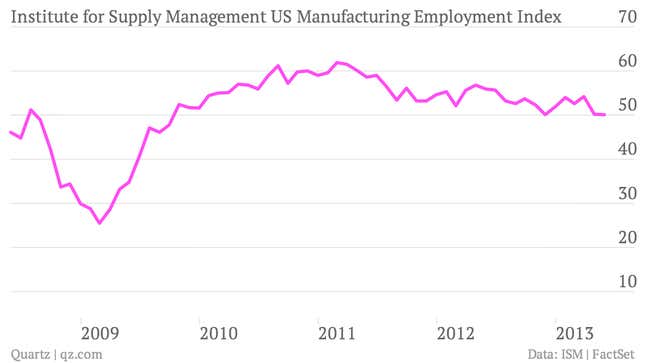

A closely watched reading on US manufacturing suggested that factory activity contracted in May, the weakest reading seen in the sector since June 2009.

The Institute for Supply Management’s US manufacturing index fell to 49.0 from 50.7 in April. (Above 50 indicates expansion, below means contraction.)

The employment component of the index, which people watch in the hopes of getting a sense of how the all-important US employment report will look for June, stayed in positive territory, but only barely. The employment index hovered at 50.1 in May.

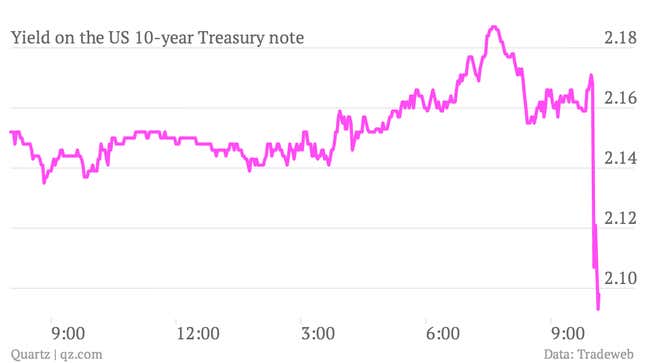

Traders interpreted the weak ISM report to mean that the Fed might be less likely to taper off its bond-buying program soon. The prospect of softening in Federal Reserve support for the economy and markets—particularly the bond market—has pushed yields higher lately. But that reversed course sharply after the ISM report hit.