Despite the recent struggles of some international markets, there are powerful reasons to look outside the US for stock investments, such as enhanced diversification, the potential for better risk-adjusted returns, and more.

Nevertheless, many investor portfolios remain underexposed to international stocks, often due to misperceptions about these investments. So here are Fidelity’s responses to five common “myths” investors have about investing in international stocks.

Myth 1: International investing is too risky.

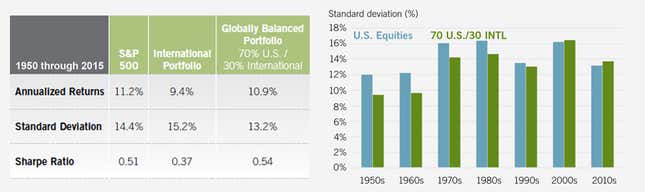

Reality: In combination with US stocks, international exposure can actually lower risk in a stock portfolio. Over the past 65 years, a globally balanced hypothetical portfolio of 70% US/30% international stocks has produced better risk-adjusted returns (Sharpe ratio)1and lower volatility (standard deviation) than an all-US portfolio. The 70/30 relationship has fared worse over the past decade or so, but we believe it may revert to its historical norms given the cyclicality of US and international stock market performance.

Foreign exposure can lower portfolio risk over the long term, though it’s been less supportive recently

Myth 2: US stocks usually outperform foreign stocks.

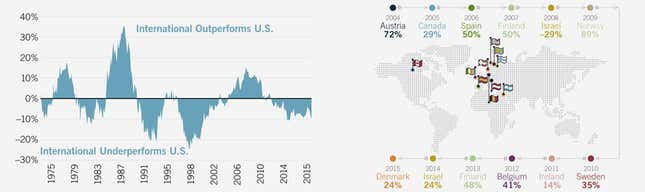

Reality: Historically, the performance of international and US stocks is cyclical: One typically outperforms the other for several years before the cycle rotates. Recent performance has favored US stocks, but foreign stocks are likely to take the lead again, eventually. Timing these rotations is difficult, though, so investors who are underexposed to international could miss significant gains when the market corrects.

Even when the cycle of performance favors the US, foreign markets can still offer higher returns

Myth 3: US multinationals provide adequate international diversification.

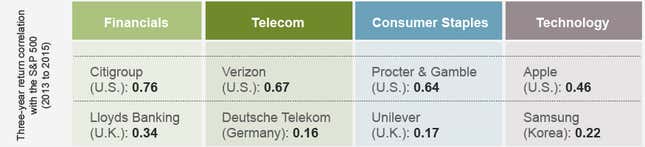

Reality: Over the years, many large US companies with operations overseas have experienced periods when their stock prices have been highly correlated to the performance of the S&P 500.

The chart below compares the average correlations of several US multinationals in different sectors to international counterparts with US-listed shares. The international stocks shown here have offered lower correlations to the S&P 500 over the past three years, which typically signals better diversification benefits.

International stocks can provide more diversification benefits than US multinationals

Myth 4: Investors should hedge their currency exposure.

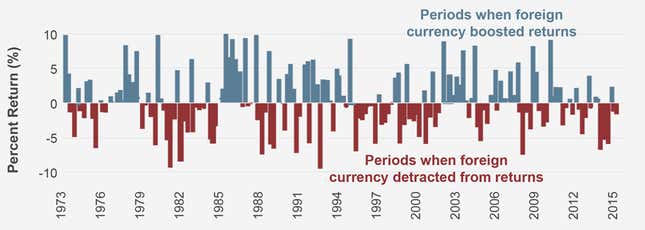

Reality: Currency hedging involves holding a stock denominated in a foreign currency and an equal but opposite position in the currency itself. This is intended to prevent currency fluctuations from hurting the stock price. While it sounds good in theory, the effort and expense involved might not be worth it. Timing currency calls is very difficult, even for professional investors. And currency tends to be a relatively small component of returns.

Historically, earnings growth and price-to-earnings ratios have been far bigger drivers of performance. Most important, currency hedging does not pay off over time. Since 1973, currency hedging has detracted from returns in 50% of quarters, and helped in 50% of quarters. During that same period, the unhedged MSCI EAFE Index has actually beaten the local-currency-denominated (hedged) EAFE by 1.09% on an annualized basis.

Historically, hedging currency has hurt returns about as often as it’s helped them

Myth 5: Index funds have beaten active funds in international.

Reality: An index fund provides exposure to all available companies—good and bad—in a particular investment universe. By contrast, active managers backed by skilled research analysts have the ability to select (or avoid) specific companies they believe will beat (or lag) the index average.

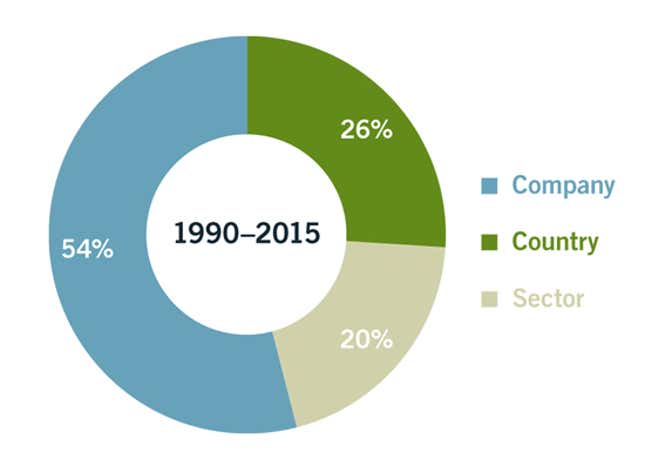

This is especially notable because company selection is the biggest driver of equity returns—twice as important as country or sector selection. The ability to pinpoint specific opportunities may explain why the average actively managed large-cap international fund has beaten its benchmark index by 0.86% annually, even after fees. In comparison, the average large-cap international index fund has trailed its benchmark by 0.32%.2That’s a difference of 1.18% per year in favor of active funds.

Company selection is the biggest component of stock returns

Average source of return for global stocks

Investment implications

International exposure is an essential component of the stock portion of a balanced portfolio, and it’s important not to let myths and misconceptions derail a sound asset allocation strategy. Given this, here are several important considerations about the six-year bull run in US stocks:

- It won’t last forever;

- Investors may now have too much US equity exposure, which could increase portfolio risk; and

- We may be seeing the early signs of recovery in a number of markets abroad. (For details on the outlook for global markets, read the latest market update.)

For individual investors, now may be an ideal time to reexamine their stock allocations to see if it makes sense to add more international equities to their investment mix.

Investing in companies overseas comes with political, liquidity, and currency risks, all of which can create price inefficiencies within individual stocks, sectors, or countries. Active managers by definition can maneuver a portfolio to take advantage of these inefficiencies, and potentially produce greater excess return.

Learn more about

international funds

,

ETFs

, and

individual stocks

.

This article was produced by Fidelity and not by the Quartz editorial staff.

Fidelity’s Investment Product Vice President Matthew Godfrey, Investment Product Directors Wilson St. Pierre and Cheri Kotlik, Asset Allocation Research Team Senior Analyst Jacob Weinstein, and Thought Leadership Vice President Matt Bennett contributed to this report.

- See Glossary of Terms.

- Fidelity Investments, “U.S. Large-Cap Equity: Can Simple Filters Help Investors Find Better-Performing Actively Managed Funds?” May 2015.

Read our full disclaimer here.

Fidelity Brokerage Services LLC, Member NYSE, SIPC, 900 Salem Street, Smithfield, RI 02917

748494.6.0