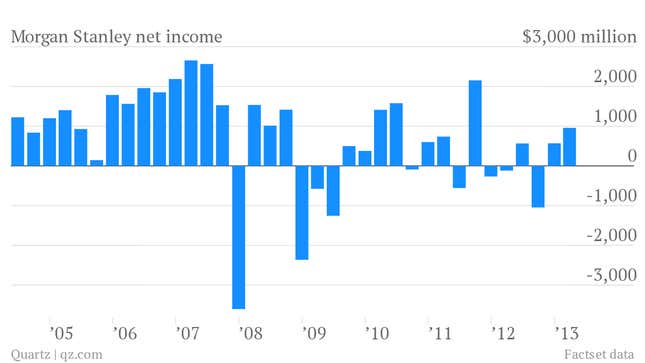

The numbers: Morgan Stanley’s earnings beat analyst expectations, with earnings per share of $0.61 versus $0.56 that analysts expected. Net income totaled $958 million, compared to a loss of $119 million in the first quarter of last year.

Revenue is where things got interesting, however. The bank reported $8.5 billion in revenue—better than the $8.35 Wall Street was looking for—before adjustments for debt-related credit spreads (DVA), which take into account creditors’ negative perceptions of the bank’s risk. Those credit adjustments imposed a $317 million charge on the bank, meaning that overall, revenue came in at $8.2 billion.

The takeaway: In shifting towards wealth management and making strategic shifts for its future, the bank seems to be having a bit of an identity crisis. Investors don’t seem sure of exactly what Morgan Stanley will look like after that’s all over. The bank still earned less per share than it did in the same quarter last year ($0.71). Moreover, revenue from the bank’s core business in institutional securities trading declined year-over-year even before credit adjustments, from $1.6 billion to $1.1 billion.

What’s interesting: That said, income from the bank’s global wealth management business is steadily increasing, from $562 million in the fourth quarter of 2012 to $597 million in the first quarter this year. It was just $403 million a year ago.