There is an accusation on Wall Street against Rex Tillerson, the CEO of ExxonMobil. It is that he has weighed down the crown jewel of Big Oil, until recently the world’s biggest oil producer, with two big, bad bets—on a natural-gas company in the US, and an oil field in Iraq—and thus sabotaged its share price. His predecessor, Lee Raymond, would never have made such lame-brained investments, it is suggested.

But are they lame? Let’s take a look.

The evidence for the prosecution: Exxon’s share price, which dived by 5.9% in 2012. Barclay’s has forecast another 1.4% drop this year. Since the two bets in question were announced at the end of 2009, Exxon’s shares have risen by about 31% in price, but those of its main rival, Chevron, have gone up by more or less 54%. Exxon’s profit per barrel, a common industry measure, averaged $18.10 from 2010 through 2012, compared with Chevron’s $21.90.

That weak performance has been blamed first on a gas gamble: Tillerson’s December 2009 purchase of XTO Energy, at the time America’s largest natural-gas producer, for $41 billion including debt. He is accused not of wrong-footing the trend—natural gas clearly is the global fuel of the future, and both the US and China are turning increasingly to gas for producing electricity—but for failing to foresee the plummet in US gas prices that followed the deal. He should have waited, critics say, to buy XTO at a lower price per share.

Prices were going up before they were going down

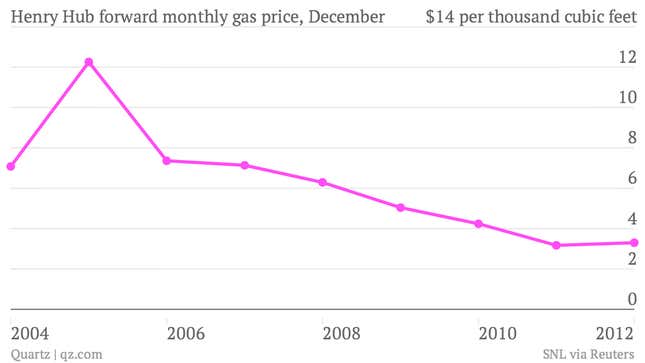

When it comes to prices, the accusers have their facts right. When the deal was announced, the average US natural gas price was $5.04 per 1,000 cubic feet. Since then it has fallen (see chart below). When that gas price is translated into barrels-of-oil equivalent, Tillerson paid $13.42 a barrel for XTO’s proved gas reserves. According to Ernst & Young, the average US proved reserve acquisition cost in 2009 was $9.86 per barrel; the three-year average (2009-2001) was $10.60. So on this score, Tillerson overpaid.

But these critics fail to look the other direction. Compared with the average price in the five years before, Tillerson’s acquisition was a steal. Moreover, in the months prior to the XTO acquisition, the gas price was highly volatile, but was generally on the rise. It had risen from $3.56 per 1,000 cubic feet in April, so that $5.04 did not seem outrageously high in December 2009.

If you are playing a decades-long game, which Tillerson is, low-price periods are mere hiccups. If average prices are below, say, $6 per 1,000 cubic feet in the 2020s, then brand the deal idiotic. As of now, it seems smart to be bulked up on gas.

He was hoping for a better future

Then there is ExxonMobil’s Iraq business. Just the month prior to the XTO deal, Exxon, along with Shell, signed a deal to develop Iraq’s super-giant West Qurna-1 field. The field holds some 8.7 billion barrels of oil. But the deal was stingy in industry terms, paying $1.90 per barrel produced. As an inducement, Exxon receives a dime more—$2 a barrel—for production from nearby formations that were undeveloped at the time of the signing.

Today, West Qurna-1 produces 495,000 barrels a day, up from 200,000 barrels a day when the deal was signed. Exxon plans to increase the output to 540,000 barrels by July and 600,000 barrels by the end of the year. Eventually, the production is to go over 2 million barrels a day.

A payday of $3.8 million a day, or $1.3 billion a year, is measly for Exxon, which had $482 billion in revenues last year. And the $1.90-per-barrel earnings from West Qurna-1 are just one-ninth of Exxon’s $18.10-per-barrel average. So why did Tillerson do the deal? In order to be in place should Iraq offer up better terms.

Big guys can turn on a dime

But here is a case demonstrating that, contrary to the old saw, an aircraft carrier can make a sharp and nimble pivot on a dime (or at least can give that impression). In 2011, Tillerson signed a deal for five oil fields in Iraq’s autonomous region of Kurdistan. It was a standard contract, called a production-sharing agreement, allowing for the accustomed high upside on success. This was signed in defiance of Baghdad, which forbids companies from dealing directly with Kurdistan.

Since then, Baghdad has attempted to draw Exxon back into the fold by improving the terms at West Qurna-1 in an undisclosed manner. Tillerson would like to have it both ways—continuing to drill in Iraq proper with hopes that the money will get better down the road, and working in Kurdistan, where there could be huge profit if the fields in fact do hold significant volumes of recoverable oil.

If Baghdad forces him to choose, Tillerson is likeliest to go with the Kurds, which would in the end mean a higher profit per barrel, and perhaps even greater production overall.

But it will also show that oil drilling, while the game of engineers, chemists and geologists, is actually as much an art as a science. To win big, you have to bet big, and it can take a long, long time to know if it has truly paid off.