Ignore the naysayers, US consumers are doing fine

At first glance, it looked like US consumers were wheezing just a bit in April.

At first glance, it looked like US consumers were wheezing just a bit in April.

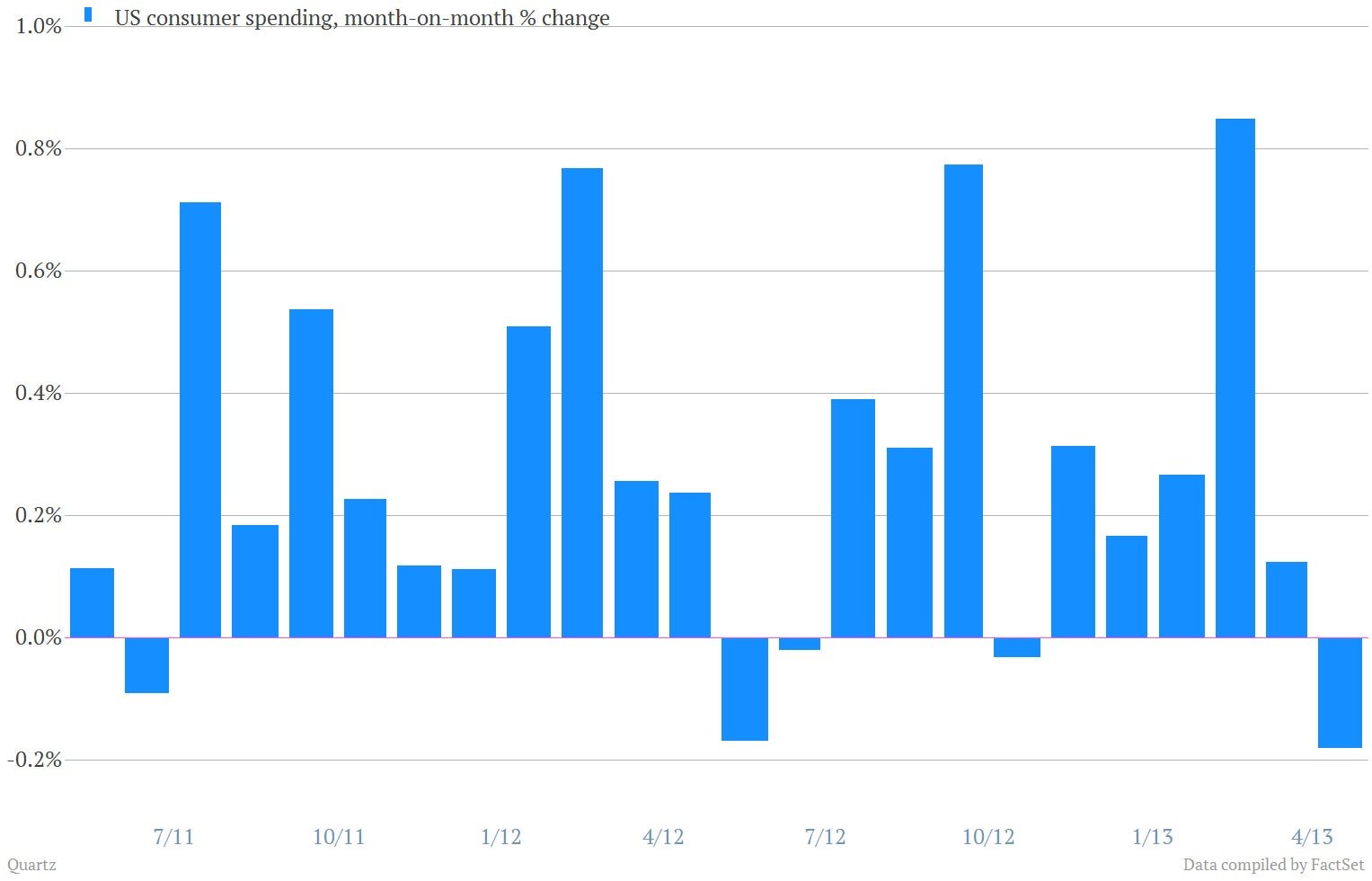

- Household purchases slipped unexpectedly by a headline rate 0.2% in April, after a 0.1% rise in March (chart below). But that’s not the whole story. Thanks to falling gasoline prices and generally weak prices, the inflation-adjusted—or “real”—value of consumer spending was actually up a bit, 0.1%.

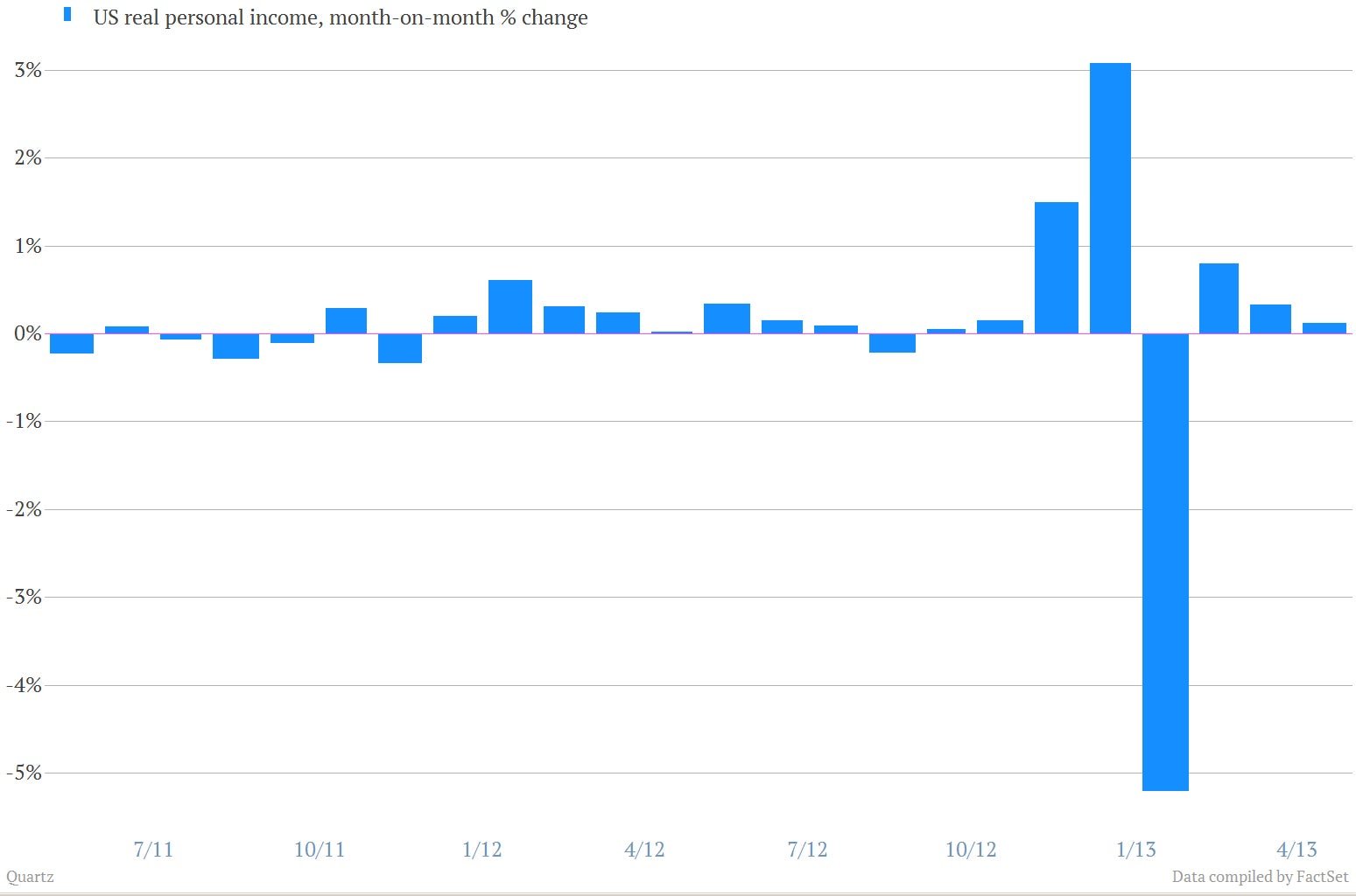

- And those muted prices also meant that inflation-adjusted disposable income grew slightly month over month, by 0.1% (chart below). Sure that’s not gangbusters, but it’s no reason to panic. The big swings recently in disposable income reflect the rise of US social security taxes, something that was agreed to as part of negotiations over the so-called fiscal cliff. Companies rushed dividends and bonus payments out the door before the new year in order to avoid the tax hikes, and that pushed up disposable income at the end of 2012, and made it crash in January.

- Personal income is made up of a lot of things. But our favorite thing to look at in this report is inflation-adjusted wage and salary growth at private companies. Short version: they’re looking good. Again, that’s not because people are getting huge raises. But they’re getting modest raises and with prices muted, the buying power of those raises is nothing to sniff at. This measure is up about 3.1% in April, versus April 0f 2012. That’s one of the better numbers in the post recession era, if you strip out the impact of one-offs like the recent payroll tax switcheroo.

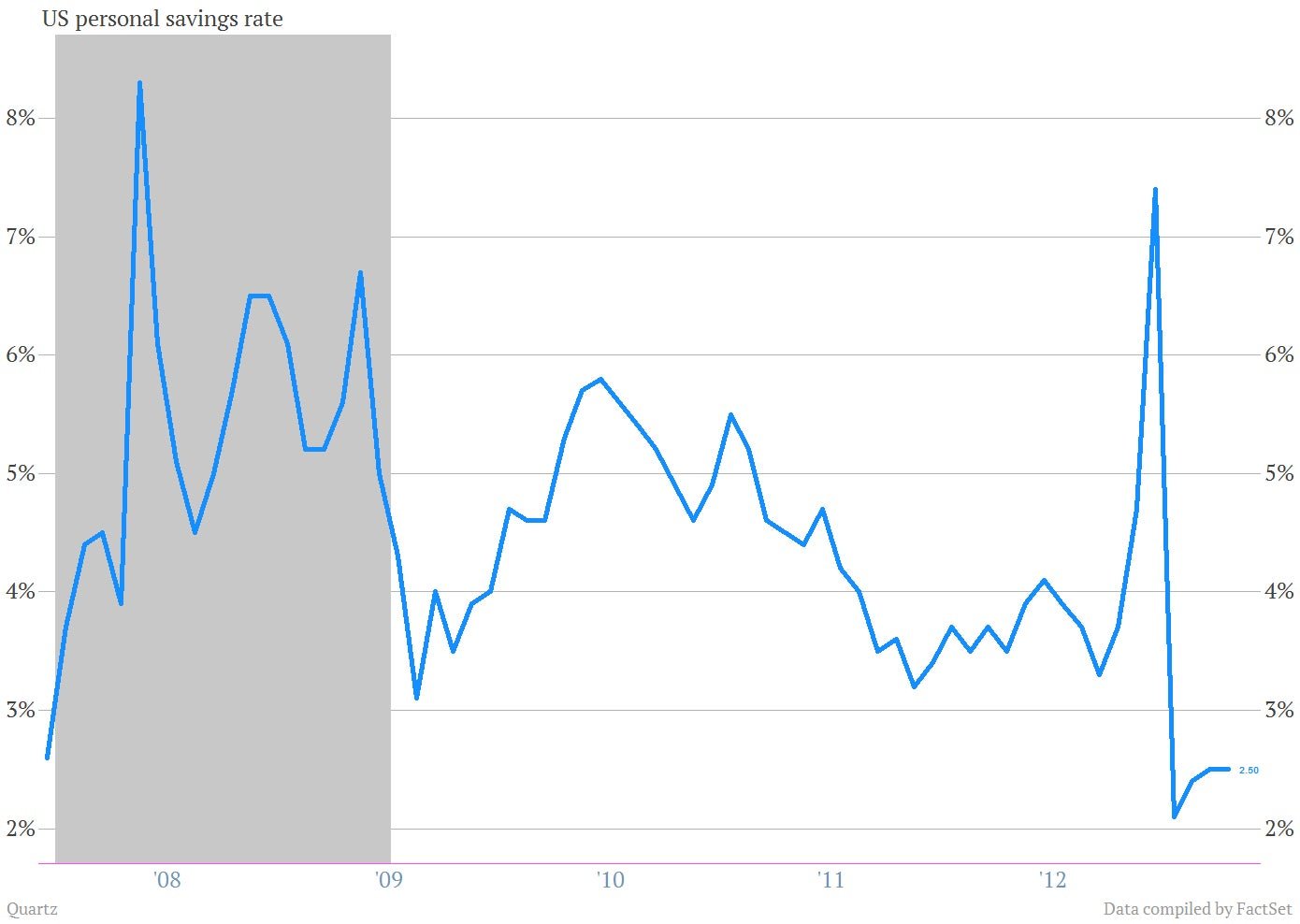

- On the other hand—and there’s always another hand—it’s not like Americans are afloat in spare cash. After a brief dalliance with saving during the great recession, Americans have returned to their low-saving ways. The US savings rate was unchanged at 2.5% in April.

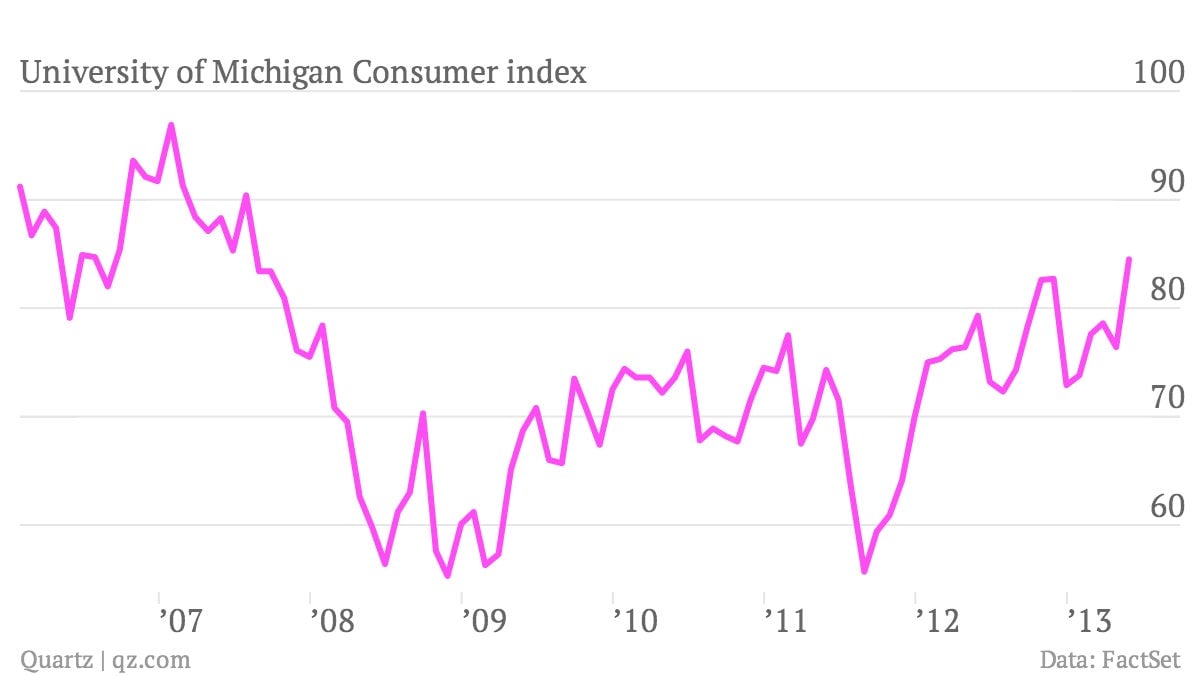

- Over the long run, low savings will be a problem. But for the doomdayers worried about another recession right now, this isn’t important. The takeaway is that US consumers are largely fine. And if you don’t believe me, believe them. The University of Michigan Consumer Sentiment index just jumped to its highest levels since July 2007, when the great recession wasn’t even a glimmer in Ben Bernanke’s eye.