The European Commission is €130 billion more pessimistic than a year ago

The European Commission messed up a little. In its semi-annual report, the EC says it now expects the euro zone economy to shrink by 0.4% in 2013 (pdf). That’s a big reduction from the 1.0% growth it forecast just a year ago (pdf)—and an even starker reversal on the 1.3% growth it anticipated this year in the report it published back in fall 2011 (pdf).

The European Commission messed up a little. In its semi-annual report, the EC says it now expects the euro zone economy to shrink by 0.4% in 2013 (pdf). That’s a big reduction from the 1.0% growth it forecast just a year ago (pdf)—and an even starker reversal on the 1.3% growth it anticipated this year in the report it published back in fall 2011 (pdf).

Tally all that up and you get roughly €130 billion less in euro zone output than what the EC expected only a year ago.

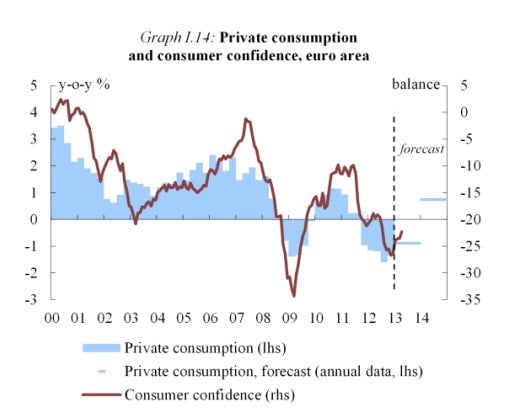

Why the gloom? “Multiple headwinds continue to weigh on domestic demand” (pdf), says the report, noting that five straight quarters of declines in both private consumption and investment may persist throughout 2013. It chalked this up to delveraging among banks, businesses and households.

At least the EC’s consistent. Its view on unemployment has undergone a similar dimming. After projecting 2013 unemployment rate of 9.6% back in the fall of 2011 and 10.3% just a year ago, the EC now expects 12.2% unemployment for this year. The rate is now about 12.0%, with 19.2 million without jobs as of February.

Olli Rehn, EU commissioner for economic and monetary affairs, finally acknowledged that unemployment is perhaps more of concern than hitting targets of his austerity crusade. In a statement, Rehn urged leaders to “do whatever it takes to overcome the unemployment crisis in Europe.”

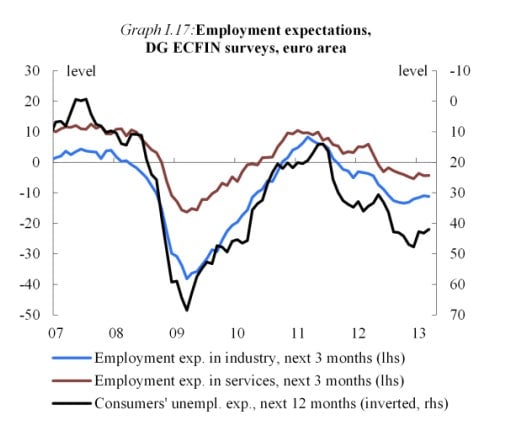

“Whatever it takes” is so last year, Olli. And anyway, what would it take to dislodge the unemployment problem, which the report says is “becoming more firmly entrenched”? Here’s a look at hiring expectations among industry, services and consumers:

Consumers are the dreariest bunch, evidently. And that’s a massive problem given the withering of consumption, contributing to an implosion of intra-euro zone demand for goods and services. The report expects private consumption to decline even more in the first half of 2013, and to fall by 1.0% in the euro zone compared with 2012.

And, unsurprisingly, we shouldn’t expect public demand to offset the withering of private consumption—it should stay flat in 2013. In general, the report projects a slower pace of fiscal consolidation, and to shift from revenue-raising to “discretionary cuts in expenditure, mainly wages and salaries as well as public investment.”

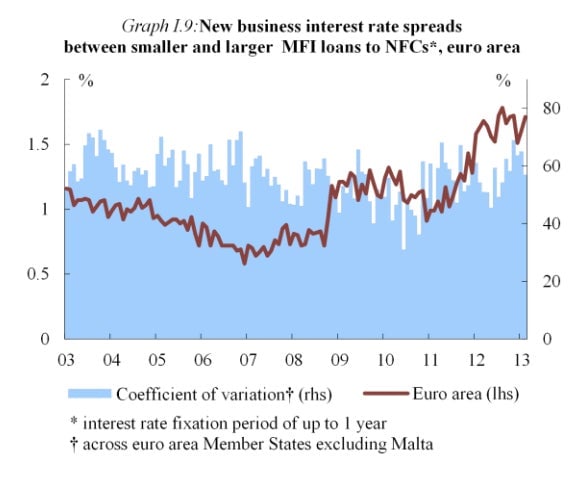

It also notes that the improved state of euro zone banks have “so far not translated into increasing credit supply and an easing of lending conditions across countries.” As we discussed recently, that’s a big problem—and one that even rate cuts like yesterday’s isn’t likely to fix.

The good news is that the EC expects a reversal in the sharp drop in new export orders in the second half of 2013. That’s much needed: As we discussed yesterday, a sharp drop in new export orders are knocking out the final engine of business activity for the euro zone’s manufacturers.

The bad news is that an export revival is pretty much the only thing it’s counting on to drive GDP. And given the EC’s knack for forecasting accuracy, it might be best not to hold one’s breath.