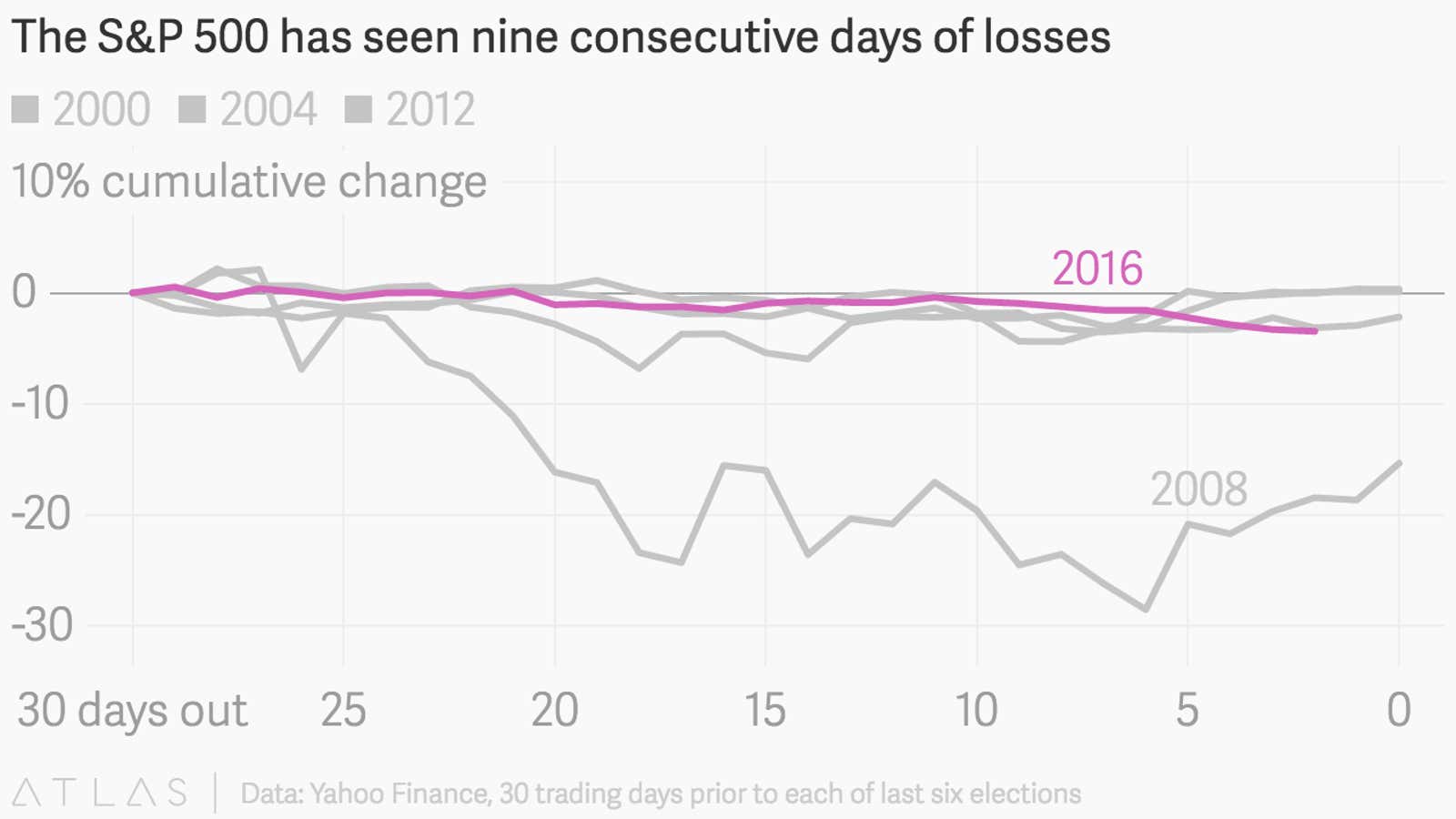

With only a few days left before Americans go to the polls, anxiety seems to be spiking. The S&P 500 experienced its ninth consecutive day of losses—something that hasn’t happened since 1980, much less immediately before an election.

This multi-day decline is especially troubling given recent warnings that a Trump victory could cause the S&P to tank. The Brookings Institution predicts a 10 to 15% loss (pdf). The Financial Times, while rejecting the 10 to 15% figure, also projects significant losses.

However, as Quartz reported in September, market reactions to US presidential elections are often less dramatic than they first appear. While the declines in the S&P are worrisome, total losses are similar to those in the run-up to previous elections. Those trends have generally not been predictive of performance after election day.

Presidential elections rarely herald a change of direction in the stock market. The days leading up to the 2016 election have, for the most part, looked pretty similar to previous years. Consider gold, which is generally considered to be the safest investment to flee to when markets turn bad. Despite a recent rebound, gold is still slightly down from where it was a few weeks ago.

Unfortunately, there is at least one measure that is wildly out of the ordinary: a 75% increase in in the VIX over the last two weeks. The VIX is an index of volatility in the S&P 500. Speculating on the VIX is essentially betting that volatile days are ahead. Savvy investors can use it as a hedge against future declines in stocks—something many wish they had done before Brexit. It seems investors don’t want to be caught unawares twice.

Taken together the decline in the S&P, the rise in the VIX, and the modest bounce in gold seem to reflect nothing so much as a stressed out and irritable Wall Street. Unsure investors are pulling money from volatile equities and putting it into more stable commodities, but only in modest amounts. With Trump on the ballot anything is possible next week, but it’s important to keep in mind that today’s market vibrations are mostly similar to previous elections. Hovering on the edge of panic does no one any good.