High frequency trading (HFT) has come in for much criticism during the last month, and today the Securities and Exchange Commission (SEC) is devoting a special roundtable meeting to it in Washington, DC. The upset isn’t merely over the unpredictable spikes and drops (“flash crashes”) that HFT is blamed for: it’s also about fairness. Investors are incensed that some HFT firms have been able to obtain information earlier than others, whether by submitting inconsistent orders they don’t intend to trade on or setting up their computers near an exchange to make transactions faster.

Yet despite the outcry, HFT firms really haven’t been making a killing. Competing with other firms to profit from the same tiny inaccuracies in the equities market is an expensive business. While HFT has ballooned in market share during the ten last years, it’s also becoming less profitable. ”The environment that we’re currently in—an environment of low volatility and low turnover—is particularly bad for HFT,” says Andrew Sussman, the Director of Research at TABB Group, an organization that has worked closely with the SEC on the subject. “It’s a zero-sum game for those players so you’re going to see a lot of competition.”

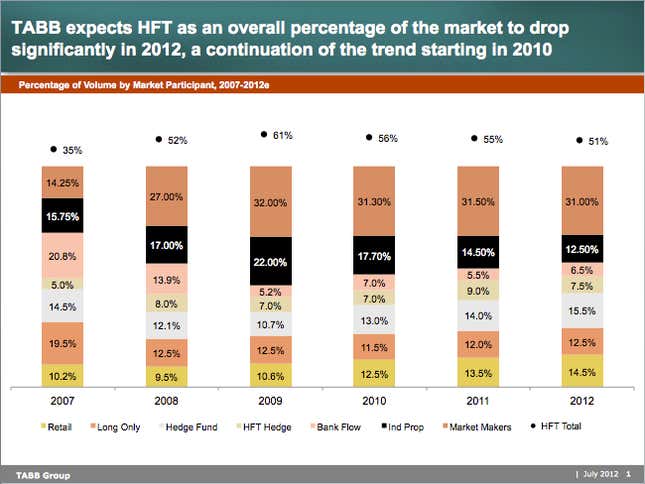

Diminishing returns for HFT players appear to be making them less inclined to play the equities market at all, according to data compiled by the TABB Group. But it remains to be seen if this trend will follow in other asset classes, where the percentage of high frequency trading volume is still increasing.