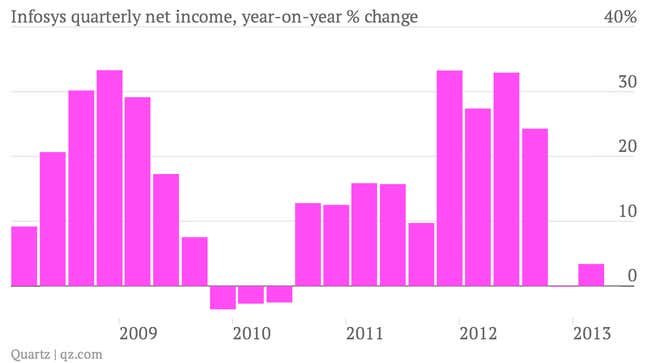

The numbers: Indian outsourcing giant Infosys reported a net profit of 23.94 billion rupee (~$440 million) for the three months ending March 31, up 3.4% from the same period one year ago. But sales were weaker than expected at 104.54 billion rupees, shy of market expectations for around 107 billion rupees, even though they were up 18% from the prior-year period. More distressing to investors was Bangalore-based Infosys’ piddling sales forecast for the full year. The company pegged sales growth between 6% and 10%. Analysts were hoping for around 12%. The stock tanked in Mumbai trading, falling roughly 20%.

The takeaway: The Indian outsourcing industry has matured fast. In order to continue generating sizable growth, companies such as Infosys—India’s second largest outsourcing company—have got to find a way to burst out of traditional low-margin back-office services.

What’s interesting: Part of Infosys’ effort to chase more high-margin business has meant an effort to handle local customer services for global corporations by staffing up outside of India. For instance, the company recently added a new operations center in the southeastern US, in the Atlanta area. But such efforts can get expensive. Looking ahead to the current quarter, Infosys cited the rising costs of fees for US visas and the expense of hiring in the US—it expects to hire 1,200 there this fiscal year—as part of the reason it thinks operating margins will fall, according to the Associated Press.