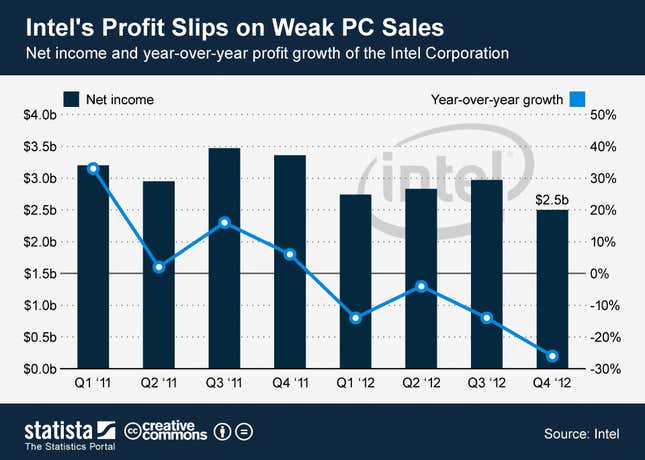

Intel’s quarterly results, expected after markets close today, April 16, are by all estimates going to be as bad or worse than Intel’s last quarter—and for all the same reasons. The only way to describe the overall trend in Intel’s revenue is dismal. Intel is starting to resemble other technology giants—think BlackBerry—for which stagnating revenue was a warning sign that the company’s fortunes were about to fall off a cliff.

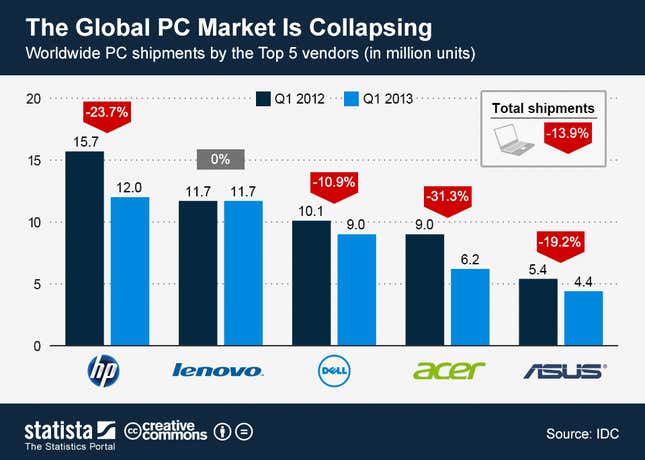

Intel’s main problem is the same it’s been for many previous quarters: the decline in sales of PCs. But in the past quarter, PC shipments had their most precipitous drop in the past 19 years.

Intel has two alternatives: recognize that the world is shifting toward tablets, smartphones, and other mobile devices as outright PC replacements, or stay in denial and continue with business as usual. The unofficial motto of Intel, articulated by former CEO Andy Grove, is that “only the paranoid survive.” And yet so far Intel has mostly gone with business as usual, continuing its cycle of putting most of its development effort behind the ever more powerful chips that are only suitable for PCs and high-end servers.

The problem, put simply, is that consumers don’t seem to want the devices that these more powerful processors—the next generation of them is called Haswell—enable. Intel has tried and failed, in partnership with Microsoft, to sell consumers on “ultrabooks,” which are simply thin, high-priced notebook computers in the style of the Macbook Air, but they’ve flopped.

PC manufacturers have responded by making them ever fancier. Here’s a new one from Asus with a screen on both sides of its lid, just in case no one needs that ever. Analysts see these strange new beasts—hybrid tablet/laptops with insufficient battery life to be good laptops and too much heft to be good tablets—and yawn.

It would be easy to blame Microsoft for the 13.9% drop in PC sales last quarter—and industry analysis firm IDC does. But there is a larger story here that Intel has failed to come to grips with. As Forrester analyst Ted Schadler notes, people still need PCs to get work done. (Three hundred million will be sold this year!) But due to factors that include more and more computing moving to the cloud, the replacement cycle for PCs is getting longer, as older PCs remain “good enough.” This, Schadler notes, is stretching the time between when people buy new PCs from “6 years instead of 4 years in the home and 4 years instead of 3 years at work.”

At this point, the logical thing for Intel to do would be to recognize that there is a very obvious structural shift in the market for microprocessors—mobile good, high-end PC not so necessary—and adjust accordingly. But that change won’t happen without Intel possibly becoming even smaller, for one simple reason: Mobile processors tend to be smaller, less complicated and less expensive, which means lower margins on each chip. Even if Intel were dominating this industry, it’s a very different one than the Microsoft/Intel duopoly over personal computing it has enjoyed for the past 20 years.

This quarter Intel’s revenue is expected to be 23% lower per share, says Sanford C. Bernstein analyst Stacy Rasgon. And analysts aren’t just worried about revenue, but also Intel’s growing capital expenditures—$13 billion in 2013.

But this is the one place where analysts are probably wrong. The simple fact is that for Intel to survive at all, it must continue to do what it has always done: innovate and invest to the point that it’s 18 to 24 months ahead of competitors in terms of the fundamental technology of the microchips it can produce. This is one reason why a rumor that Apple may start producing 10% of its most advanced mobile chip, the A7, with Intel is so interesting. Intel is usually not in the business of producing other people’s designs. But it may have no choice but to hedge its own efforts at producing mobile chips—the Atom line of processors that mobile device makers have largely ignored—with partnerships with companies that could combine Intel’s advanced technologies with proven consumer demand.

That’s one of the things that’s so depressing about being an Intel watcher. Unlike Microsoft, Intel has no shortage of innovation and drive. It’s just that its efforts have been so misdirected for so long, as the company’s leaders failed to recognize that the PC landscape that brought the company so much success has fundamentally and permanently changed.