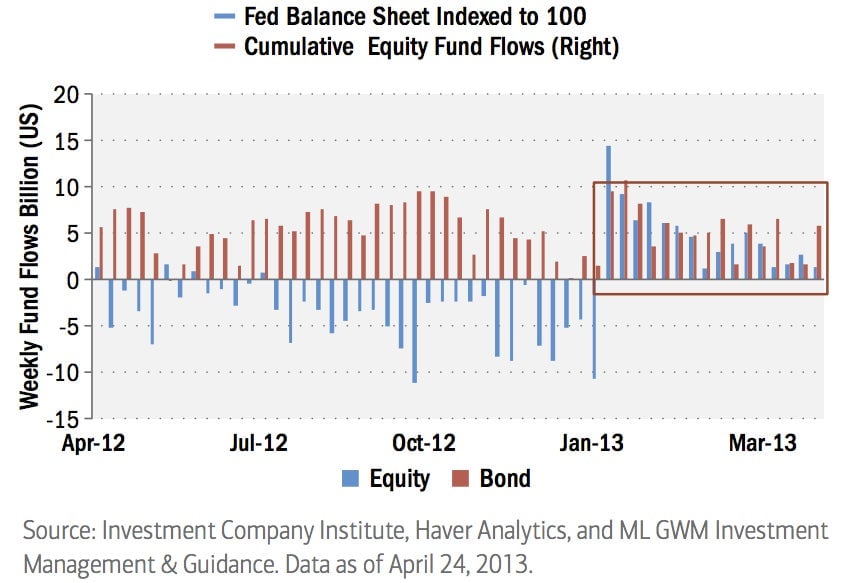

The bonds-to-equities great rotation fallacy, in one chart

A few months ago, strategists warned of a “great rotation” away from bonds, which are currently earning investors record-low yields, into equities, which might be more lucrative. “Equities will become more attractive because they are geared to growth and offer returns that investors simply cannot get from their bond portfolios,” John Bilton, European investment strategist at BofA Merrill Lynch, said late last year (paywall).

A few months ago, strategists warned of a “great rotation” away from bonds, which are currently earning investors record-low yields, into equities, which might be more lucrative. “Equities will become more attractive because they are geared to growth and offer returns that investors simply cannot get from their bond portfolios,” John Bilton, European investment strategist at BofA Merrill Lynch, said late last year (paywall).

Since then, we’ve seen the S&P 500 beat all-time highs. But we’ve also seen the yields on junk bonds fall to historic lows—meaning there’s a ton of demand for the stuff. Weird things have been happening in bond markets around the world. So while it’s certainly true that investors have started purchasing stocks in big numbers, bucking the 2012 trend, it’s not at all clear that this is going side-by-side with a pullback in the funds flowing to bond markets. So far, the data suggest the opposite, as the chart above shows.

Notably, this doesn’t rule out the possibility that investors could be part of a different great rotation—from commodities to stocks—which Barry Ritholtz laid out in April.

Despite this data, Merrill Lynch still thinks the bond-to-equities great rotation is in the works for 2013 (pdf). We’ll believe it when we see it.