Here’s how much you would have made had you invested in Apple after its IPO

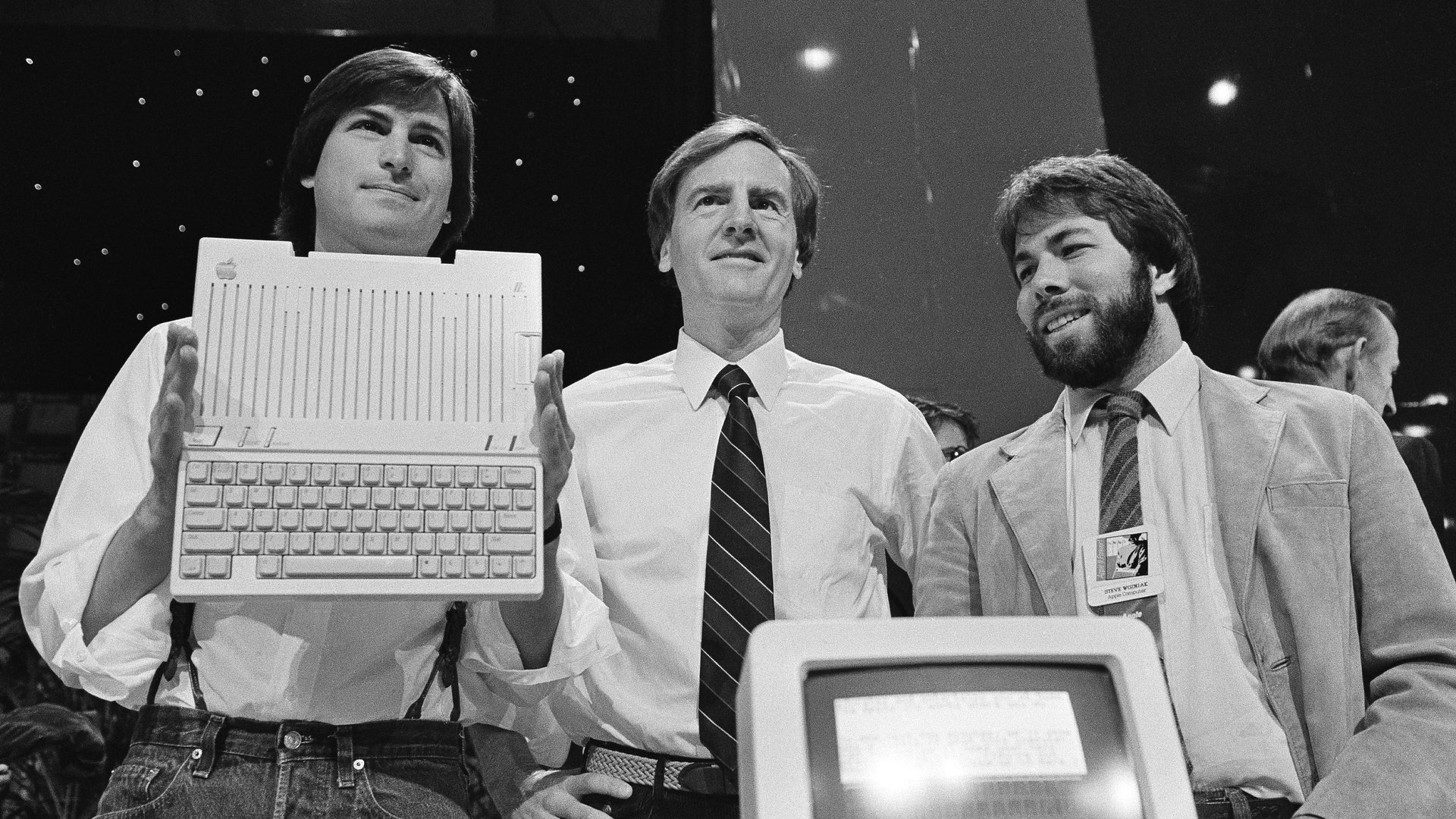

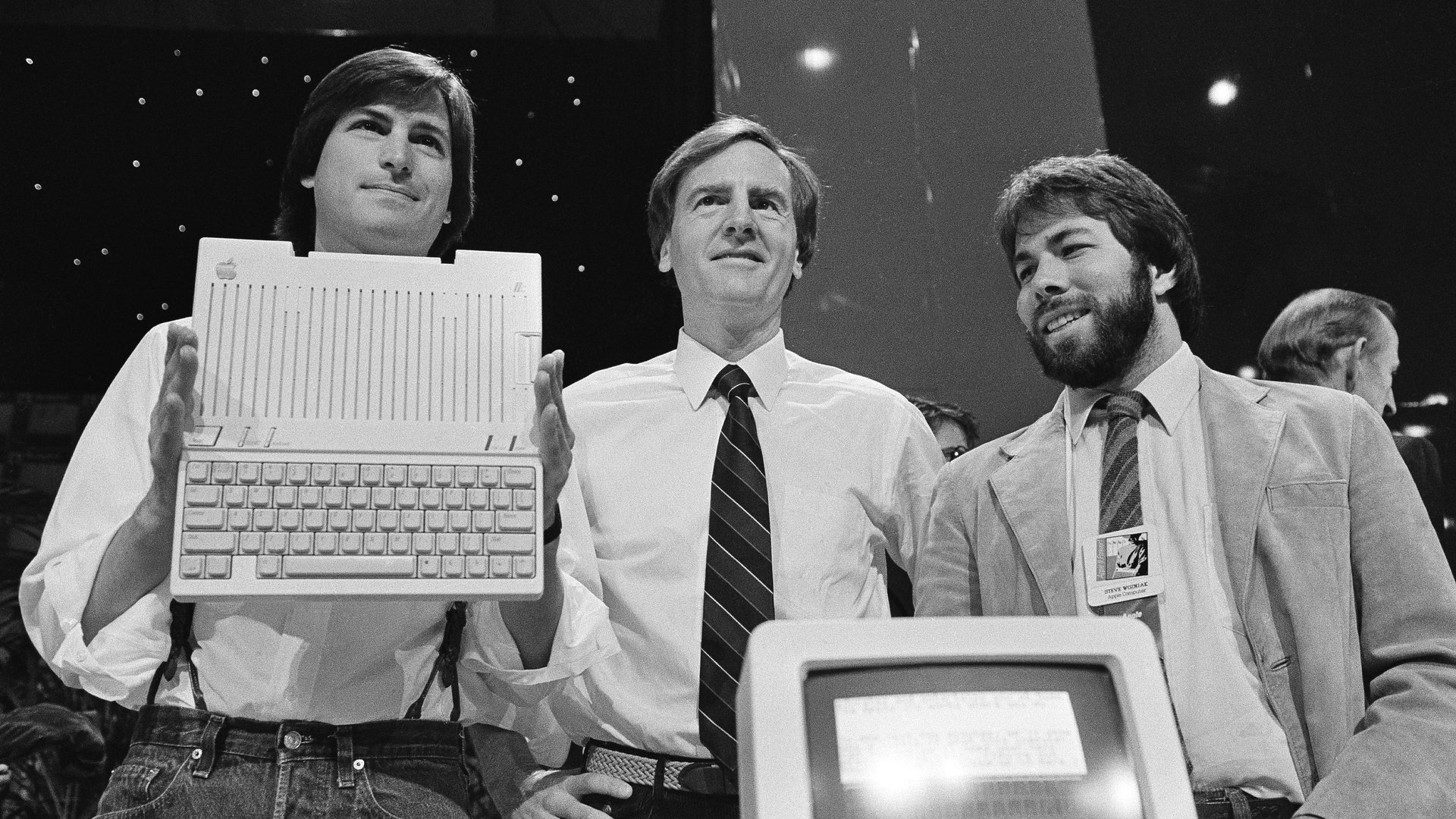

Thirty-six years ago today, Dec. 12, Apple went public. If you’d been investing in fledgling computer startups in the early 1980s and had no problem playing the long game with your investments, they would’ve paid off dearly with even a small investment in Apple.

Thirty-six years ago today, Dec. 12, Apple went public. If you’d been investing in fledgling computer startups in the early 1980s and had no problem playing the long game with your investments, they would’ve paid off dearly with even a small investment in Apple.

Through the successes of the Macintosh, iMac, iPod, iPhone, and in spite of recent stumbles, Apple is now the most valuable company in the world, in terms of market capitalization. At the time of publishing Apple’s market cap was roughly $610 billion.

An investment of $1,000 (or $990, as shares opened at $22) would be worth $285,440 today—a roughly 28,700% return—and that’s not including the thousands of dollars in dividends that Apple paid over that time. In the last 36 years, Apple’s stock has been split four times—three two-for-one splits, and a massive seven-for-one split in 2014, according to Investopedia. That means a single share in 1980 would have multiplied into 56 shares today. (It’s worth noting, though, that $990 in 1980 would be worth $2,904.27 in 2016 dollars, meaning the return would be closer to a paltry 9,728%.)

It would, however, have been beneficial to sell off those shares on May 22, 2015, when Apple stock closed at its highest-ever post-split price, $132.54. That same $990 investment would’ve netted you roughly $334,000 then.

Since the introduction of the iPhone in 2007, Apple’s stock has endured a series of peaks and troughs, with the peaks aligning relatively closely to each new product line the company has launched. Apple may have hit its peak in 2015, but it’s looking like the share price is rebounding again, perhaps in anticipation of the myriad “moonshots” that Apple may be working on, or at least the rumors that the next iPhone is going to be a lot more impressive than the iPhone 7 was.