If you’re an investor, the ideal opportunity would be one that promised you great return for little risk. But, in reality, hitting that one perfect bet is tough, if not impossible: a company’s revenues can shift, its industry may fall out of favor, or economic news may suddenly paint a different picture of the future.

That’s why diversification—spreading your investments across different types of assets—is something to consider when building a long-term portfolio. Some investments will do better than others, and perform differently at different times. So while you won’t do as well as your best-performing investment, you’ll do better than your worst. And over time you’ll have potentially broadened your opportunities for growth and helped reduce your overall portfolio risk.

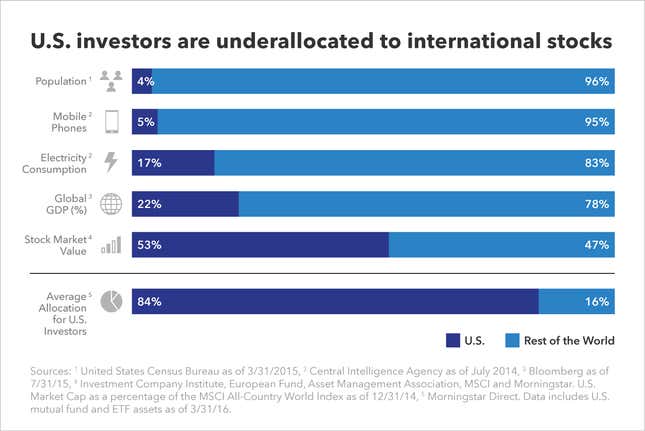

Home country bias, or the tendency to gravitate to stocks and bonds in one’s domestic market, can result in a portfolio that’s not properly diversified. As shown in the chart below, investors in the U.S.—including many institutional investors—allocate 84% of their stock investments to U.S. stocks, even though only 53% of the world’s stock market value is based here and much of the globe’s future growth will take place outside the U.S.

It’s also difficult to predict which markets will outperform others over any given timeframe. That’s particularly true in the current volatile environment. Diversifying your international portfolio across countries and regions can further help to mitigate risk while still targeting long-term returns. It’s one of the reasons that diversification has been called the “only free lunch” in investing.

A turn in the cycle?

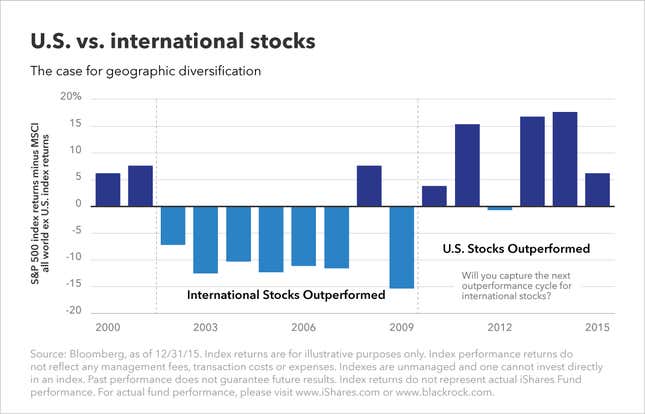

Beyond home country bias, recent performance is another reason U.S. investors have been in the domestic market. U.S. stocks have been hitting record highs while international returns have been relatively weak.

Market leadership is cyclical, however. While U.S. stocks have outperformed international stocks for most of the past five years, the opposite was true for five of the six years spanning 2002-2009, as shown in the chart below. The trend suggests we may be approaching a change in the cycle once again, perhaps making this a good time to consider rebalancing your portfolio.

How emerging markets fit in

Emerging markets are a key segment within the global opportunity, and another potential diversifier for your core, long-term portfolio. These are among the world’s fastest-growing economies, constituting 56% of global population and generating 32% of the output.¹ In fact, the IMF expects GDP growth of 5.1% for emerging markets by 2020—more than double its projection for developed markets.²

While emerging markets do carry additional risks, they may also offer patient investors with higher growth potential. At times, their performance will be driven by forces that differ from those driving U.S. performance—a weak dollar or commodity prices can drive investors elsewhere. So by zigging when other markets zag, they may help you spread your risks even wider.

Home may be where the heart is, but a home country bias could mean too many U.S.-centric investors may be missing out. iShares Core International and Emerging Market ETFs make going global easy, efficient and low cost.

This article was produced on behalf of iShares by Quartz creative services and not by the Quartz editorial staff.

¹Population Research Bureau; Bloomberg and World Bank, as of 3/31/16.

²International Monetary Fund, World Economic Outlook, as of April 2016.

Visit www.iShares.com or www.BlackRock.com to view a prospectus, which includes investment objectives, risks, fees, expenses and other information that you should read and consider carefully before investing.

International investing involves risks, including risks related to foreign currency, limited liquidity, less government regulation and the possibility of substantial volatility due to adverse political, economic or other developments. These risks often are heightened for investments in emerging/developing markets and in concentrations of single countries.

Diversification and asset allocation may not protect against market risk or loss of principal.

Transactions in shares of ETFs will result in brokerage commissions and will generate tax consequences. All regulated investment companies are obliged to distribute portfolio gains to shareholders. Certain traditional mutual funds can also be tax efficient.

The iShares Funds are distributed by BlackRock Investments, LLC (together with its affiliates, “BlackRock”).

©2016 BlackRock. All rights reserved. iSHARES and BLACKROCK are registered trademarks of BlackRock. All other marks are the property of their respective owners.

iS-19009-0816