Economist Stephen Roach recently distilled exactly why it’s so important that China move away from unsustainable growth propped up by exports, infrastructure projects and real estate. ”China’s services sector requires about 35% more jobs per unit of GDP than do manufacturing and construction,” he wrote. In essence, China’s service-sector growth is a measure of how sustainable its overall economic growth will be.

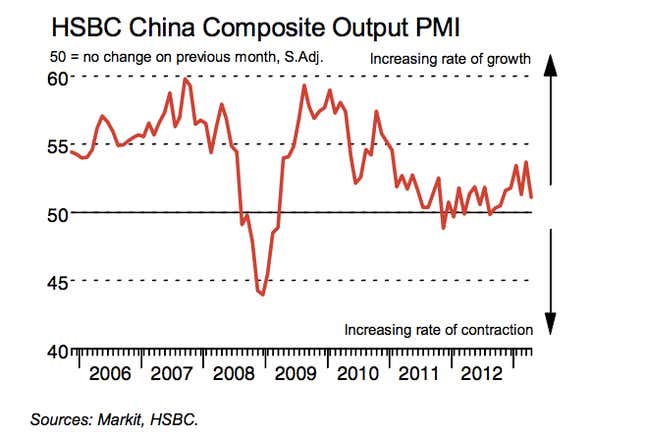

Unfortunately, new metrics out today are not encouraging. The Markit/HSBC purchasing managers’ index for China’s service sector slipped to 51.1 in April, from 54.3 in March (a reading above 50 indicates growth; below 50 indicates contraction). That was the slowest rate of growth in service-sector business activity since August 2011 (pdf). Here’s a look at the trend:

One particularly worrying trend is that the service sector laid off workers for the first time since January 2009—the nadir of the economic slump caused by the global financial crisis. Beijing tends to be particularly anxious about anything that could prompt social unrest, and employment ranks high on that list. Usually the government tries allay such fears by boosting credit and green-lighting investment projects. But China needs to cut back on its reliance on investment, and a return to the profligate spending of the year after the financial crisis defers structural changes in the economy that many, including the Chinese government, think are critical.

Though today’s PMI is but a single datapoint, it chips away at the hope that China is successfully encouraging households to spend more. While domestic consumption generated 4.3 percentage points of the first quarter’s otherwise dismal 7.7% GDP growth, much of that came from construction, which reflects growth in credit-led investment than it does an uptick in domestic appetites.

Even as wages have shot up in the last five years, domestic consumption continues to stall, as today’s data show. The Chinese government needs to do more than merely admitting the problem. Shifting wealth away from the state and toward households will require liberalizing interest rates and ending the exchange-rate rigging that drives export growth. Doing otherwise will merely forestall the inevitable day of reckoning.