Spain’s unemployment data for the first quarter of 2013 couldn’t be more dismal: the unemployment rate grew one percentage point to 27.2%. Among men, the rate is now 26.8%, and 27.6% for women. The worst unemployment, however, is among those aged between 16 and 29, where the rate is 53.2%. This new data, along with the gloomy expectations for Spain’s economy and the inability of its politicians to solve the current crisis, has fragmented the political landscape and led to the emergence of leftist and radical parties. It’s a potentially explosive cocktail and it’s not unreasonable to think that it could, like it has in the past, led to a regime change.

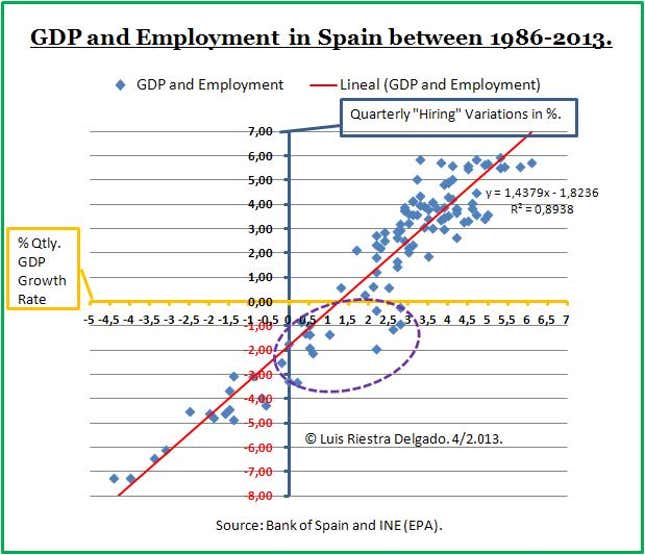

The Spanish employment function

We know that the annualized GDP growth rate for the first quarter of 2013 was -2%, which makes the unemployment number less of a surprise. My employment model indicates that Spain must sustain growth of over 1.25% to stop all of the layoffs. But considering that the average forecast of GDP growth for Spain is -1.5% for 2013 and -1% for 2014, we may actually have another 1.2 million people unemployed at the end of 2014, which would put the total number of unemployed at 7.4 million.

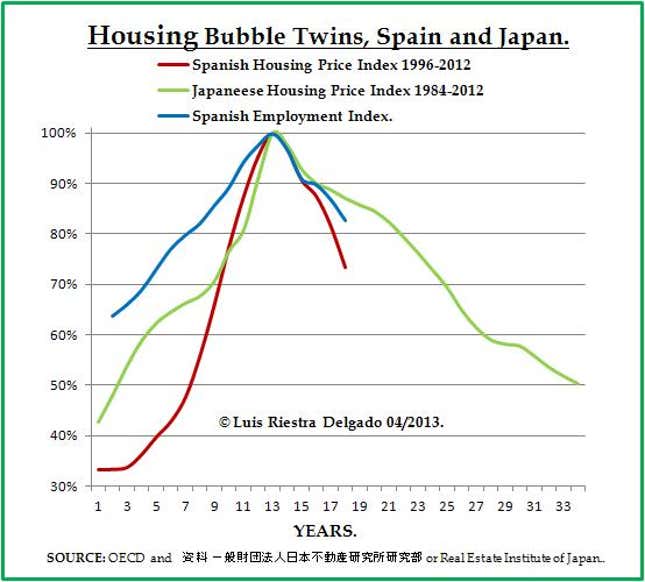

The roots of the drama

Spain’s housing bubble was probably even more virulent than Japan’s. The crash in the housing sector likely expanded to the rest of the economy since the fall in employment mirrored the fall in housing prices.

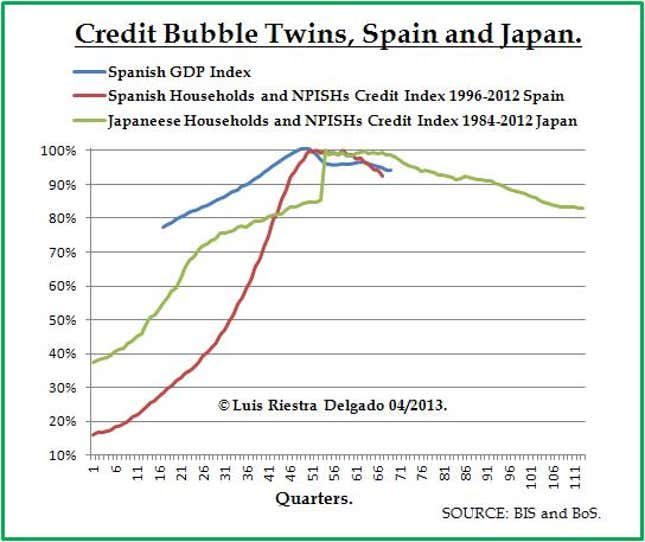

Bad austerity and bad reforms

In 2010, the socialist government reacted by increasing the Value Added Tax (VAT), reducing salaries in the public sector and cutting expenses in social areas like health care. In terms of reforms, it opted for mergers and recapitalizations of the public regional banks, mainly by allowing cajas (savings banks) to do it, despite their obvious political biases. The socialists lost the elections and the new Tory government increased income taxes and VAT, again adding similar cost cuts. It also continued with the politicized reform of the previous government, nationalized some cajas, of which Bankia seems to be going well, and created a poorly managed bank buying system or “bad bank”, called SAREB, in which bad assets (bad loans) were bought with public money. I have warned about the problems with these measures since 2009. The similarities between these and the Japanese mistakes are numerous; they also had a housing bubble and suffered from bad banking reforms. The difference is that, since we don’t have an independent currency, we are falling much faster. Comparatively speaking, we are where Japan was in 2001 when the Economist wrote: Banking Reform in Japan. Seriously? And I quote:

Another matter which has not yet been addressed is the issue of management responsibility. The managers that got banks into this mess are still at their desks, and it is hard to see how revived banks can prosper in future under such a benighted lot.

This particular change in management has not been made for political reasons; the top management at fault has stayed in their posts and the credit crunch has continued to make the economic cycle even worse.

There is an example for how the root of the problem can be addressed: In 2008 before the fall of Lehman, when the National Bank of Switzerland knew UBS was in trouble, it took fast and tough actions regarding UBS’s top management, recapitalized the bank, and sold its stake at a profit. UBS dividends are now on their way to normalization. Lending from UBS’s rebound, we recommended similar actions along with a reform of our central bank for its failure in supervision and change of the cajas’ business model.

Downward spiral and social unrest

As unemployment grows so do unpaid loans, making doubtful the capital needs of the last Wayman audit recommendations(the basis for the agreement between the EU and Spain for helping finance our banking recapitalization process) for Spain’s financials. The government says it is ready to announce new taxes and cost cuts if they are necessary, making the risk of social unrest so high that this all could be the prologue for a regime change.