While hustlers in Buenos Aires secretly buy dollars on the street, the Argentine government is openly begging for greenbacks.

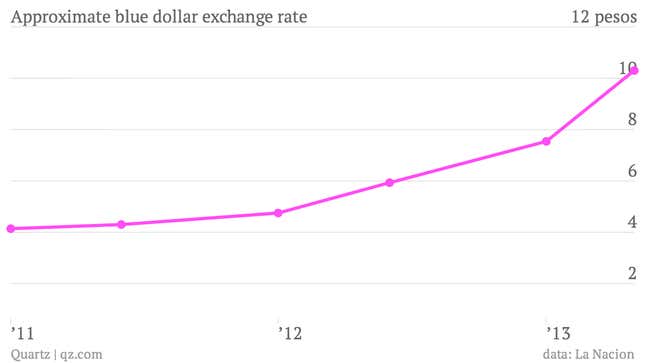

Fears of Argentina once again defaulting on its debt have sent the country into a dollar-hoarding frenzy, and government restrictions on the amount of US dollars locals are allowed to purchase in Argentina have driven many people to buy their US dollars at a premium on the black market. As a result, the black market rate for dollars—widely known as the blue dollar rate in Argentina—has skyrocketed over the past month.

In response, Argentine president Christina Kirchner unveiled a new bill last week, which aims at recovering as much as possible of the estimated $160 billion discreetly held by Argentines. For three months, anyone sitting on a pile of undeclared dollars will be able to contribute to Argentina’s already astronomical debt by depositing them at the central bank in exchange for a 4% annual return through 2017.

But why would anyone buy Argentine bonds right now with American dollars?

People aren’t sitting on dollars in Argentina because they make comfortable cushions; they’re hoarding them because it’s the safest investment in Argentina right now. Argentines are so sure of that bet that they’re now willing to pay more than twice the open market exchange rate. The country’s crippling default in 2001 and the ensuing flash devaluation of the Argentine peso are fresh on everyone’s mind; no one wants to be caught unprepared this time around if the economy tanks. And the reality is that Argentina is teetering on another collapse.

The country is dangerously near another default, Dr. Robert Shapiro, co-founder of economic and political advisory firm Sonecon, told Quartz.

The likelihood of a default is one of the greatest in the world according to credit default swap rates. Inflation is running at about 20%. I’m sure there’s no guarantee that the bonds would be paid back in dollars. It’s a desperate move and I expect it to fail.

Kirchner’s plan to sell Argentine debt for dollars doesn’t address any of the fundamental problems. Argentina has to re-establish itself as a trustworthy borrower first. Shapiro added:

They’re trying to raise funds any way they can, but Argentina’s word is not sound these days. The defaults in 2001 and 2005 have kept them out of international capital markets. If Kirchner were to settle with bondholders, she could begin to restore some international confidence.

Other economists feel that Argentina should first focus on switching to a dollar-based financial system. With a stable currency anchoring its economy, Argentina could function inflation free, and in doing so, theoretically eliminate the peso-driven paranoia keeping investors at bay and leading Argentines to load up on foreign currency. According to economist Steve H. Hanke, who thinks the US dollar could save Argentina, dollarizing the economy wouldn’t even be that difficult.

In short, the Banco Central de la Republica Argentina (BRCA) would take all of the assets and liabilities on its balance sheet denominated in foreign currency and convert them to U.S. dollars. The Central Bank would then exchange these dollars for all the pesos in circulation (monetary base), at a fixed exchange rate. By my calculation, the BRCA would need at least $56.36 billion to dollarize at the official exchange rate (as of 23 April 2013).

Argentina’s central bank has roughly $31.23 billion in net foreign assets. If Argentina were to dollarize at an exchange rate above the official ARS/USD rate of 5.17, but below the current black market rate of 10.30, the central bank could manage to buy all of Argentina’s pesos.

But Kirchner is as unlikely to dollarize Argentina’s financial system as she is to settle the $1.4 billion in defaulted bonds leftover from Argentina’s 2001 default on anyone else’s terms but her own. Currently, that means asking Argentines to hand over the US dollars they covet for the Argentine bonds they don’t. It’s hard to see why anyone would oblige.