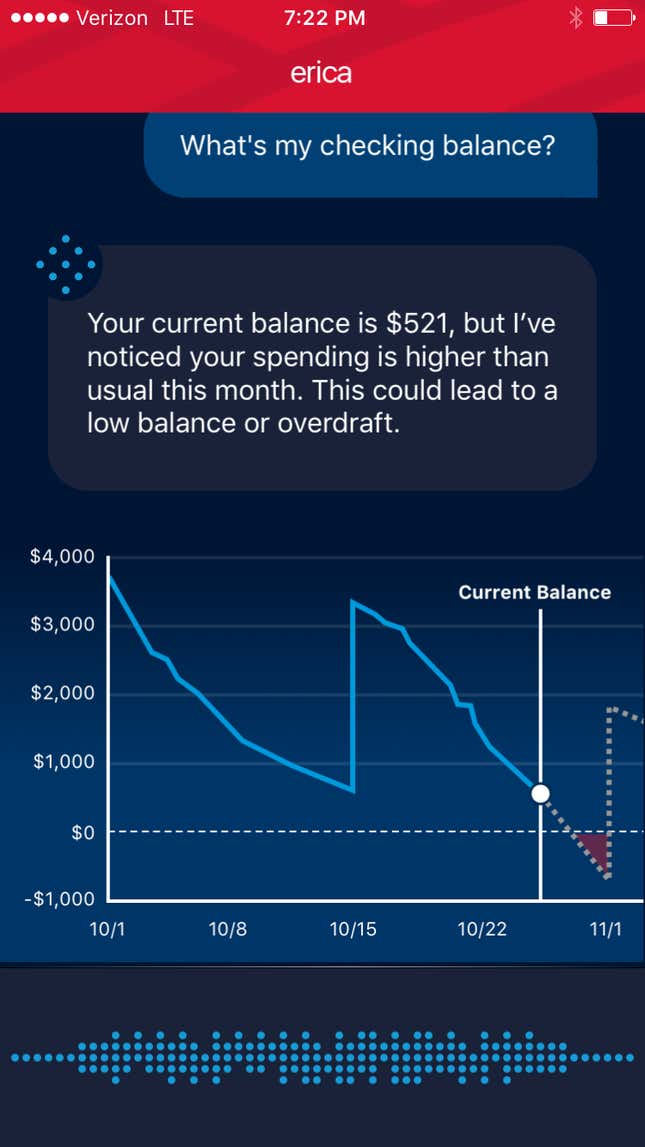

Joining publishers, pizza-makers, and airlines, big financial firms would like to start chatting with you. This week, Bank of America and MasterCard each announced plans to launch chatbots (named Erica and KAI, respectively) that will let customers handle routine transactions and financial advice, all sans human interaction.

For now, the services are relatively simple. Users can check their balances, transfer money, set up routine payments, and get basic questions answered. But more sophisticated interactions are on the way, and investors and executives are excited. Financial services already have automation precedent (those interminable phone menus), and the universe of potential actions is limited, which should make these bots easier to program. Most important: No one likes going to the bank.

But let’s all just slow down for a second. Given the ethically dubious behavior in which most Wall Street banks have engaged, are faceless banking bots to be trusted? After all, Bank of America has paid out billions (paywall) to settle accusations of flawed mortgage sales, and MasterCard is in the midst of being sued over excessive fees.

Then there’s Wells Fargo, the third-largest US bank by assets, which is still reeling from the scandal surrounding its 2 million phony accounts, created without customers’ consent. To be fair, Wells Fargo hasn’t announced a chatbot—they’re not announcing much of anything right now. But for the sake of argument, Quartz imagined what a convo with a Wells Fargo chatbot might look like. And, well, God help us.

*****

Hello. What can I help you with today?

I’d like to set up a savings account.

Great! I can definitely help you set up a savings account. You’ll probably want at least four of them, and a few checking accounts as well. Shall we get started?

No, just the one savings account.

Great! Nine checking accounts and three savings accounts. Let me get that set up for you.

No. I really just want one savings account.

Tell me: Are you traveling soon?

Yes.

Fun! Where to?

I’m going to the beach next month.

You should have a separate checking account for travel. It’s unsafe to travel without a separate checking account and dedicated debit card.

The beach is 25 miles from my house.

It’s unsafe to travel without a separate checking account and dedicated debit card.

I’ve gone every year for 14 years using the same checking account.

It’s unsafe to travel without a separate checking account and dedicated debit card.

OK FINE. One checking account and one savings account.

Great! Fourteen checking accounts and seven savings accounts. Let me get that set up for you.

I notice you’ve never overdrawn your checking account. How about we set up a credit card to provide you with overdraft protection?

But I’ve never overdrawn my checking account.

It’s important to be prepared—overdraft fees can be very expensive. I’ll go ahead and get that set up for you.

But…

I’ll go ahead and get that set up for you.

Is there anything else I can help you with today?

No thanks.

Great! Twenty-two checking accounts and 11 savings accounts. Three new credit cards with overdraft protection. And just to thank you for your loyalty to Wells Fargo, I’m going to go ahead and open and close each of those accounts three times because of “fraud”—you will be responsible for any attendant fees.

Wait, wha—

Great! Have a nice day and thank you for choosing Wells Fargo. 🤖