Last week, the Colorado state legislature passed four bills that, together, lay the groundwork for a grand experiment: the regulation of a large-scale market for recreational marijuana. The proposed taxes are especially interesting, because additional state revenue is an oft-cited benefit of legalization.

One of the bills (pdf), passed on Wednesday, lays out the tax rates: a 15% excise tax on wholesale pot and a 10% special state sales tax, in addition to the standard sales tax of 2.9%. The taxes will take effect at the beginning of next year, when licensed retail stores first start selling the drug (pending approval of the bill by the governor and the state’s citizens, which are both expected).

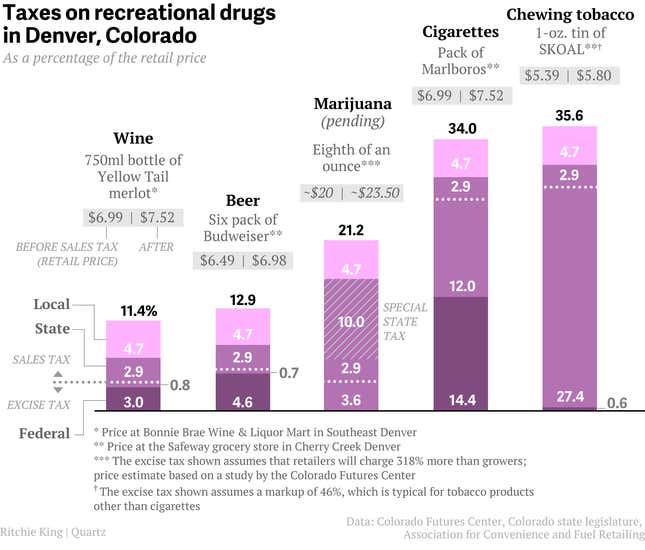

These rates will put pot in a tax realm that is somewhere in between a case of beer and a pack of cigarettes. Here’s the effective tax on a selection of legal drugs in Denver as a percentage of the retail price:

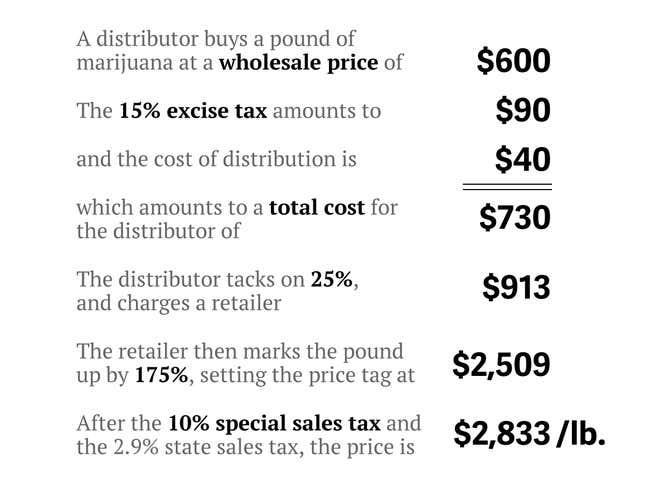

Why is the excise tax showing up as only 3.6% in the chart, when the bill sets it at 15%? Markup. Excise taxes are generally levied when a product first changes hands (so, in the case of marijuana, when a grower first sells it to somebody else, like a distributor), either at a flat rate (like Colorado’s 4.2-cent excise tax on every cigarette) or as a percentage of the average wholesale price. Sales taxes, on the other hand, are charged at the register and based on the retail price, which is, of course, always higher. Researchers at Colorado State University have estimated how much the price of weed will change (pdf) as it makes its way from a grower to a distributor to a consumer, and the markup is significant:

That’s $90 in excise tax on a pound of pot that retails for $2,509, or 3.6% of the retail price.

So, how much revenue are these taxes expected to create for Colorado? Again, researchers at Colorado State have come up with some figures (and have also built an online calculator that lets you derive your own). They estimate that next year, 642,772 Coloradans (about 13%) will buy an average of 3.53 ounces apiece, making for a total tax revenue of $94.4 million.

Though that amounts to almost a one percent increase in total state revenue, some, including the study’s authors, have expressed concern that the money raised won’t be enough to cover the cost of enforcing new marijuana laws, such as legal driving limits. But they don’t take into account the money that will be saved by not prosecuting and incarcerating the many marijuana users who were breaking the law prior to legalization but aren’t anymore. The Colorado Center on Law and Policy estimates those savings (pdf) to be $12 million per year.

How it will all play out remains to be seen. And the world will surely be watching, some through glazed eyes.

(Note: if you use Colorado State’s marijuana tax revenue calculator, be advised that the default value for the special state sales tax is 15%. That was the value proposed in the original bill, but it was ultimately amended to 10%.)