If you want your money to grow, keeping it in a state-owned Chinese bank is not generally a great idea. To make sure the banks have enough money to lend, the Chinese government sets deposit rates that are usually much lower than what banks can charge for loans, and oftentimes even lower than inflation—meaning that keeping your cash in the bank actually loses you money. Despite making noise about “interest-rate liberalization,” the government has done nothing to adjust this cushy setup for banks. That’s left Chinese desperate for more profitable places to keep their money.

And that’s something Alibaba—one of China’s biggest digital companies—is cashing in on. Less than three weeks ago, Alibaba launched a time-deposit service offering 6.299%—a lot better than the 3.0% you can get at one of the state banks. The Yu E Bao service, as it’s called, was jointly launched with Tian Hong Asset Management and is offered through Alipay, Alibaba’s online payment system. Its 2.5 million users have already deposited $1 billion. A source told Caixin that the total amount of invested funds is growing by $45 million each day.

For those wondering what this might mean for Alibaba’s hotly anticipated IPO, it’s not clear that Alipay will be included. In theory, the Chinese government permits only Chinese companies to operate online payment systems in China, which caused controversy in 2010 when the new regulation required Yahoo to divest of Alipay, in which had previously owned about 40%.

Nevertheless, Alibaba’s foray into financing has been promising—and it’s something that Alibaba chairman Jack Ma is clearly serious about (link in Chinese). Take for example its funding programs for small- and medium-sized enterprises (SMEs), which traditionally have had trouble getting funding from most banks. The company is apparently using data it gathers about businesses that trade on its e-commerce site, alibaba.com, to evaluate the risk for lending to them. That might sound like a no-brainer, but Chinese bank lending often tends to be guided more by policy goals than by risk management. In fact, it’s something that the head of Minsheng Bank said is “overturning the traditional banks completely“ (paywall).

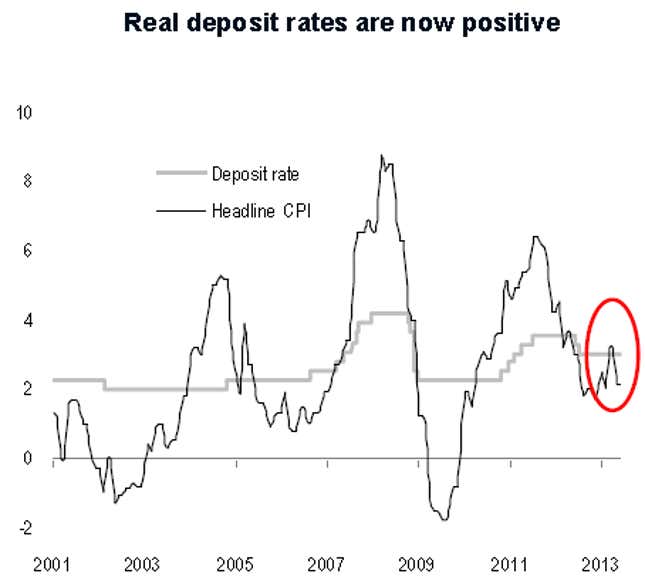

Also worth noting is that this surging demand for Yu E Bao comes after several months of easing inflation, which has caused the real interest rate—meaning, the rate you get when accounting for inflation—to turn slightly positive. Here’s a look at that trend, via Sober Look:

But why would you sock money away even at a slightly positive rate if you can get nearly twice the return in your Alipay account? And that highlights another intriguing point. Just as Alibaba has begun to give Minsheng Bank a run for its money in financing SMEs, perhaps Alipay will do the same for consumers. China’s state-owned banks desperately need those deposits to even appear to be meeting capital adequacy requirements. Competing with Alipay on interest rates would mean they either have to cut profits, or pass on costs to the state-owned enterprises they tend to lend to.

The securities regulator is currently deciding whether to allow Alibaba to proceed with Yu E Bao. But if it does, it’s possible that Alibaba will eventually make banks—and their government patrons—finally get serious about letting markets set rates. If it doesn’t, expect Yu E Bao to continue to rake it in.