Intel’s decline in four charts

Earnings for chip giant Intel are due after the close of US trading. Wall Street analysts expect profits of $0.40 a share on sales of $12.59 billion. Dour sentiment surrounding Intel has meant shares lagged the broader rally in US equity markets this year. Year-to-date, the stock is up 5%, versus 10% for the benchmark S&P 500.

Earnings for chip giant Intel are due after the close of US trading. Wall Street analysts expect profits of $0.40 a share on sales of $12.59 billion. Dour sentiment surrounding Intel has meant shares lagged the broader rally in US equity markets this year. Year-to-date, the stock is up 5%, versus 10% for the benchmark S&P 500.

But the stock price has been a real dog since Intel’s last earnings report on Jan. 17.

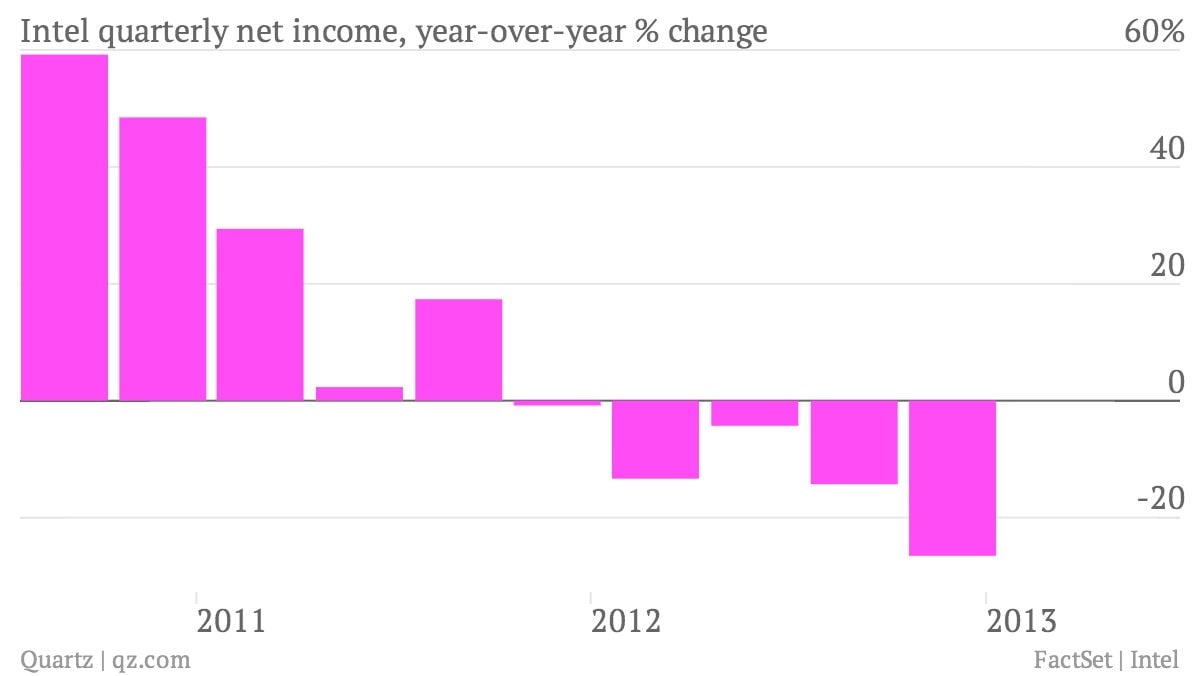

That report showed profits declining 27% from the same period in the previous year.

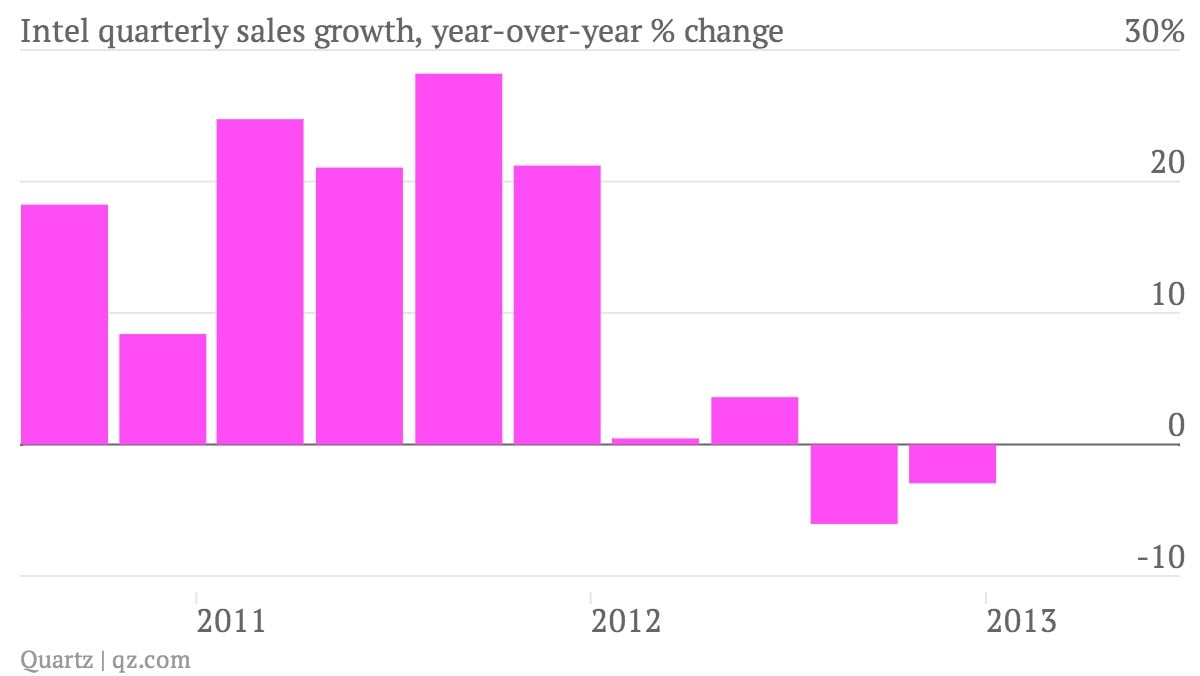

And sales slumped 3% during the fourth quarter of 2012…

…the second straight quarter of declines.

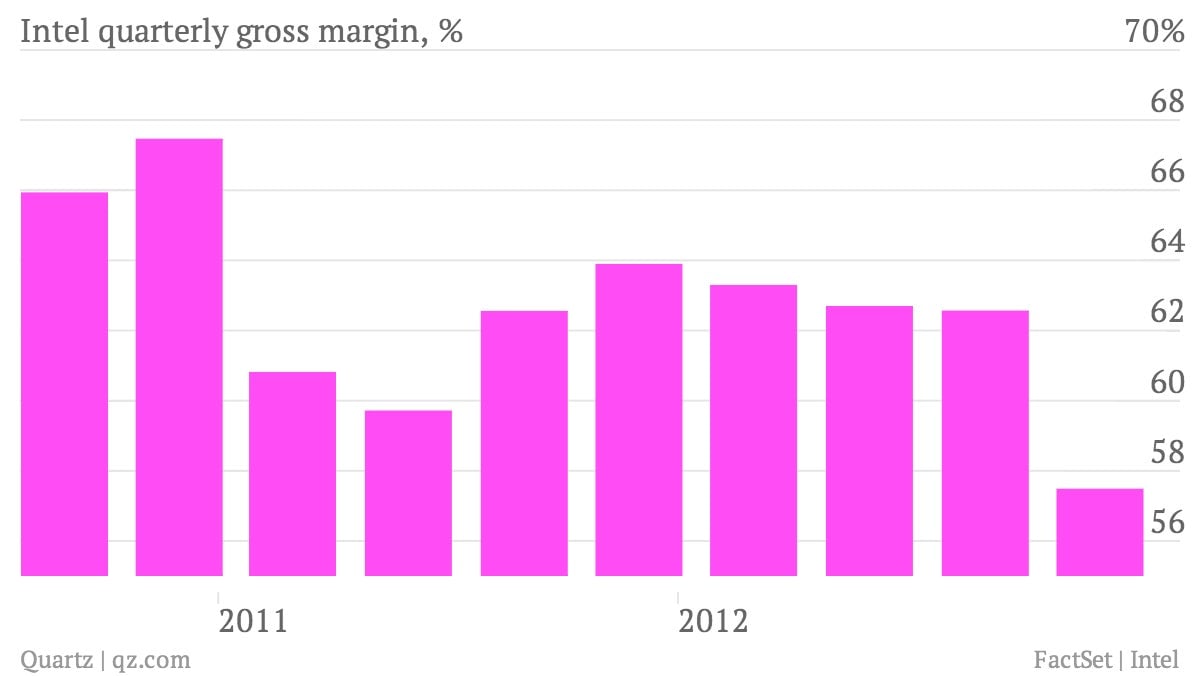

Profit margins shrank sharply…

…as the company expanded away from its core, high-margin business of supplying chips for PCs, a market enduring some severe disruption. Mobile chips tend to be smaller, less complicated and cheaper than PC chips.

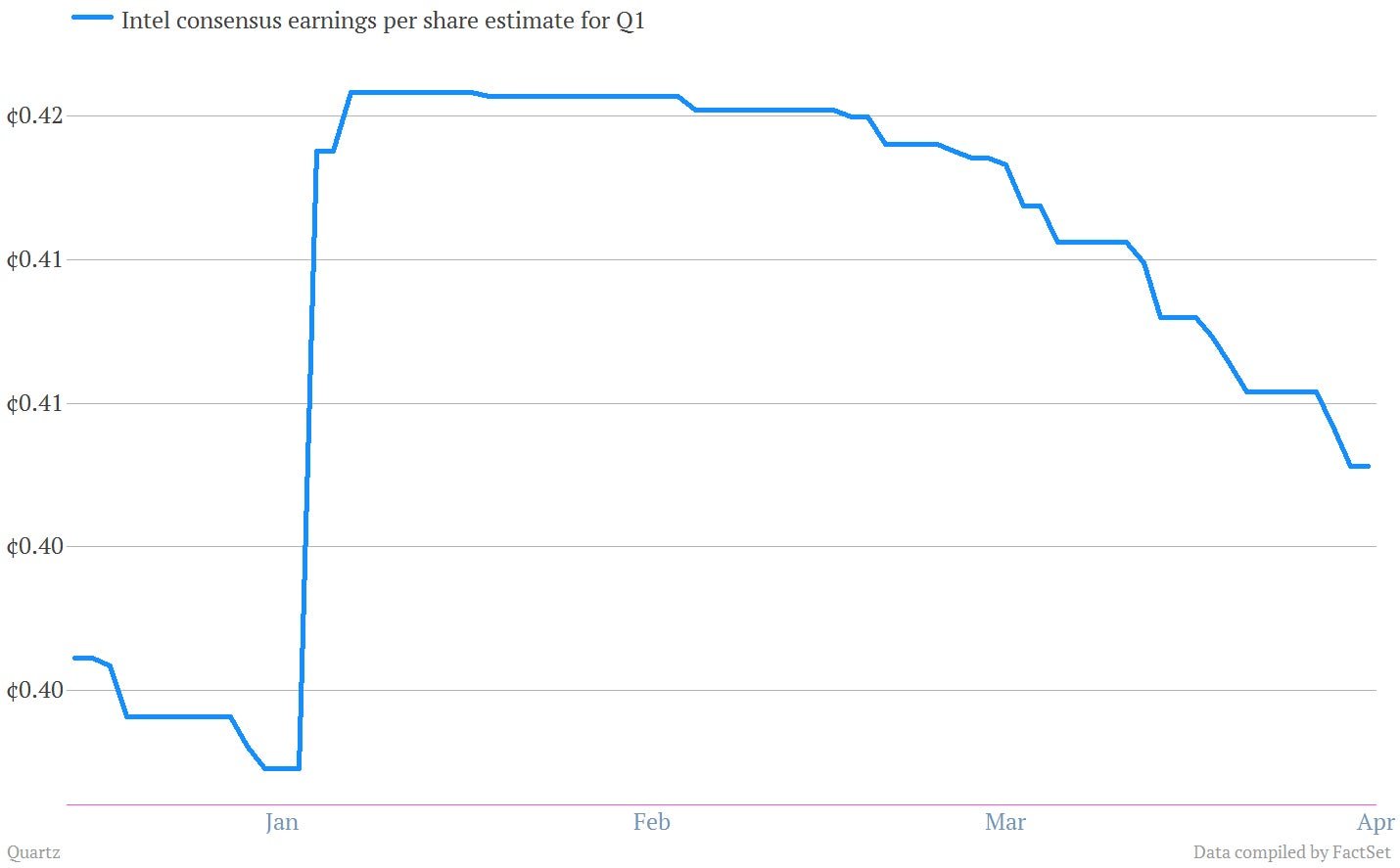

But analysts have been bracing for far worse…

After the fourth-quarter earnings, Wall Street analysts revised their estimates higher, but in the run-up to today’s report they’ve been steadily chopping their consensus view lower. So if Intel manages to exceed these lowered expectations, that’s worth keeping in mind.