A flash flood of Japanese money just snuffed out the euro crisis flareup

Remember Cyprus? Neither does the bond market.

Remember Cyprus? Neither does the bond market.

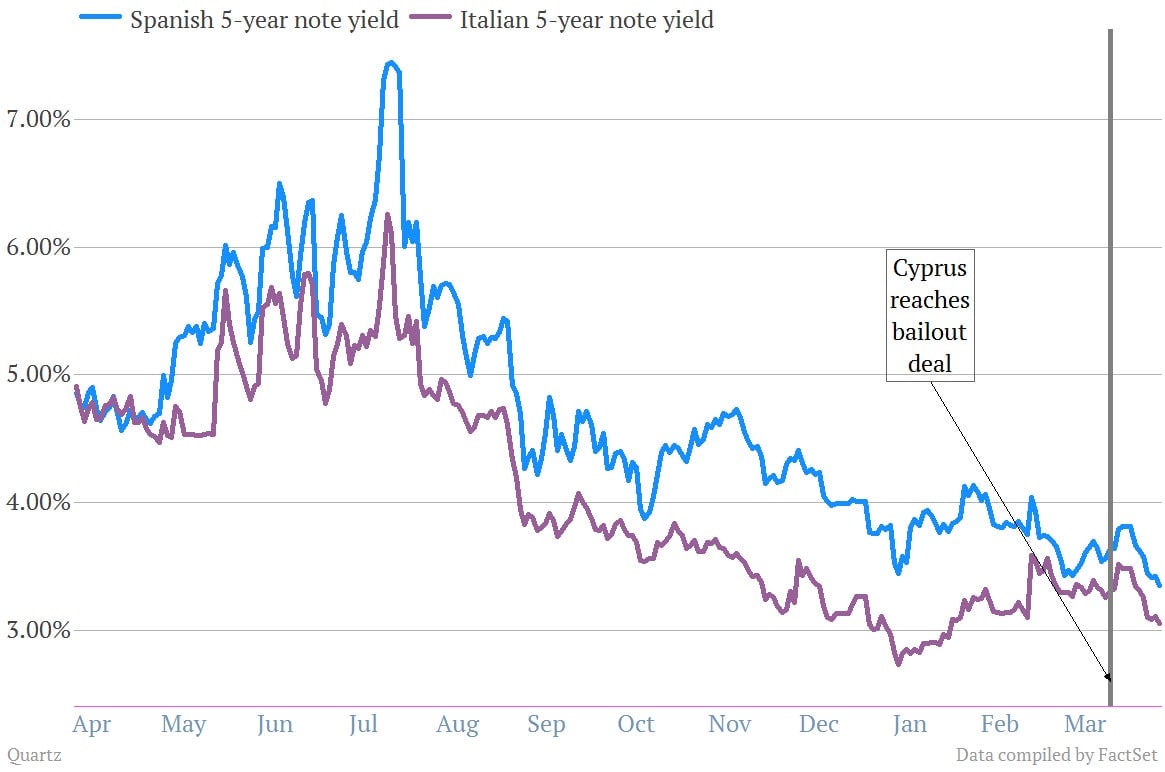

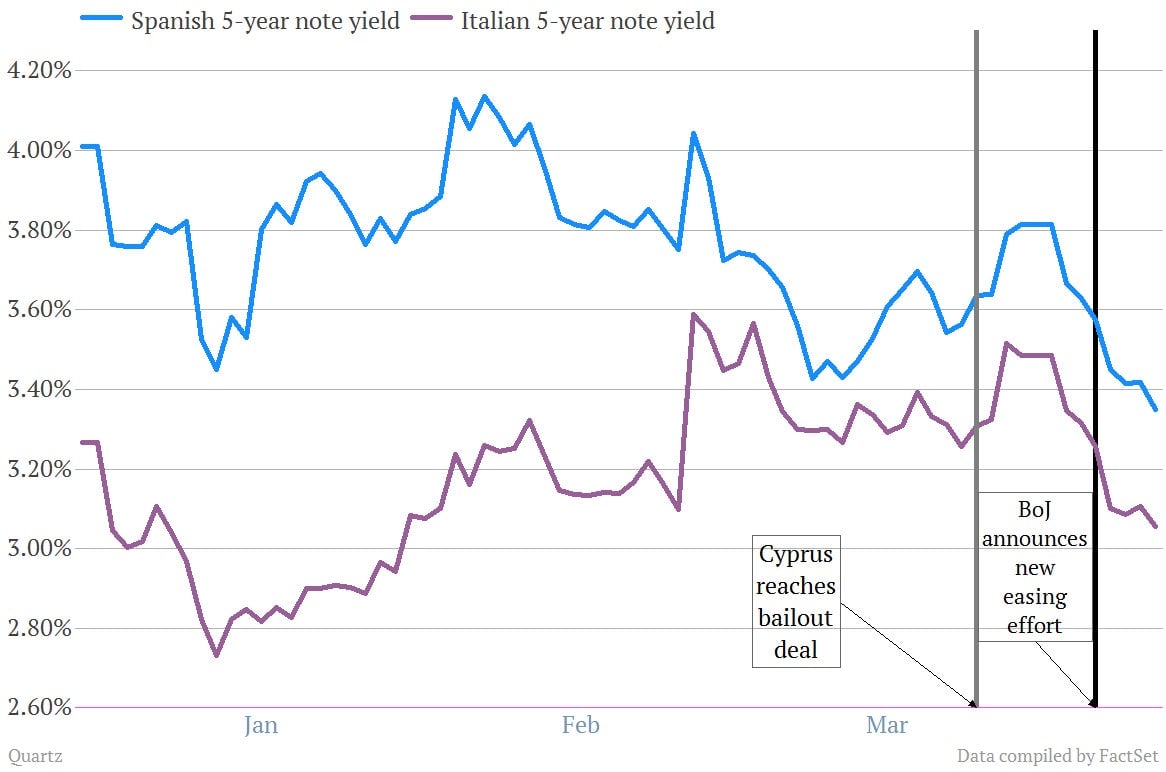

Since Cyprus cinched a deal with the powers-that-be in Europe on March 25, thus averting its exit from the euro and general meltdown, bond yields on some of the biggest elephants in the room that is the European debt crisis—Italy and Spain—have moved steadily lower. If the market were worried euro-land is going pear-shaped, yields would be l a jumpier. In fact, Ireland—which remains in terrible shape—is now sporting yields on its 10-year bonds that are as low as anything since 2006.

Could the markets really be that forgetful? Or is something else going on?

Well, the current consensus seems to be that the Bank of Japan’s recent seismic shift towards quantitative easing is sending cash coursing out of Japan. That’s part of how quantitative easing is supposed to work. Central banks buy up government bonds to push down their yields and push investors out to riskier assets. The BoJ’s goal is for investors to buy assets that might help economic growth, such as Japanese corporate bonds, but inevitably some will take their money into higher-return sovereign debt overseas, which is what seems to be happening here. Italian and Spanish yields were already moving generally lower before the the Bank of Japan announced its new easing push, but they have continued that way ever since.

And so have other euro area benchmarks, such as French government bond yields…

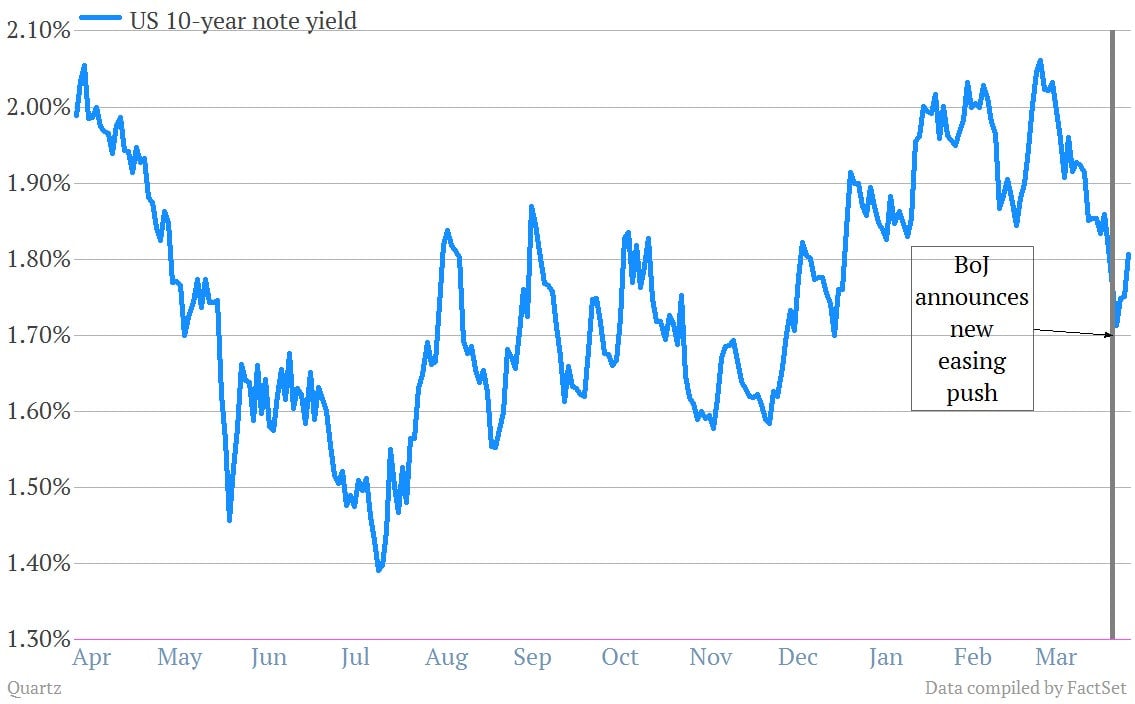

…And the same pattern seems to be playing out in other markets. Look at yields on the US 10-year note. They tumbled around the same time. (Though a nasty jobs report also hit around then which one would expect to send yields lower.)

The anecdotal evidence also seems consistent with a flood of Japanese cash coming into foreign bond markets. “We have seen a strong pick up in purchases of [US dollar] and euro-denominated bonds by Japanese investors,” wrote Société Générale bond market analysts in a note to clients today. So what does this mean? Essentially, it means that the Bank of Japan’s willingness to print money is taking a lot of the pressure—at least for the moment—off of the European Central Bank, which has been reluctant to warm up the printing presses.