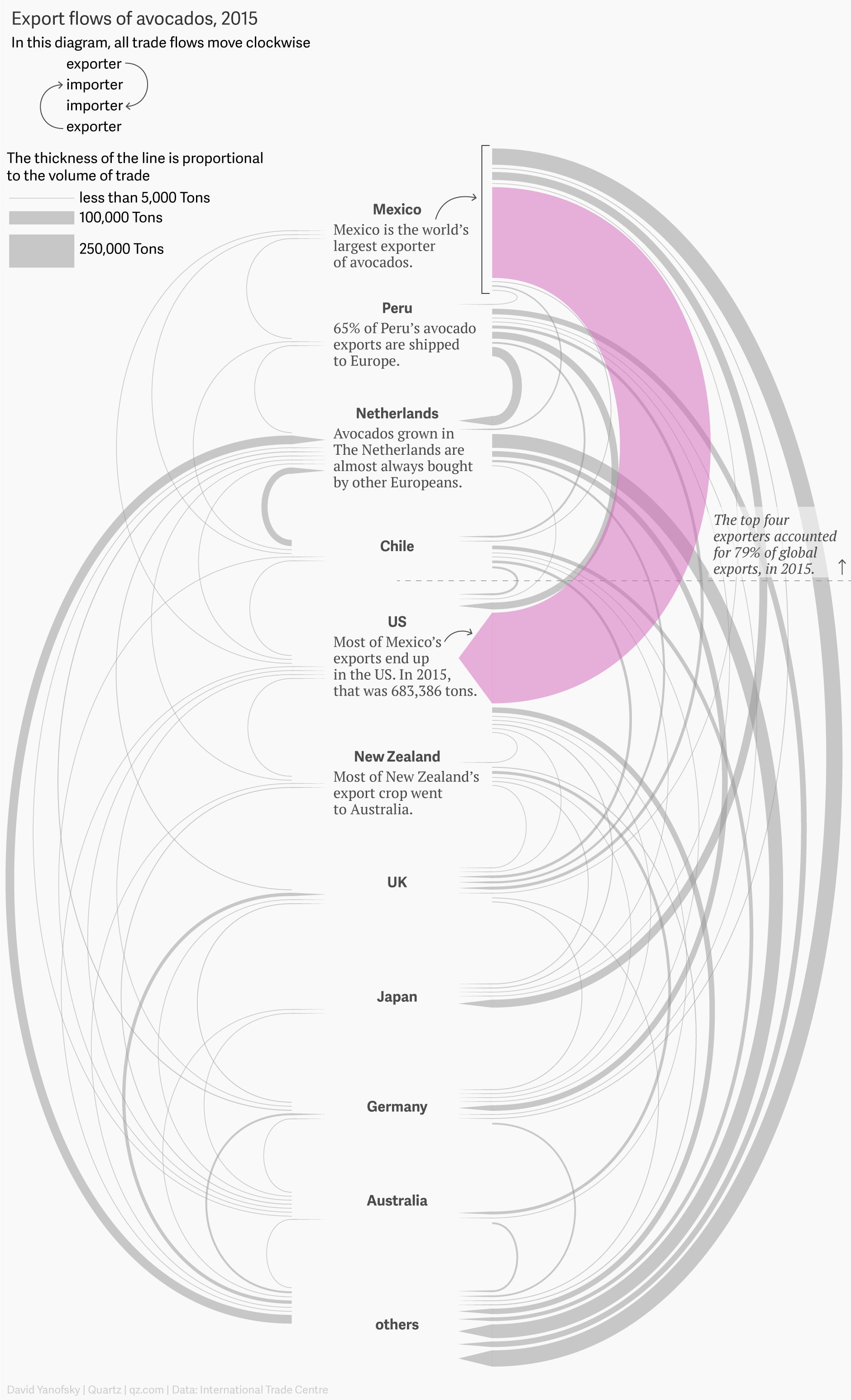

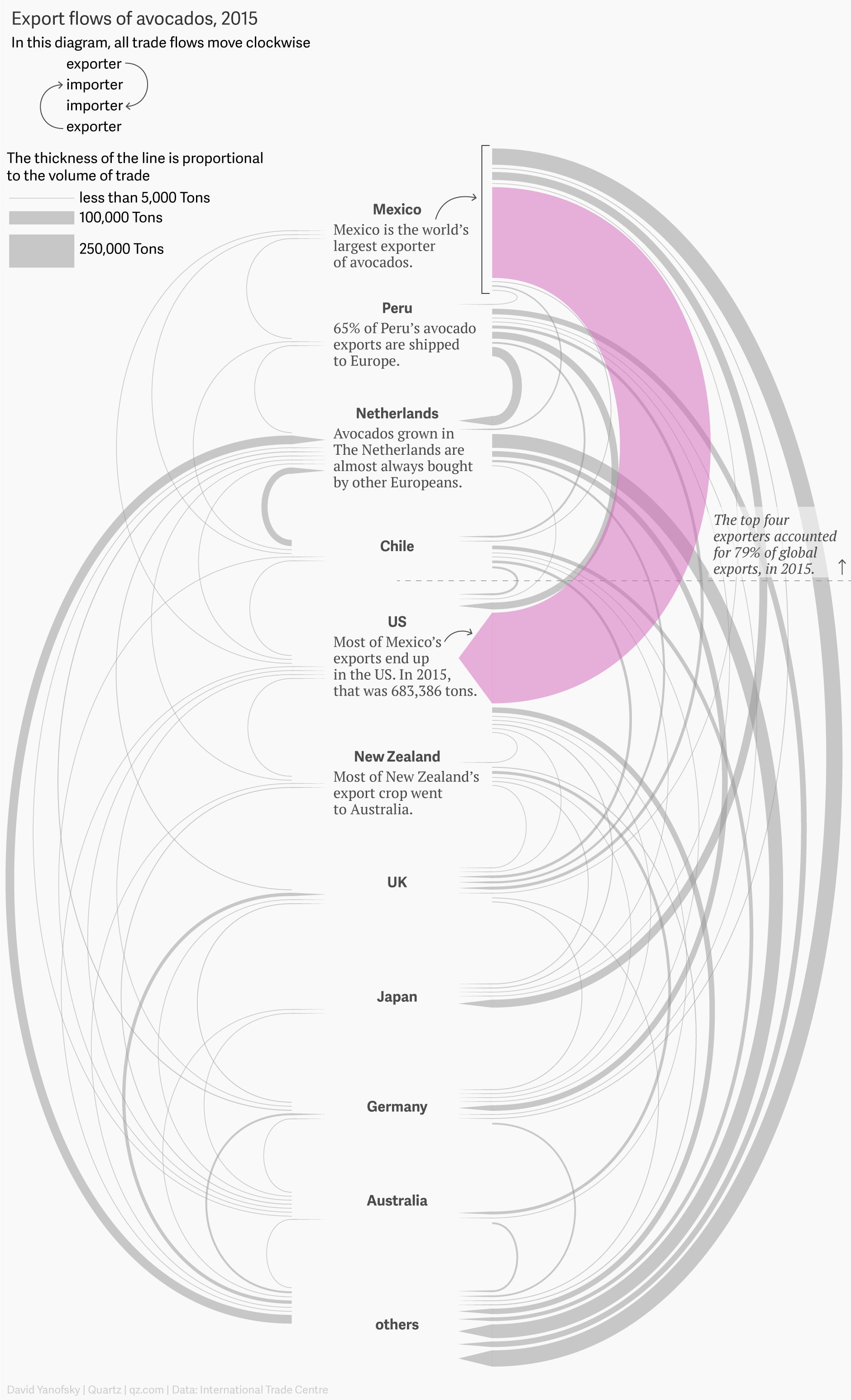

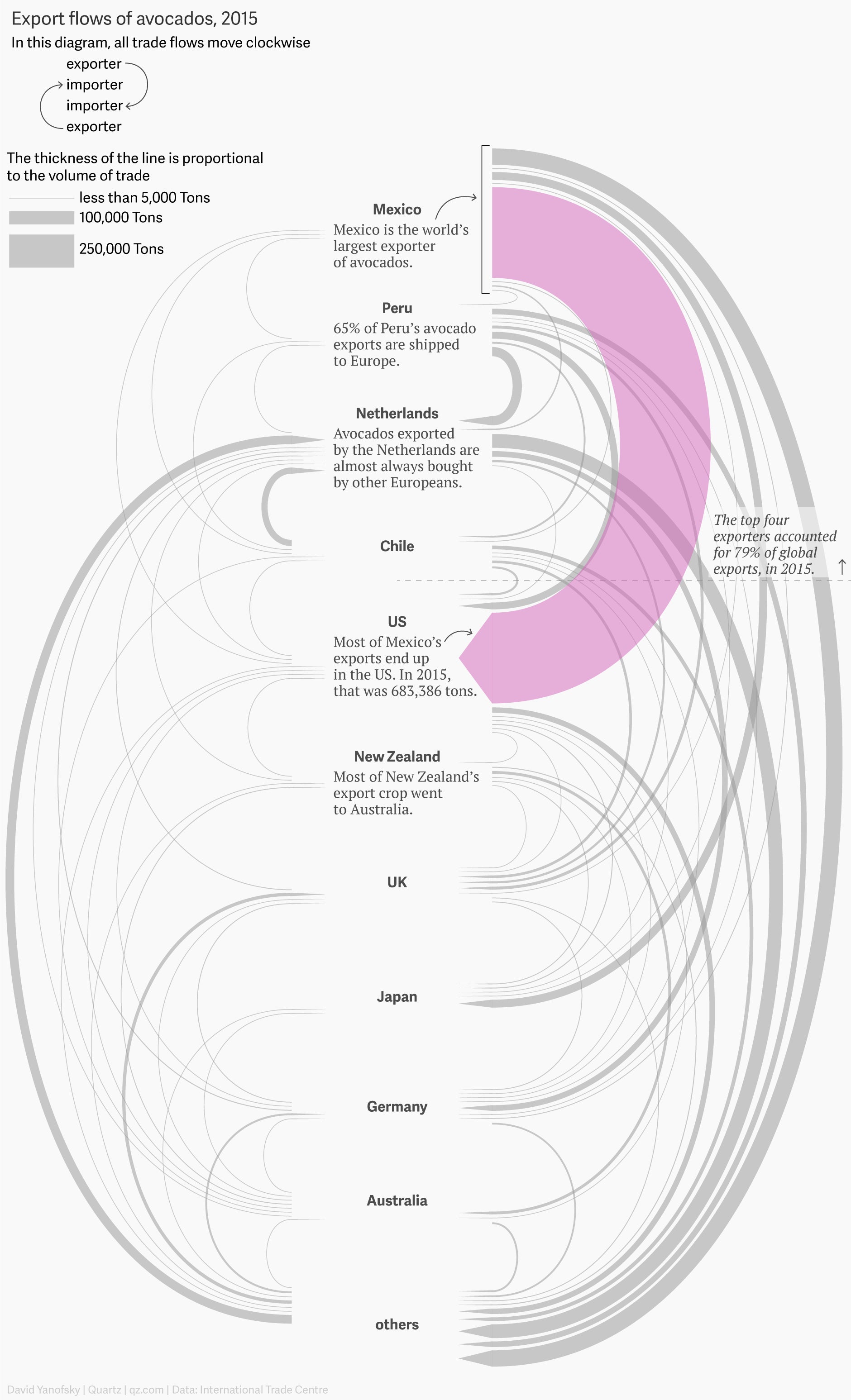

The great global avocado trade flow chart

Avocado prices are on the rise. An increase in US demand and weak production in Mexico and California has left the Americas in short supply of the fruit, with chefs seeking alternatives like sweet potato.

Avocado prices are on the rise. An increase in US demand and weak production in Mexico and California has left the Americas in short supply of the fruit, with chefs seeking alternatives like sweet potato.

On the other side of the world, Australia and New Zealand recently had the same problem. Avocado theft rose in New Zealand along with prices earlier this year. There were nearly 40 large-scale avocado thefts from growers on the north island of New Zealand in the first half of the year, according to The Guardian.

The avocado trade is intensely concentrated in Mexico. Half of the world’s exports originate there.

The US is extremely dependent on its southern neighbor for the silky green fruit. Trade data from the US Census Bureau show that 90% of avocado imports by value came through the border crossings of Laredo and Hidalgo in southern Texas in 2015. Just 7% were imported through seaports.

Temporary food shortages and price increases for single crops and livestock are common and typically short-lived. Recent years have seen spikes in coffee, pork, egg, and even cauliflower prices due to shortages.

Correction: An earlier version of this item incorrectly described all the avocados exported by the Netherlands as having been grown there.