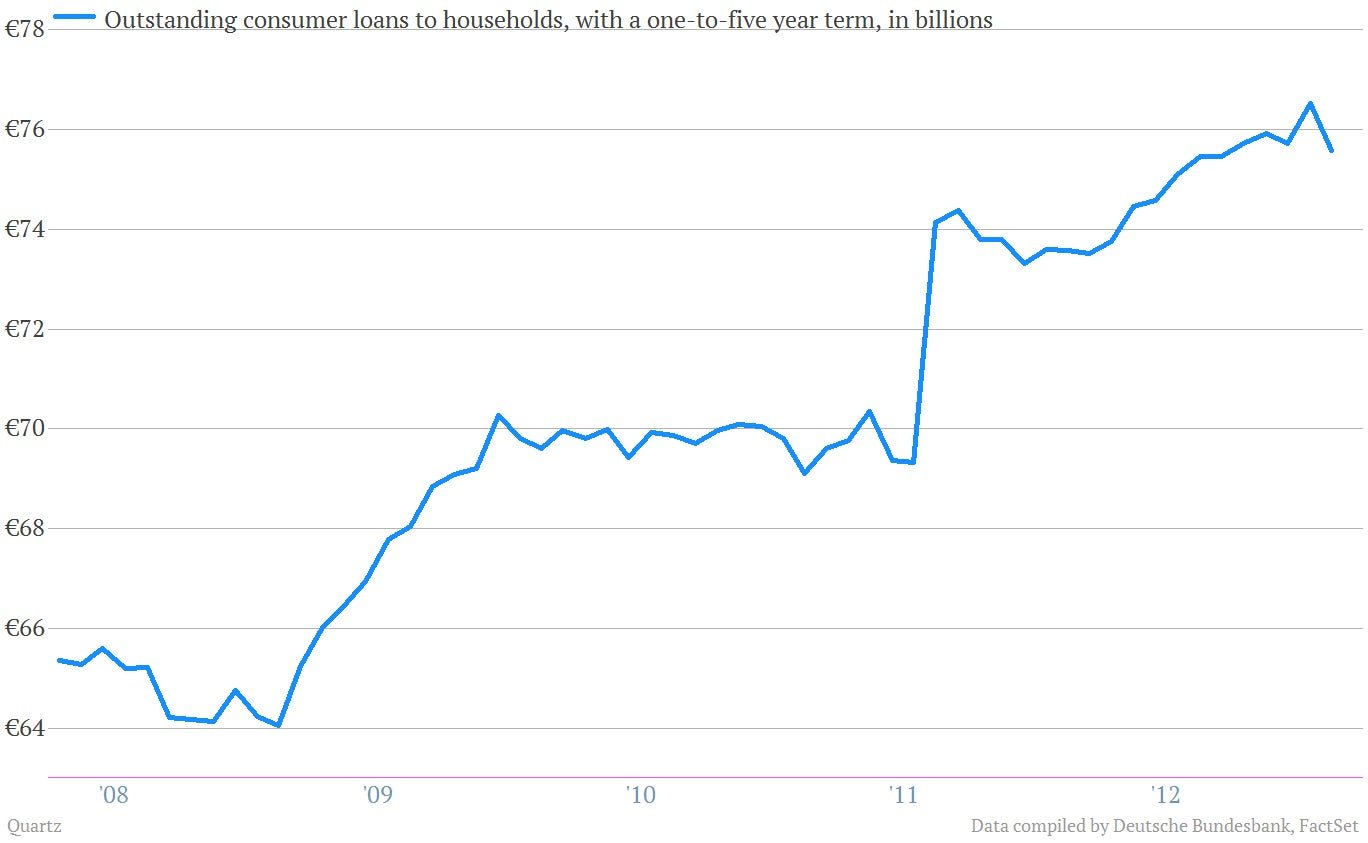

And it looks like German households are jumping on those low rates. The volume of loans outstanding from German banks has rebounded strongly off the post-crisis lows, according this data from the Bundesbank.