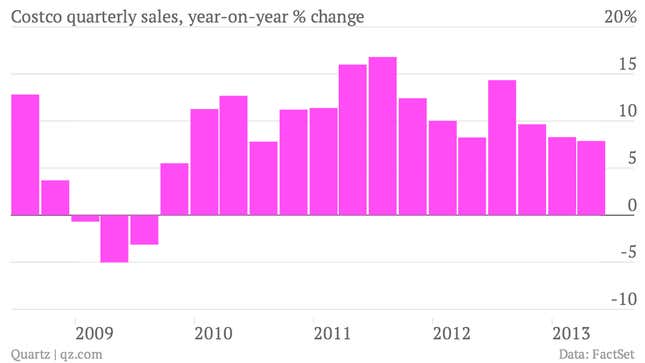

The numbers: Okay. Costco profits rose a better-than-expected 19%. Sales rose 7.9%, just shy of expectations. The stock rose initially but lost its mojo through the day.

The takeaway: Housing got the US into its economic mess. The Fed-orchestrated effort to boost housing seems to be getting it out. There’s a whole range of reasons why people trying to support the US economy, mostly the Fed, wanted housing to recover. But a key one is that rising house prices make people feel wealthier, and when people feel wealthier they spend more. Costco spotlighted that in its post-earnings conference call, saying that hardware, home and garden, and consumer electronics were the departments with the strongest results during the most recent quarter.

What’s interesting: Housing has long been thought to be the key to getting American consumers spending again. And that’s no small thing for an economy where consumer activity accounts for roughly 70% of GDP. The US’s first-quarter earnings season, which is now in its final days, has delivered several indications that the long-hoped-for housing-related spending may be showing up. Home Depot’s results, which showed an uptick in activity among small contractors, is another recent example. And a range of recent economic indicators from construction jobs to residential fixed income investment confirm that things are developing the way policymakers had been hoping.