The holdings of Chinese conglomerate Tencent have a barnyard feel to them: the CEO is known as Pony, online games are the cash cow, and WeChat, the company’s blockbuster mobile instant-messaging app, is its golden goose. Or at least, a golden goose is what investors expect. But despite all of WeChat’s blockbusting, Tencent hasn’t yet figured out how to earn money off the app.

Investors might finally be getting impatient. Tencent’s stock has fallen 12% since March 8, after analysts downgraded it on rising costs. And now it appears the company is getting nervous too. Over the course of this week, Tencent bought back what now amounts to $73 million worth of stock, as of April 11—something it seldom does at all, let alone for an entire week. (You can see the effect on its share price at the right-hand end of this chart.)

The likely reason for concern is the ongoing controversy kicked up by China’s three big telecom operators, which could potentially make Tencent’s WeChat woes much, much worse. The telecoms—though that mainly means China Mobile—say “signaling” (meaning the pinging of the server that happens with things like geo-location) from WeChat’s 260 million Chinese users is driving up their operational costs without generating enough mobile data revenue. They have asked the government to consider charging Tencent a form of rent for its signaling traffic.

A levy could prove problematic for Tencent, says Mark Natkin, managing director and founder of Marbridge Consulting, a Beijing-based tech research firm. ”Right now, Tencent faces substantial development costs,” Natkin tells Quartz. “If on top of that it has to pay a substantial fee to telecom operators, it creates pressure to demonstrate what exactly the potential revenue for WeChat is.”

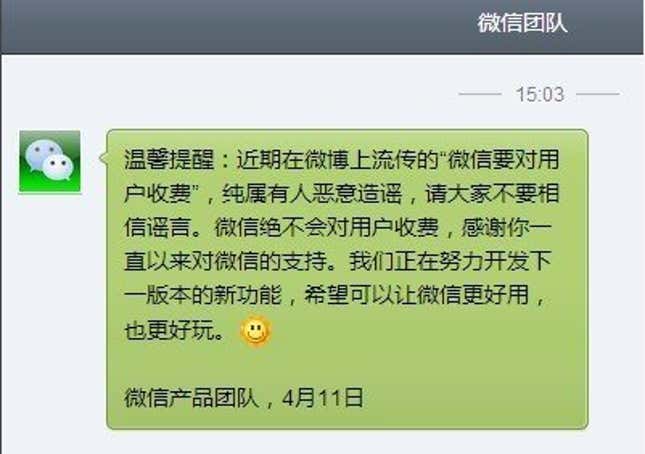

And it’s increasingly looking like that may happen. Word on the social media channels is that the government would start charging WeChat users to use the app, starting July 1. CEO Pony Ma and other Tencent execs have repeatedly denied this. Yesterday, WeChat called the talk a “malicious rumor,” saying that it would “absolutely not charge users” (link in Chinese) and closing the message with a sunny emoticon:

But sunny emoticons don’t impress investors so much. Perhaps buying back stock will do the trick?

Fredrik Oqvist, founder of Beijing-based consulting company ChinaRAI, thinks it might. He argues that the company’s stock buyback is a sign of the company’s confidence that the government won’t assess a fee, implying that Tencent will be free to monetize WeChat at its own pace and that the stock is therefore undervalued.

Even if there is a fee, says Oqvist, Tencent’s $2 billion in cash means that it can run WeChat at a loss for a while before it has to wring income from it. And that plays to Tencent’s long-standing strength: mimicking. “Tencent [itself] doesn’t have figure it out,” Oqvist tells Quartz. ”There are plenty of startups that do things similar to WeChat. If one of those figures out how to monetize this type of product then Tencent can leverage [whatever that monetization tactic is] across its entire user base.”