As an African social entrepreneur in the technology industry, I am forced than most to think in terms of “whole systems”.

Not a single technology I have worked on has ever been deployable without building a whole ecosystem afresh. This means that I need to be exceptionally attuned to the cultural and political economy context of technology. It also means that I find most of the debates around blockchain somewhat naïve because of the perennial failure to address its ideological baggage and consider how other cultures might relate to that ideology.

In many ways this ideo-cultural blindspot is the true cause of blockchain’s struggles to scale and become ubiquitous.

In the case of cryptocurrencies, blockchain’s only globally successful application to date, for instance, concerns about interconvertibility or divisibility or the impact of volatility on credit are trivial. They completely underestimate the power of “smart contracts”, self-executing computer programs that can be used to program how any financial metric should behave given a particular scenario, addressing many of the drawbacks usually cited as showstoppers.

In fact, AI-based smart contracts can even anticipate hard to predict scenarios. And virtually any smart contract of the appropriate kind would be cheaper and more adaptable than even the best contracts drafted by the best lawyers.

The real problem of blockchain goes to its roots, to the implicit manifesto which embedded the values of its creators in 2008 into the underlying concept.

At the core of the blockchain theory, first applied to bitcoin, is the idea of transactions between equals (peers) without a trusted third party.

This “trustless” approach originates in Blockchain creators’ desire to remove the power of powerful authorities (whether banks, stock exchanges or governments) to grant or deny “permissions” and “privileges”.

“Trust”, in the understanding of these techno-activists, is therefore almost synonymous with “dependency” in a “power relationship”. Blockchain’s original creators understandably therefore want less trust and more trustlessness in the world they seek to build.

It is very critical to understand this underlying vision of blockchain. It emerges from within very deep places in the Western tradition, and easily traceable from the radical 16th French theorist, Etienne de La Boétie, all the way down to Robert Nozick.

Starting from such puzzles as the ancient Byzantine Generals’ problem of how to coordinate an attack by allied armies using messengers who could have been compromised, blockchain cryptographers have dramatically expanded the implications of their mathematical solutions, and claimed the capacity to make “trust” irrelevant.

But there are actually different ways of seeing “trust”. Africa’s Ubuntu ideology, for instance, interprets it as an emergent property of certain collaboration systems. It is not a static quality that some network has. It is something that grows over time as a result of evolving rules created and recreated by the participants.

Please don’t confuse my point as canvassing for “African exceptionalism”. Ubuntu was just one example. The Dutch theorist, Bart Nooteboom, comes to remarkably similar conclusions in a career spent examining the “trust” concept.

In his seminal 2006 paper (which extends his equally seminal 2002 paper) on how social capital, trust and institutions interrelate, he made the profound statement: “Trust is both an outcome and an antecedent of relationships.”

He sees the dynamic nature of trust, but most importantly he strongly deviates from the notion of trust as resulting merely from some calculation of the risks of some party acting contrary to an agreement (which is basically how the original philosophy behind blockchain sees trust). The agreement is but the starting point. How it shapes the behaviour of both parties over time is more important than knowing whether at some point in the future either party will keep to the terms.

Another way of fully grasping Nooteboom’s arguments is to see trust as a composite with changing composition over time. Trust in intentions is not the same thing as trust in competence. Nor is trust in position the same as trust in orientation, etc. For that reason alone, in the real world, trust is fluid and organic.

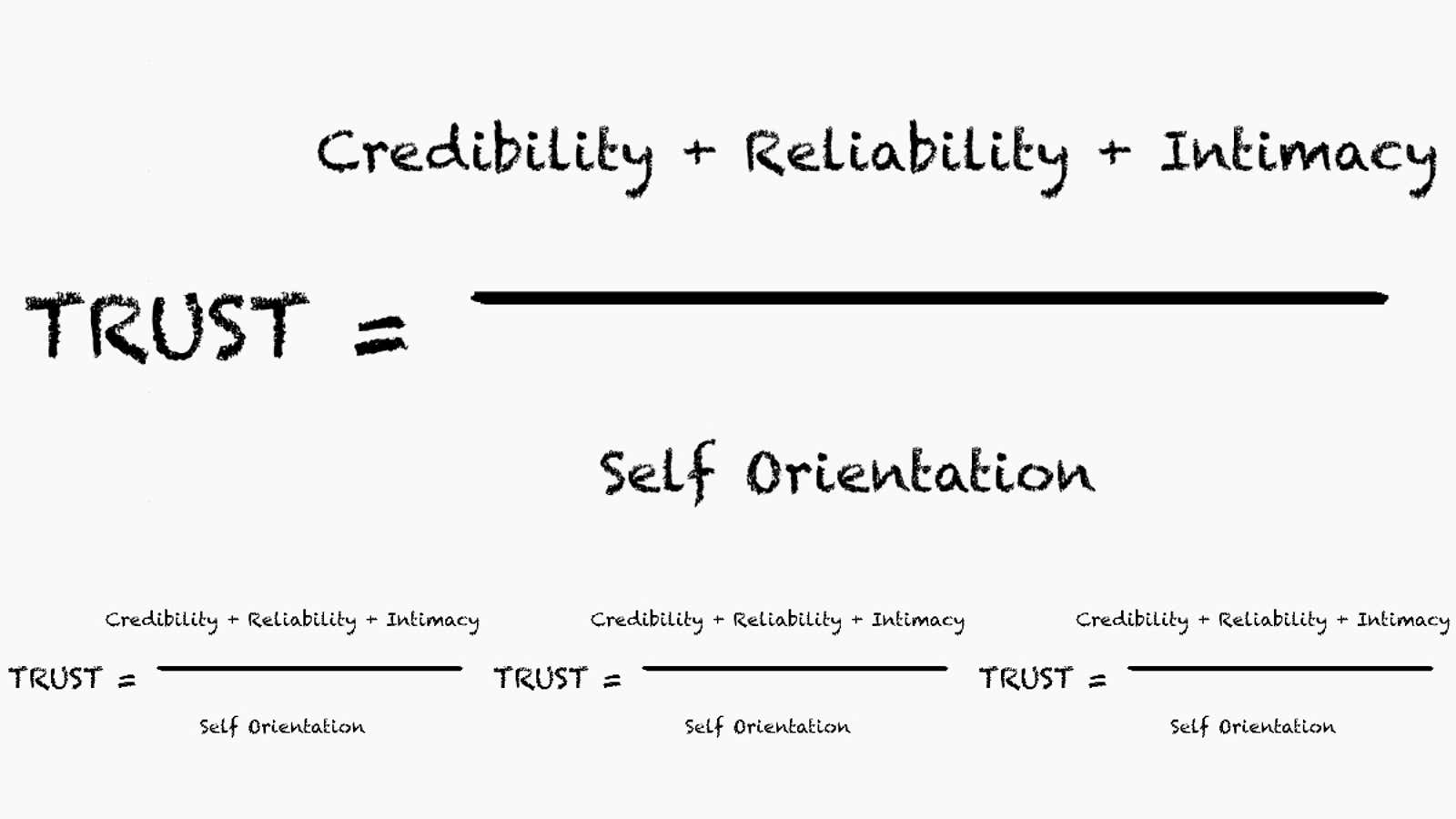

If you look at the attached Maister equation in the image it is obvious that whilst blockchain scores strongly on “reliability”, it does very badly on “intimacy”. This further reinforces the argument that the original designers had a naïve, simplistic, understanding of “trust” and thus designed a “trustless” system that actually is merely “trust-weak”.

With the above in mind, it is easy to see the naivete of the idea that trust among network actors is not necessary so long as every operation in a network is replicated in the same fashion across every computer before attaining validity. For the simple reason that it makes rather credulous assumptions about the “peers” in this network, starting from a rather crude reduction of trust to predictability.

Firstly, not all “peers” in the real world are connecting and engaging in the same way, to the same extent, for the same goals, with the same expectations, and at the same strength.

Some of the participating users in the peer networks of blockchain need support from more competent parties to achieve their particular goal in the network.

So, for example, in many African markets, most retail investors participating in the bitcoin trading mania simply contract the entire headache to younger, more dynamic, “consultants”. In the West, participants use wallets made by third parties to hold their bitcoins and install tools supported by SAAS providers to manage their access keys.

In both societies, we see at work a process of “delegated trust”, but in the West the non-technical blockchain participant is happy to mask that delegation of trust behind a firewall of impersonality. In Africa, social capital is cheaper so the relatively wealthier investor would rather not trust some impersonal certificate authority or Public Key Infrastructure provider. The African bitcoin investor might prefer to deal with an upcoming IT technician who is looking to gain more from the relationship than just the fee of helping her digitally less savvy client maintain her bitcoin portfolio.

But let’s make no mistake about it: in neither instance, Western or African, is the original blockchain vision of a trustless system achieved. Across the entire blockchain economy today, multiple layers of competence, convenience, risk management, and social capital (why an ICO backed by more “credible” people still perform better than one by complete unknowns) lubricate the cogs and wheels of the blockchain protocol. However, the precise configuration of these layers are likely to differ from society to society, and culture to culture.

The intermediaries that Blockchain purists insist must not determine how transactions occur are very much in place, simply because the average user of technology, whether email or blockchain, cannot become a cryptographer or PKI expert just to be able to hold true to the original notion of a true peer to peer system of equals operating without intermediation.

The promise of a trustless system continues, however, to create dissonance. On one hand, blockchain systems are projected as wholesale replacements for institutions, and, on the other hand, “co-innovation” is demanded from the same institutions to enable blockchain systems to become viable. This is a palpable contradiction.

Blockchain systems will not thrive except in the context of “more trust”, properly defined. Trust in the competence, availability, orientation, positioning and intents of the multiple layers of intermediation is needed before blockchain applications can actually enhance hopelessly broken systems like SME to SME international trade.

For example, to replace letters of credit (LOCs) with blockchain smart contracts, freight forwarders, banks, customs clearance agents, invoice discounters and a whole bunch of peripheral players need to understand the system better, make investments to support them, project reasonable future gains, hire the right consultants to guide development, and alter current business models. Without a considerable increase in the level of trust among these actors, forget about smart contract LOCs going mainstream. In the end, any truly effective version of the system that emerges must allow intermediation and trust.

Note that trust here does not require the absolute technical predictability promoted by the original blockchain theorists. In fact, the trust will come through working together.

That means considerable deviation from the Hobbesian vision in which the design of a blockchain system assumes from the start that everyone is a potential traitor and will stay that way regardless of how the relationships evolve.

That worldview has led to wasted investments in blockchain designs that simply do not deliver performance, user-friendliness, convenience and clarity. And yet, all these are components of trust, properly defined.

Until systems innovators who see “more trust” as essential for all forms of digital interactions and know how to build systems that enhance trust get involved, blockchain applications shall fail to integrate at scale into those systems where they can make the most impact: health financing, supply chain transparency, international trade, public integrity etc.

So, if you are going to adopt blockchain to solve any problem facing your business or country, bear this point in mind.