Avocados are now too popular for their own good

US consumption of avocados is at record levels, but the industry behind the fatty green fruit is staring down a gauntlet of new challenges brought by a changing climate.

US consumption of avocados is at record levels, but the industry behind the fatty green fruit is staring down a gauntlet of new challenges brought by a changing climate.

Waves of scorching heat hit California avocado farms this summer. Then came pests, invasive beetles that drilled holes into the trees and left behind a pathogenic fungus. And finally, by August, the $1.72 avocado. As crops languished across California’s farmland, Tom Bellamore, head of the state’s avocado commission, was left to wonder.

“Avocados have this huge popularity now, and yet these things are happening in the California industry that have never occurred before,” Bellamore said. “It causes you to question, what does the world really hold?”

When he first entered the business 25 years ago, the main challenge for growers was to convince US consumers that avocados were nutritious, despite the fruit’s high fat content.

Now demand is so high that prices in swaths of the US are forcing some in the food service industry to improvise.

Sorry, New York

Jessie Gould is the founder of Ox Verte, a New York catering company. Her menu boasts as much regional produce as she can get her hands on, depending on the season. For avocados she’s dependent on supply chains rooted well outside the US Northeast—and she felt that distance when prices this summer began to rise, to triple and even quadruple the normal rate, she says.

“We called it avo-geddon,” she says. ”We actually took avocados off of our menu for a bit and subbed in sweet potatoes.”

The trouble wasn’t just due to the crop damage from the triple-digit heat in California, which Bellamore says “literally sort of toasted the trees, especially young ones.” High temperatures also hurt shipments to the US from Mexico, as did a growers’ strike in July. Mexico is the primary supplier of avocados eaten in the US; only about 7% of avocados consumed on the US side of the border are grown domestically.

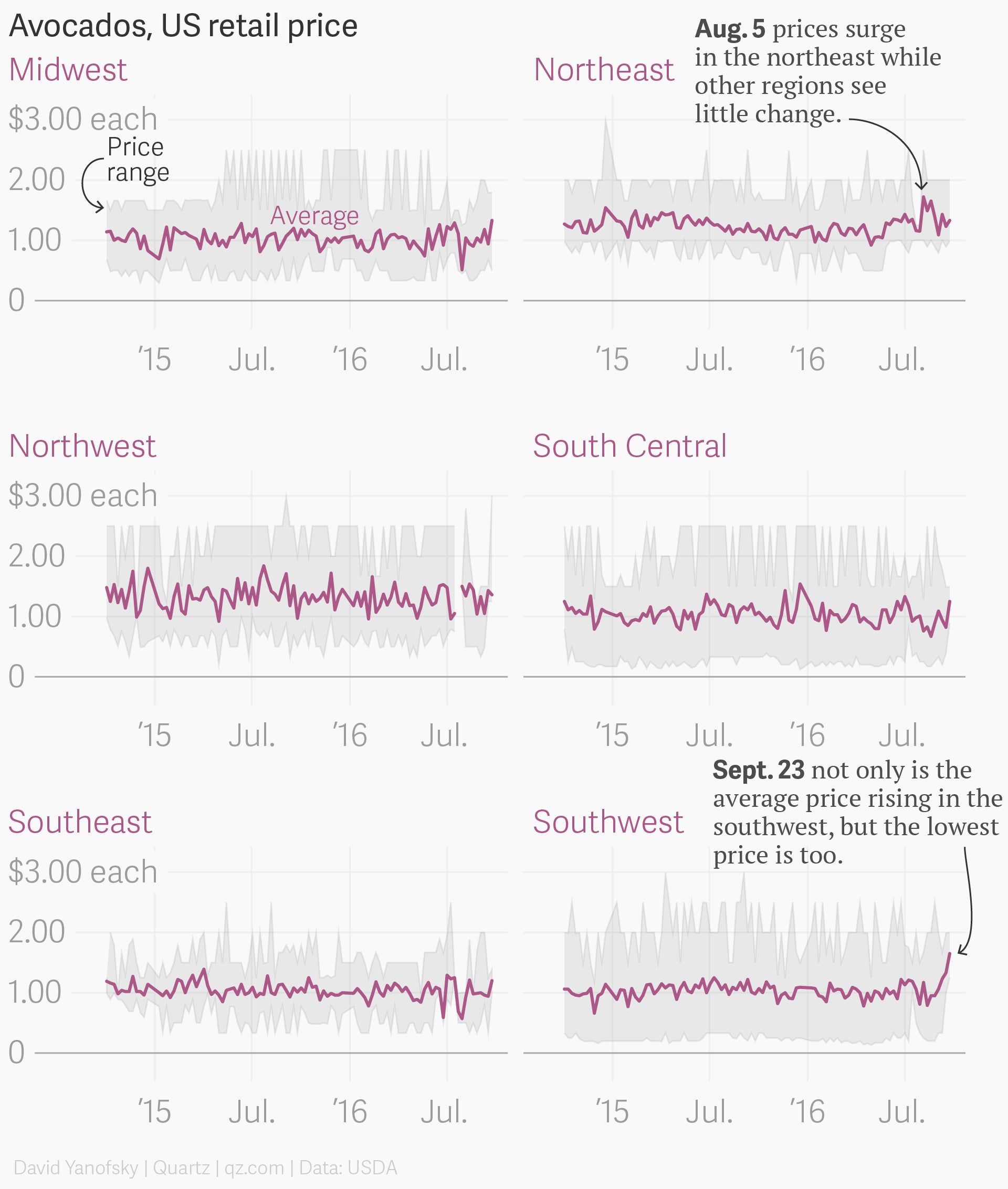

Supermarket prices across the US can fluctuate dramatically from region to region. For example, while retail prices in much of the country remained at normal or lower levels in August, prices in the Northeast jumped $0.57 per fruit, according to the USDA.

It’s not over yet

Prices are now on the rise in the US southwest, where the average price of $1.65 per fruit is the highest ever recorded in the region—and twice as much as it was six months ago. Typically the region with the cheapest avocados, the southwest now has the most expensive in the contiguous 48 US states. That’s despite being relatively close to the US-Mexico border crossings of Laredo and Hidalgo in southern Texas, where 90% of avocado imports by value came into the US by truck in 2015. (Just 7% was imported through seaports.)

Alternative sources of supply don’t seem to be picking up all of the slack. Fewer avocados are landing in New York, Philadelphia, and Miami—major east coast ports—compared with last year. Typically the crop coming through those ports is from countries like Peru, Chile, and the Dominican Republic, and is cheaper than the Mexican imports. This year through July, avocado import volumes at US east coast ports were down 9.8% from the same period in 2015.

Perhaps it’s time for Americans to reconsider their avocado addiction.

“I think it’s an important dialogue to have,” Gould said. “We all need to be thinking a bit about which items we can have sustainably. It is really, really inefficient for our country to consume as much of it as we do.”