There’s double-counting in US president Donald Trump’s budget—an elementary mistake worth $2 trillion. Want to see it for your own eyes? Let’s get this thing (pdf) open.

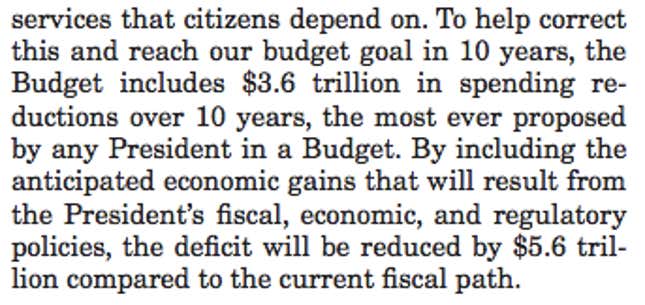

Skip the throat-clearing and head for page nine, in the section called “How to Make Things Right.” This is where the budget announces the White House’s priorities. “The first step,” it says, “is to bring Federal spending under control and return the Federal budget to balance within 10 years.” Here’s how:

So the president proposes cutting $3.6 trillion from spending, and finding $2.0 trillion in extra revenue because the economy will grow, thus eliminating a total of $5.6 trillion from the deficit.

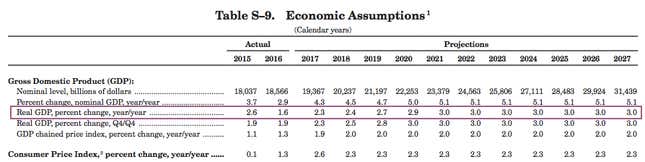

OK. Let’s take a look at where that $2 trillion will come from. The assumptions behind it are broken out on page 45:

That line outlined in red says that GDP growth, which was 1.6% last year, will rise to 3% by 2021, and stay there. That’s where this budget gets that missing $2 trillion. GDP growth will provide new revenues which will fill the gap created by tax cuts, because businesses will be selling more and paying their workers more and all that will drive more money to the federal coffers.

One problem is that no one else is expecting steady 3% growth. Here are some other forecasts for comparison:

Why such a divergence? To understand it, turn now with me to a budget appendix known as the “Analytical Perspectives.” These provide, well, analytical perspectives, like comparisons between White House forecasts and other standards. They discuss the forecast variation on page 14 (pdf): “This reflects the Administration’s expectation of full implementation of its policy proposals; other forecasters are unlikely to be operating under the same assumption.”

Unlikely indeed. Getting to that level of growth wouldn’t just require new stimulus, but a massive and unlikely surge in US productivity. But let’s accept this dubious assumption for a moment. To summarize what we’ve learned so far: The budget deficit will be closed with $3.6 trillion in spending cuts and $2.0 trillion in new economic growth. That growth will be delivered by the administration’s policy proposals.

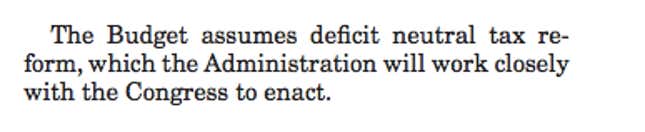

So let’s go back to the budget and look at those policy proposals. After all the spending cuts, the next priority is fixing the tax code, on page 13 of the budget. “Simpler, fairer,” yadda yadda yadda, but then we run into this doozy:

For those not familiar with the language, “deficit neutral” means that these tax cuts, when enacted, won’t reduce the amount of revenue received by the government.

There are two ways to do this, hypothetically. One is to keep tax revenue the same overall but spread the pain around by “broadening the tax base”—increasing the number of people who pay taxes while lowering overall rates, say by closing loopholes.

The other is to cut tax revenue overall but count on the cuts to spur enough economic growth to compensate for them. In other words, hope that a larger economy with lower taxes generates as much revenue as the smaller one did with higher taxes. No one serious expects that to happen entirely, but some forecasts suggest tax cuts like those Trump has proposed will achieve it partly, generating perhaps as much as $2 trillion of extra revenue by optimistic estimates.

OK. But here’s the problem. You’re counting on the tax cuts generating $2 trillion in extra revenues to compensate for the cost of the tax cuts. You’re also counting on them generating $2 trillion in extra revenues to help close the deficit. That $2 trillion can’t do both jobs at once. Either Trump isn’t balancing the budget, or he’s not doing a massive tax cut.

And that’s what people mean when they say there is the double-counting in the budget.

But it’s more than just sleight-of-hand. Some of it is just blatant. Part of Trump’s tax-reform plan, on that same page 13, talks about eliminating tax paid by heirs on estates greater than $5.5 million:

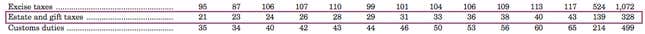

Now join me on page 19, where table S-4 lists receipts from different sources. One of them is the estate tax, producing $328 billion over ten years:

In other words, the budget says it will abolish the estate tax—but assumes it will keep on getting revenues from the estate tax.

Is anyone in the government taking this budget thing even remotely seriously?