It’s been a long time coming.

The US Federal Reserve raised its benchmark interest rate (pdf) by 0.25 percentage points today. The rate banks offer to lend to each other overnight—the Federal Funds rate—will now be set between 0.5% and 0.75%, up from a 0.25% to 0.5% range.

Twelve months ago, Fed policymakers hiked rates for the first time in almost a decade. It was an important step that marked the removal of unprecedented emergency stimulus following the global financial crisis. It was supposed to usher in a new era of “normalization”—that is, interest rates that are meaningfully above zero. Last December, Fed officials, led by Janet Yellen, predicted that there would be four more quarter-point hikes in 2016, leaving rates much higher than they are today.

In the end, the bank only managed to squeeze in one hike at the very end of the year. And while a solitary quarter-point increase doesn’t seem like a lot, this “normalization” business isn’t easy.

In January, China’s stock market plunged and sparked anxiety in global markets. Japan also ended the month by cutting interest rates below zero, which investors took as a worrying sign. As things gradually improved, the Fed maintained a cautious stance, delaying a hike for fear of derailing the fragile recovery. Then, in June, the UK unexpectedly voted to leave the European Union, roiling Europe. The US presidential campaign was shortly in full swing, and the Fed continued to sit on its hands until the ballots were cast.

Going into 2017, the Fed seems optimistic. This is in part due to the effect Donald Trump’s election has had on financial markets. While Trump has been a vocal critic of Yellen, analysts expect his policies to boost the economy, at least in the short term. His plans to lower corporate taxes, cut regulation, and approve huge amounts of infrastructure spending have led to a surge in US stocks and stoked expectations for higher inflation.

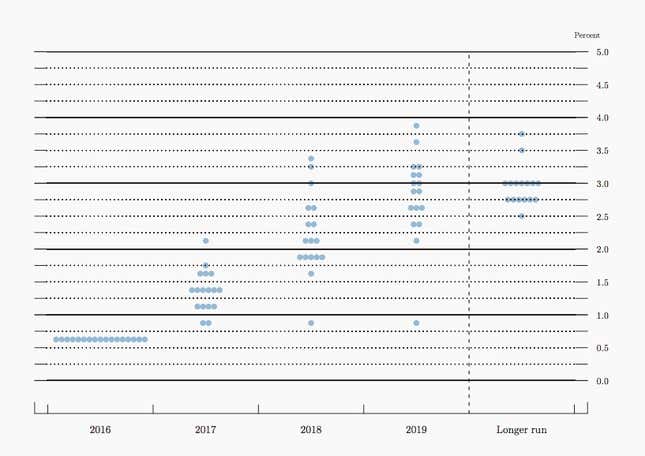

This is where the Fed’s “dot plot” comes in. This a closely watched chart of where each policymaker expects the midpoint of the federal funds target rate to sit in the future. (Look for the line with the most dots to identify the consensus view.)

Today, Fed officials expect three quarter-point hikes in 2017. After their previous meeting, in September, they only predicted two hikes, suggesting greater confidence that the economy can weather tighter monetary policy. Traders are putting a greater than 50% probability that the next hike will come within six months, but given how quickly things changed last year, don’t hold your breath.