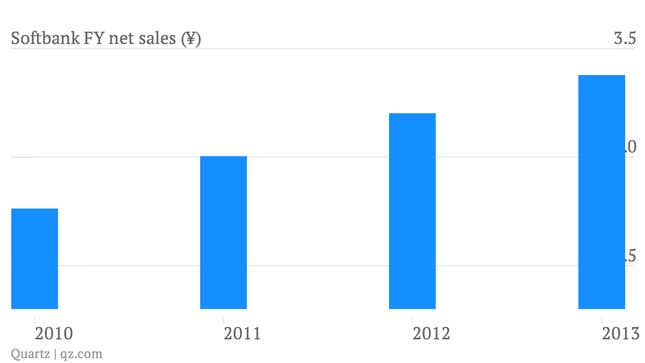

The numbers: Fine. The Japanese wireless carrier and internet company announced fiscal-year earnings of ¥3.4 trillion ($35 billion), up from ¥3.2 for the previous fiscal year. Net income fell 7.8%, though, coming in at ¥289 billion.

The takeaway: The company seems bent on acquiring subscribers to keep its revenue growing, and its $20 billion bid for a 70% stake in Sprint Nextel would jump-start that. A successful acquisition would bring it within spitting distance of Verizon’s 99 million subscribers worldwide, it said in its earnings presentation. Meanwhile, Softbank’s mobile business is booming. Mobile service revenue is up 9%, while its 50% mobile EBITDA margins are the highest among the world’s leading carriers (pdf), beating out Verizon’s 47% and Japanese competitor NTT Docomo’s 42%.

What’s interesting: The company projected more than ¥1 trillion in operating profit for the next fiscal year, which runs from April 2013 to March 2014, despite that it expects its bid for the unprofitable Sprint to be successful. Softbank’s credit ratings are on the verge of being deemed junk, since Moody’s and Standard & Poor’s are worried that Sprint will weaken Softbank’s finances. Softbank has said that it won’t raise its $20 billion offer for Sprint, even as the Dish Network outbid it with a $25.5 billion offer earlier in April. Softbank today called Dish’s offer “incomplete and illusory” in a company presentation (pdf). A shareholder vote on Softbank’s offer is currently set for June 12.