The newest innovation in bringing banking to the people: riverboats on the Amazon River

Journalists (including ourselves) and banks have been quick to gush about the ways in which cellphones and other mobile devices are bringing banking to those with little access to bank accounts, particularly in Africa. But the newest innovation in banking may be a whole lot simpler—and a lot more surprising.

Journalists (including ourselves) and banks have been quick to gush about the ways in which cellphones and other mobile devices are bringing banking to those with little access to bank accounts, particularly in Africa. But the newest innovation in banking may be a whole lot simpler—and a lot more surprising.

Believe it or not, retail banks in Peru and Brazil have taken to sending riverboat branches up and down the Amazon River, writes KPMG’s Ricardo Delfin:

One of Brazil’s largest banks began testing Amazon River services three years ago, using a 125-foot riverboat. With a laptop-equipped banker onboard, as well as a copier and ATM, the vessel travels every two weeks between a dozen Amazon ports including Colombian and Peruvian border towns…

A major Peruvian retail bank began testing a similar concept last year by sending a riverboat branch into the sparsely populated Amazon region of Loreto. The bank has also enabled dozens of local stores to act as correspondent agency branches, to receive deposits and pay cash through SMS messages.

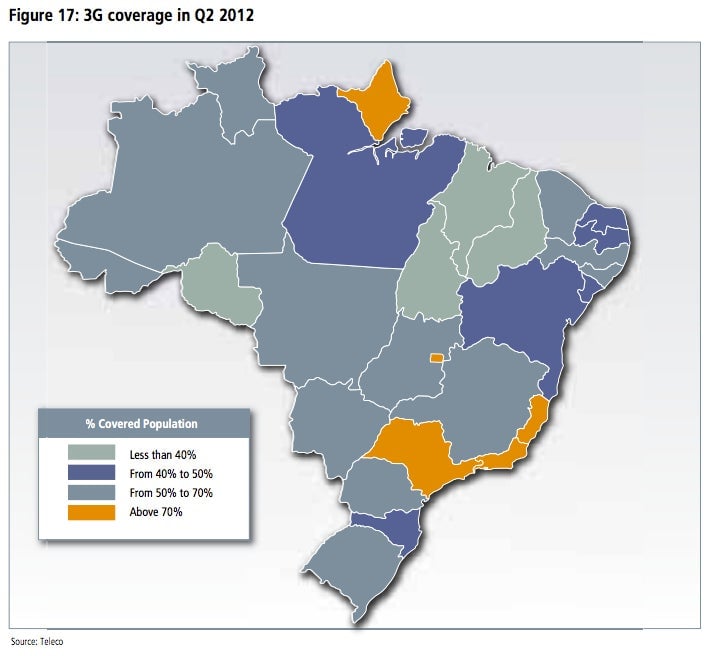

The trend is indeed related to growth in mobile networks in the region, which makes it way for easier for people to access to bank accounts. In November 2009, mobile carrier Vivo launched a program called Amazon Connect, which included building a cell tower in Belterra (pdf), a remote town with just 17,000 residents. Mobile penetration in all of Brazil reached 132.9% in 2012 and continues to rise rapidly. Nearly 90% of homes in Brazil now have access to some kind of telephone—cellular or fixed—according to Teleco.

But the existence of mobile phones and networks alone does not necessarily lead to a rise in mobile banking. Riverboats are helping to sign up customers for services that include mobile banking, equipping stores to handle mobile payments, and providing a way for people to deposit and withdraw cash.

Clearly, regional Latin American banks want to take advantage of growing economic activity even in remote areas, and mean to win customers not from other banks, but from the unbanked population. Though many large multinational banks may be pulling back from consumer-facing emerging market operations, regional banks are looking for new opportunities—and evidently finding them.