Surfwear company Billabong said on June 4 that takeover plans by two private equity firms had now been abandoned. The Australian company’s share price fell 49%. That puts the market capitalization of the company, one of Australia’s best know retail successes, below A$289 million ($279 million), the total value of its inventory of board shorts, hoodies, and other accessories, as of the end of last year.

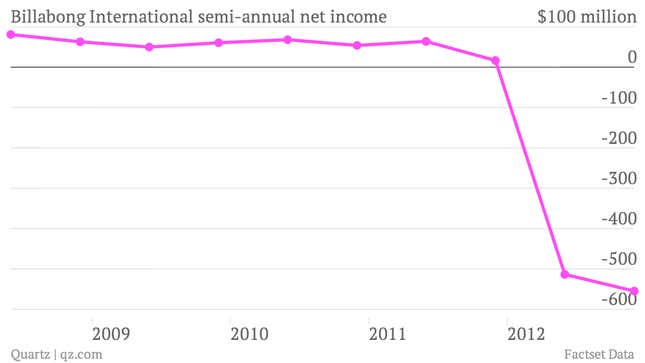

Due to shrinking sales and high debts, Billabong, established in 1973 by two surfboard shapers who sold shorts for surfers in shops along Australia’s Gold Coast, has shuttered stores, fired employees and sold half its stake in one of its best brands, Nixon. Today, the company said it may have to sell its Canadian brand, West 49, to help pay off debt. Earlier this year, it posted a net loss of A$567 million for the six months ended Dec. 31. Other big surfing labels like Quiksilver are in a similar state. Here’s how Billabong has performed over the past few years:

One big problem: Billabong acquired more retail stores globally in 2010, just as consumer confidence began tanking. A strong Australian dollar hasn’t helped, which hurts overseas sales. So have slowdowns in the US and Europe.

More importantly, its efforts to globalize the brand have killed its niche appeal. (It’s not easy to appeal to a counterculture crowd of surfers and skateboarders if your stuff sells at Macy’s). Andrew Warren and Chris Gibson, authors of a forthcoming book on the surf industry, say that when labels enter the mass market they lose credibility as local brands. No doubt surfers in California, Australia and Hawaii have moved on to sporting more obscure brands that reinforce their subculture.