This is what austerity looks like: spend less and owe more

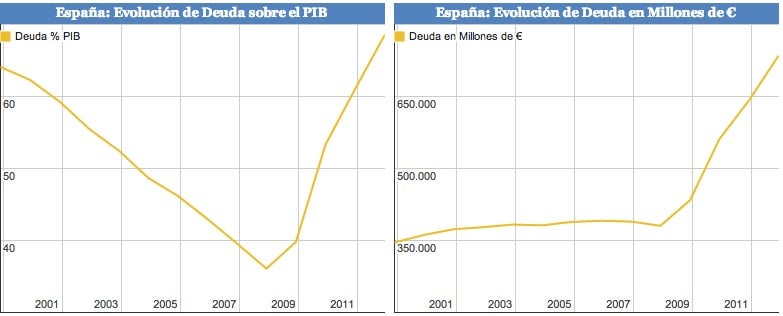

Spain’s austerity budget, revealed on Sept. 28, cuts spending by nearly 9%. But national debt will rise to a record 90.5% of GDP next year, the budget ministry said today, largely in order to finance aid to Spain’s troubled regions and its banks. The charts above, from the Spanish site datosmacro.com, show the path that debt has already taken since the 2008 crisis (the one on the left is debt-to-GDP, the one on the right is total debt in millions of euros); the new borrowing will push that even higher.

Spain’s austerity budget, revealed on Sept. 28, cuts spending by nearly 9%. But national debt will rise to a record 90.5% of GDP next year, the budget ministry said today, largely in order to finance aid to Spain’s troubled regions and its banks. The charts above, from the Spanish site datosmacro.com, show the path that debt has already taken since the 2008 crisis (the one on the left is debt-to-GDP, the one on the right is total debt in millions of euros); the new borrowing will push that even higher.

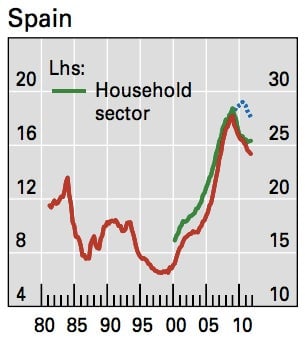

The slightly brighter side to the picture is that, as this chart from the Bank of International Settlements (pdf, p. 29) shows, Spain’s debt-service ratio—the share of GDP that private households and companies spend on paying off their debt—has been coming down steadily since the crisis after rising precipitously in the previous decade. (The red line is companies; the green line is households.) The same is true of many other countries. Fast-rising debt-service ratios, as we wrote recently, turn out to be a very good sign of impending disaster. So while Spain’s public finances are getting more precarious, its private finances at least are on the mend.