A new model by the International Energy Agency suggests that we are moving into a five-year period of much lower oil and gasoline prices—no one can say how much lower, but they could plunge. The winners will be consumers, and blood may be on the floor of some big producers such as Russia and OPEC.

Another loser—oil traders.

The big change is that, unlike the last seven or eight years, the world will have many oilfields working at less than full-capacity. In industry argot, “spare capacity” is going to expand considerably.

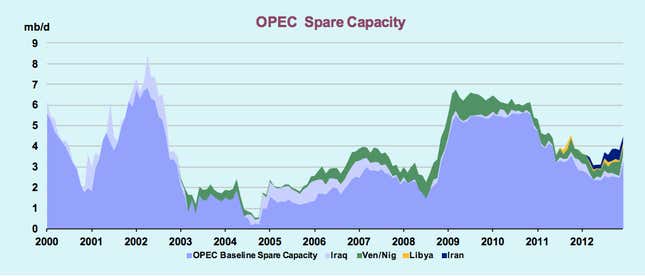

Since the mid-2000s, global supply and demand have been more or less in balance, which is the main reason that oil and gasoline prices have surged and remained high: At the mere hint of political or natural instability such as the Arab Spring, a militant attack or a big hurricane, oil traders, acting on concern over the ability of producers to supply the market, have sent prices through the roof. Average prices have been at historic highs—exceeding $100 a barrel for two years running. They especially have soared at times of narrow spare capacity. Look at what happened after 2002 in this chart.

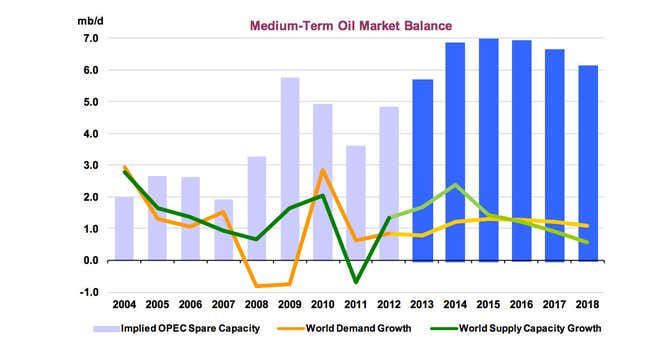

But the IEA’s new five-year global oil outlook (paywall) forecasts that spare capacity will more than double next year, from the current three million barrels a day to more than seven million barrels a day next year. Spare capacity in OPEC nations alone will remain above six million barrels a day through 2018. The standard definition of spare capacity is oil that can be brought to market within a month and be sustained for a three-month period. That is plenty of time to weather most crises. Now look at this chart, which shows the rise in spare capacity forecasted.

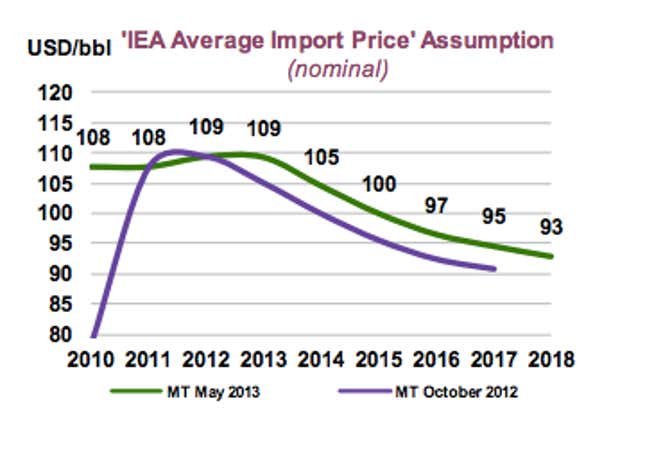

Brent crude is currently trading at about $102 a barrel. The IEA is forecasting $93 a barrel by 2018, and Brent futures on the ICE exchange are trading at $89 a barrel for that year. But prices could plunge more—last year, Citigroup forecast average $80-a-barrel prices through 2017, and they could drop even below that. The IEA does not forecast prices but here is the assumption in its model.

The winners will be consuming nations and drivers. The losers will be OPEC, which requires oil prices averaging $99 a barrel to make the social payments that helps to keep this autocratic group in power. Russia requires $117 oil prices to provide the revenue it needs to balance the state budget.

In an interview published today in the Financial Times, Saudi Aramco’s CEO Khalid al-Falih said he welcomes (paywall) the US shale oil boom, which is responsible for much of this shift in spare capacity. But Falih may not have read the IEA report before making the statement.

The cushion of available oil is why oil traders will be among the losers. To earn big bucks, traders rely on price volatility. But if no one is worried about uprisings in the Middle East or hurricanes in the Gulf of Mexico, volatility will be a relic of the mid-2000s.