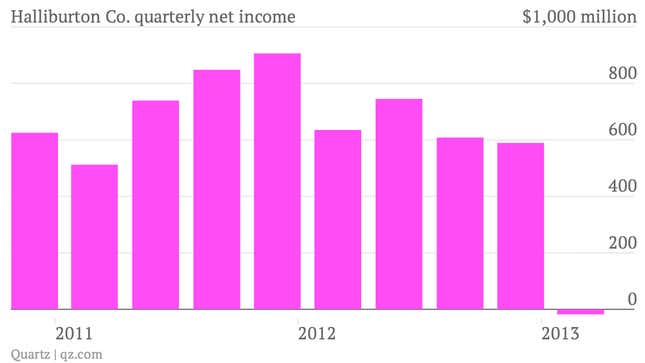

- The numbers: The world’s second largest oil field services firm reported a net loss of $18 million (pdf) on the heels of $637 million in litigation charges from the 2010 Gulf of Mexico oil spill. But discounting money set aside for the oil spill and losses incurred from closed operations, Halliburton’s quarterly profit ballooned to $0.67 per share, significantly higher than analyst expectations of $0.57 per share. Strong sales, which climbed 1.5% from last quarter to $6.97 billion, coupled with successful cost-cutting helped the company’s operating profit margin reach 16%.

- The takeaway: Many speculators, including Forbes, forecasted Halliburton’s numbers to slip in the face of rising raw material costs and the company’s heavy exposure to North American land-based drilling, but they were wrong. Halliburton’s international growth, which benefitted from particularly impressive operating income in the Middle East/Asia and Europe/Africa/CIS regions (51% and 25% increases, respectively), more than made up for pricing headwinds in North America. Even in North America, where revenues dipped 1% from last quarter, operating income soared 30% on lower costs of guar, a key ingredient used in extracting oil and natural gas from rock formations.

- What’s interesting: So much for the weak North American fracking market causing Halliburton’s earnings to dip. Despite a 3% decline in the US rig count, Halliburton still managed to improve profit margins in its largest market. Chief Operating Officer Jeff Miller told investors today he thinks the worst of the North American fracking downturn has passed, and the company announced in its press release that it expects international growth to hover in the low teens through the end of the year. If Miller is right about the fracking market, and Halliburton continues to boost margins with effective cost-cutting, there’s little reason not to believe the company will continue to beat analyst expectations going forward.