Bond-market mover and shaker Bill Gross no longer seems to think that Britain’s sizable debt load risks blowing Blighty to kingdom come.

The co-CIO of US investment giant Pimco told the Financial Times (paywall) that he thinks the United Kingdom’s conservative government has taken the wrong approach by putting its prescribed policy of budget cutting—austerity—into place. Rather he suggests that printing money and spending is really the only way for the euro zone and Britain to start to dig out from under their debt load.

“The UK and almost all of Europe have erred in terms of believing that austerity, fiscal austerity in the short term, is the way to produce real growth. It is not,” Mr Gross told the Financial Times. “You’ve got to spend money.”

Now it’s worth noting that Bill Gross’ views towards debt loads have changed markedly in recent years. Like many watchers of the sovereign debt markets, his initial reaction to the surge in government debt that followed the global financial crisis was one of concern. Perhaps most famously, he took an underweight position on US Treasurys in 2011, expecting government bond prices to fall as concern grew about the US’s ability to shoulder its debts. Instead they did the exact opposite, resulting in a terrible performance for Gross’ iconic Total Return Fund.

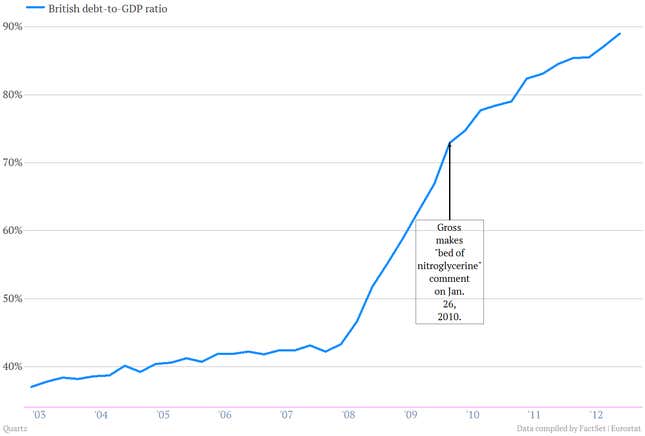

On the question of British debt, Gross famously referred to British government bonds—known as gilts—as “resting on a bed of nitroglycerine” back in January 2010. While it was difficult to discern exactly what Gross meant by that (often the case with his pronouncements), it was commonly assumed that a bed of nitroglycerine was riskier, than say, lounging around on a bed of lettuce or a bed of roses. In other words, it was a bad thing. But if he meant British interest rates were going to rise, he was wrong, again. And since he made those explosive statements, the old nitroglycerine mattress has acquired considerably more cushioning:

And yet, now it’s not a concern for him. So what’s going on here?

The simple answer is that our, and the market’s, understanding of how debt crises work has evolved a lot since the early days. And the bottom line is that as long as countries have a central bank with the ability to print money and support domestic bond markets and economic growth (see the US, Japan, and the UK), investors see that as a strength, not a weakness. It’s when countries don’t have the flexibility—see Ireland, Italy, Spain, Greece, which are all in the euro—that excessive debt starts troubling the markets. The changing consensus is quite visible in the IMF’s recent shift to a decidedly anti-austerity stance, which has brought them into conflict with Britain’s pro-Austerity government. (Oh, and for what it’s worth, it’s interesting to note that Gross’s analysis of the British debt situation drew heavily from the very same research from Harvard professors Ken Rogoff and Carmen Reinhart, which has been so heavily criticized in recent days.)