Gold is the worst investment of 2013, and Goldman now suggests you stop shorting it

Commodities watchers at Goldman Sachs suggest that those betting on a continued decline in gold prices take their winnings off the table. But that doesn’t mean they think prices will now start to rise. They just figure that in terms of risk and reward, they’d rather be out of the trade right now. In a note to clients, today they write:

Commodities watchers at Goldman Sachs suggest that those betting on a continued decline in gold prices take their winnings off the table. But that doesn’t mean they think prices will now start to rise. They just figure that in terms of risk and reward, they’d rather be out of the trade right now. In a note to clients, today they write:

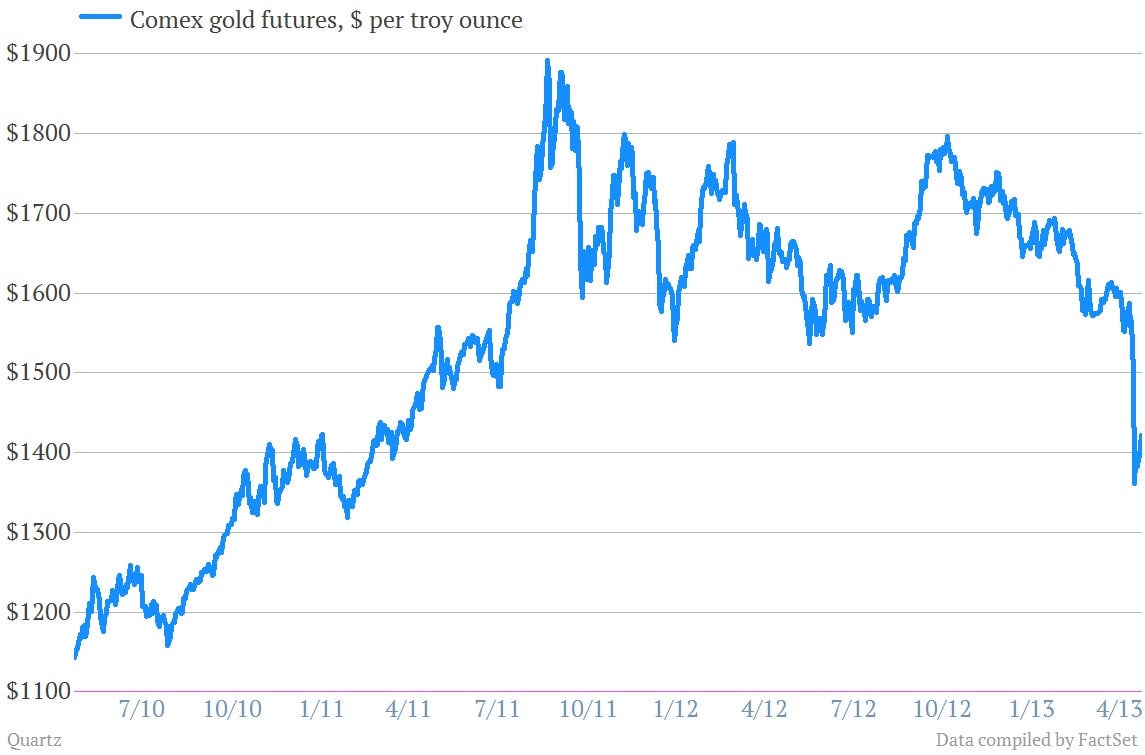

We have closed our recommendation to short COMEX Gold, as prices moved above the stop at $1,400/toz. We have exited the trade significantly below our original target of $1,450/toz, for a potential gain of 10.4%. The move since initiation was surprisingly rapid, likely exacerbated by the break of well-flagged technical support levels. Our bias is to expect further declines in gold prices on the combination of continued ETF outflows as conviction in holding gold continues to wane as well as our economists’ forecast for a reacceleration in US growth later this year.

Goldman analysts made something of a splash when they suggested clients start betting on a decline in prices shortly before the price of the yellow metal crashed well below their price target. While Goldman was surprised by the steepness of the selloff, Morgan Stanley analysts seem to have been even more startled. The collapse of gold forced them to drop their price target for gold 16%, from $1,773 to $1,487 for calendar year 2013.

Oh, and from an asset allocation perspective, gold remains the worst asset to own this year, according to JP Morgan analysts, who churned out this chart late last week. The best? Japan’s Topix stock index.