Patagonia’s venture capital arm, Tin Shed Ventures, likes to finance companies Silicon Valley investors won’t touch. That’s why Phil Graves, the fund’s managing director, thinks its investments will succeed: “We’re trying to find all the future Patagonias, and give them capital so they don’t need to go to [traditional] VCs.”

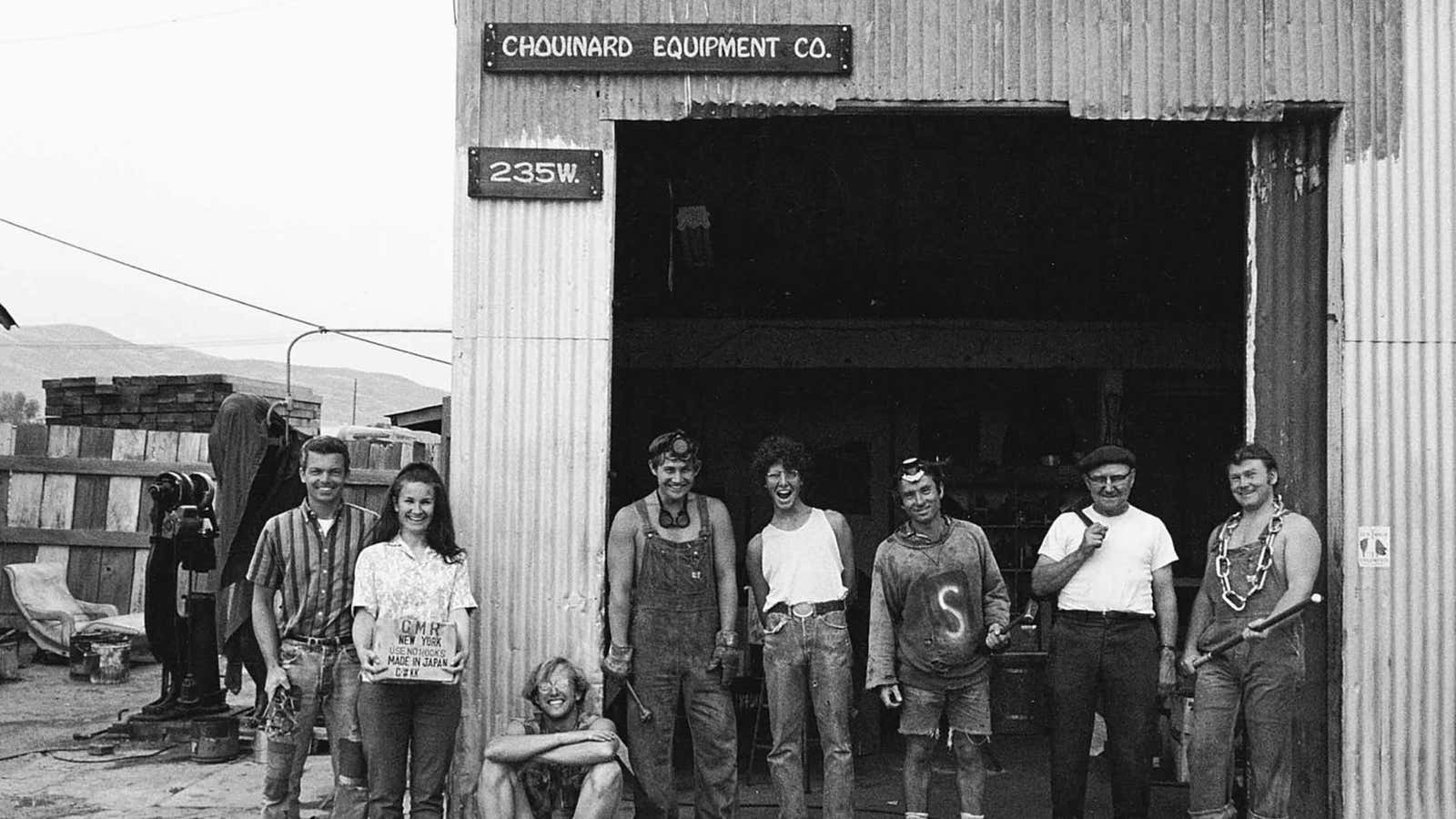

Founded by Yvon Chouinard, who started by selling climbing gear out of his truck in the 1960s, Patagonia now reports annual revenue of $800 million, 1% of which goes to environmental causes. The company has carved out an identity as a low-guilt brand that sells durable, stylish, and expensive outdoor wear; its official mission is to “build the best product…and use business to inspire and implement solutions to the environmental crisis,” leading at times to seemingly contradictory positions such as its “Buy Less” campaign against consumerism—which boosted sales.

Now, Patagonia is applying its unconventional approach to business as an investment thesis: the Tin Shed Ventures strategy assumes that a company’s’ financial success can be predicted by its concerns for its impact on people and the environment. “If you really dig into supply chains, and look for them to be as transparent as possible, you’re going to have good investment,” says Graves. To ensure this, the $75 million fund is tracking environmental metrics—reductions in carbon dioxide, waste, and chemical pollution—at the nine companies it’s invested in since 2013, which range from buffalo ranching to e-commerce platforms to textiles.

Graves argues similar metrics should become a standard for all venture investors. ”Business as usual is not going to work,” he says.

That’s unlikely to sway many Silicon Valley venture capitalists until the financial figures are out. Tin Shed has not released its investments’ private valuations, but Graves says the companies in its portfolio have seen ”double digit” increase in valuations, matching or exceeding comparable venture portfolios. But the true test—financial returns on investment—will only come after companies are sold or go public. Ben Veghte of the National Venture Capital Association says there are no Tin Shed emulators in Silicon Valley yet: ”I can’t think of any model that matches what Patagonia is doing here.”

Graves says that’s fine for now. Tin Shed’s portfolio companies have a 100% survival rate to date, and they’re patient. “We want companies that don’t make financial sense over the two-to-three year period, but do make sense over the long haul,” he says.