Why there will be no catastrophic spike in US interest rates

Plenty of people on Wall Street seem to be worried about a looming spike in interest rates if the Fed starts to ease up on its bond-buying programs.

Plenty of people on Wall Street seem to be worried about a looming spike in interest rates if the Fed starts to ease up on its bond-buying programs.

You know who isn’t? Larry Fink, the co-founder and CEO of the world’s largest money management firm, BlackRock.

Fink thinks concerns about Federal Reserve chairman Ben Bernanke’s comments that suggested the Fed may slow bond buying soon are somewhat misplaced. ”I’m not terribly worried about what it means,” Fink told listeners at an investor conference sponsored by Deutsche Bank today. Fink seem to think the Fed’s exit will mean that interest rates won’t start going nuts. Here’s why.

Interest rates, essentially the yield on US Treasury securities, are set by supply and demand for US government bonds. (Oh, and remember yields and prices move in opposite directions.)

Demand for Treasurys surged when the financial crisis hit. First desperate investors rushed to park their cash in the safety of US government debt. Then the Federal Reserve started vacuuming up vast swathes of the Treasurys market as part of its plans to shore up the economy. That helped keep prices high, and Treasury yields—i.e., interest rates—low.

So isn’t it logical to expect that, if demand decreases because of lower Fed buying, prices will fall? No!

Because price is about supply and demand, not just demand. And if the Fed is raising interest rates, the supply of government bonds is likely to fall too.

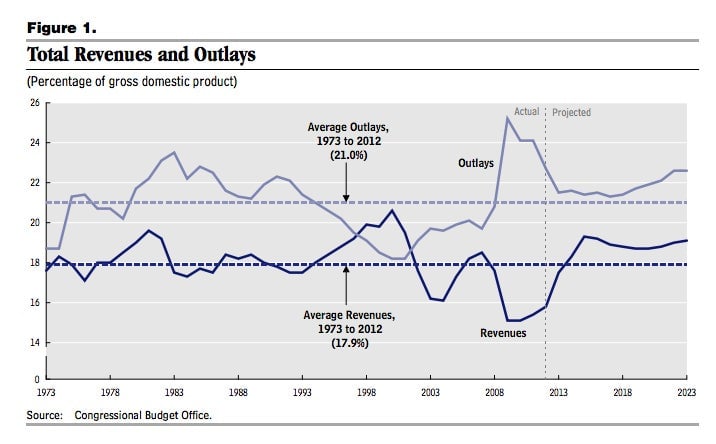

That’s because the Fed is only going to be raising interest rates because the economy is strong. And if the economy is strong, the US government will probably be borrowing less, since tax revenues will be higher and spending on so-called “automatic stabilizers” (like unemployment benefits and food stamps) will be lower. Plus, there have already been some pretty radical spending cuts thanks to the so-called sequester, as well as higher taxes, like the payroll tax increase. The upshot: the US budget deficit—while still very large by historical standards—is falling quite fast.

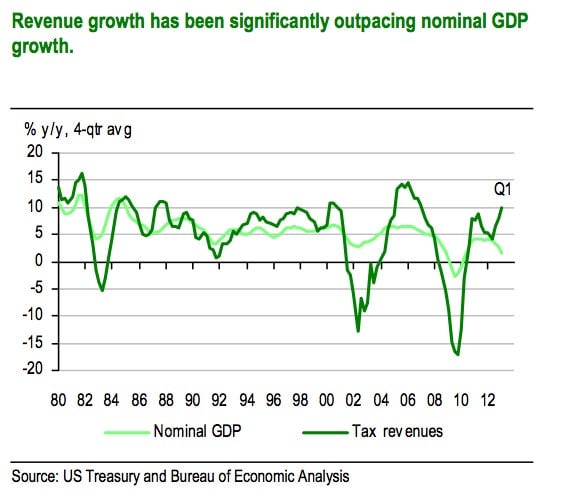

And this is more than a theory. We’re already seeing some of this play out. Check out this chart from UBS economists, which shows revenues rising…

…And spending, though high, is falling.

…That’s a recipe for lower deficits, which will limit the new supply of government bonds in the market.

Here’s how Fink sums up the dynamics: ”So at the same time the Federal Reserve will change its behavior, we’re going to see a reduction in Treasury borrowing. So, I’m just not that worried about how this is all going to play out and I think there’s is way too much discussion about it,” Fink said.