Three reasons ARM Holdings just had an amazing quarter, and one reason investors should worry

In February, we told you that ARM holdings, the company that designs the chips that power just about every smartphone and tablet on the planet, had one of the best quarters of any technology company, ever—and this quarter, they’ve gone and beaten those results.

In February, we told you that ARM holdings, the company that designs the chips that power just about every smartphone and tablet on the planet, had one of the best quarters of any technology company, ever—and this quarter, they’ve gone and beaten those results.

1. ARM’s revenue growth is bananas

Last quarter, ARM’s revenue was up 19.2% from the same time last year. This quarter, revenue is up 26% year-on-year. ARM’s total revenue was $263.9 million.

One way ARM makes money is by licensing its chip designs to companies like Apple and Samsung, who then turn those designs into customized microchips for iPhones and Galaxy phones and the like. ARM’s revenue from such deals was up 24% from a year ago, and represents roughly a third of the company’s revenue.

Another way ARM makes money is by charging smaller companies with more modest needs a per-chip royalty for microprocessors they produce, often taken directly from ARM’s designs, with little additional customization. Royalty revenue for ARM was up 33% since last year, compared to 2% for the microchip industry as a whole.

2. ARM’s chips are taking over in unexpected places

Usually, ARM chips, which are specialized to use little power (but aren’t as quick at calculating, as a result) end up in mobile phones, where battery life is important. But now they’re showing up in the data center, which is traditionally the domain of ultra-fast microprocessors from the likes of Intel and AMD. HP has launched Project Moonshot, which uses ARM’s chips in the sort of servers that make the web, apps and streaming media possible. Dell is also offering ARM-based servers, and there are yet more from other companies in the works. ARM’s processors are finding favor because data center operators are looking to reduce power consumption, an increasingly significant operating expense.

3. The number of companies licensing ARM’s chips is exploding

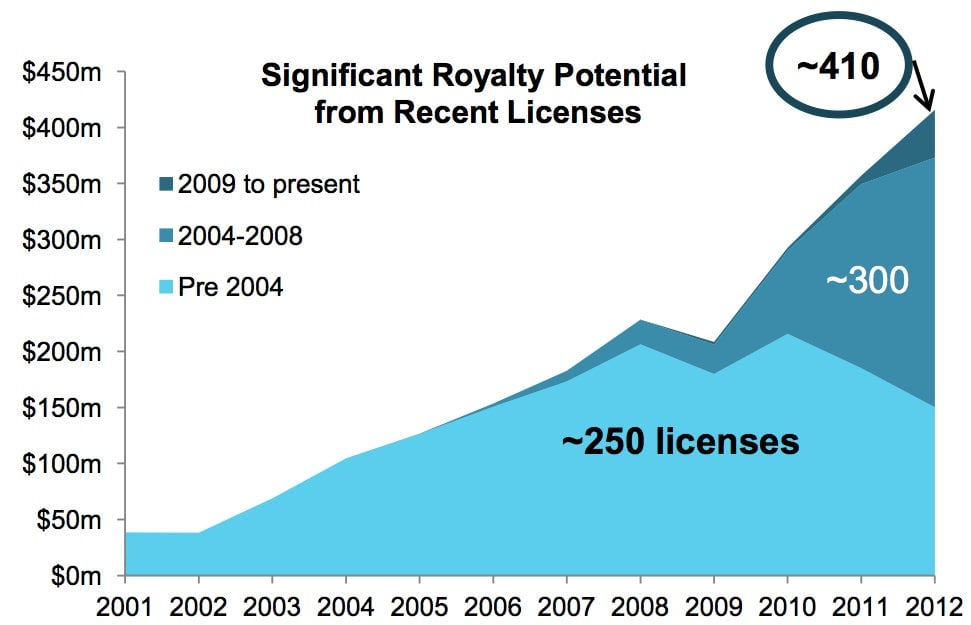

Here’s a chart from ARM’s previous quarterly report, but it bears repeating: As ARM adds more licensees, it builds up additional, recurring streams of licensing and royalty revenue.

ARM added approximately 40% of its current licensees in just the past two years alone. As those companies grow and produce more chips using ARM’s designs, the company’s revenue could continue to grow rapidly.

4. Ironically, the more ambitious ARM gets, the more of a threat Intel will be

With all this new business, and with Intel more or less absent from the mobile chip space, at least in terms of market share, to a casual observer it might seem that ARM is simply beating Intel at its own game, which is designing the best possible chips.

But a recent paper (pdf) presented at the IEEE Symposium on High Performance Computer Architecture says that simply isn’t so. Essentially, engineers who looked at Intel chips vs. ARM chips discovered that they are both really good, but “optimized for different performance levels.”

In plain English, that means that the designers of ARM chips have successfully emphasized low power consumption over processing speed, while the designers of Intel’s chips have successfully emphasized performance, at the expense of power consumption.

That’s why ARM chips got an early lead in the mobile space. And that early lead may translate to a sort of lock-in, for mobile at least, because companies that make mobile phones, like Samsung and Apple and now Google, can’t very easily re-translate huge libraries of software for Intel’s mobile chips. They simply speak a different language than ARM’s chips do, and abstracting away that fact can cause other problems, like reduced performance.

But in the data center, where ARM clearly has ambitions, the tables are turned: Most servers running the cloud are powered by Intel’s chips. So even as ARM becomes more ambitious, it won’t necessarily succeed in moving beyond its dominance in the mobile space.