After more than a century of digging, De Beers is joining the rush to the laboratory for synthetic diamonds.

The company, which has mined diamonds for 130 years since its founding in South Africa, has now launched Lightbox Jewelry, a line of “impeccably made, delightfully priced” lab-grown jewels. The latest company in the De Beers fold, the decision to combine “science and sparkle” is a clear attempt to keep up with a synthetic market that De Beers has scorned in the past—even as 21st century consumers, looking for something both affordable and conflict-free, have embraced the idea.

While other synthetic gem manufacturers have focused on the ethical reasons for opting for lab-grown diamonds, De Beers is marketing the lower cost and novelty of its pink, blue and white diamonds. The Lightbox range will offer “affordable fashion jewelry that may not be forever, but is perfect for right now,” De Beers said in statement.

“Our extensive research tells us this is how consumers regard lab-grown diamonds–as a fun, pretty product that shouldn’t cost that much,” said CEO De Beers Group Bruce Cleaver. “So we see an opportunity here that’s been missed by lab-grown diamond producers.”

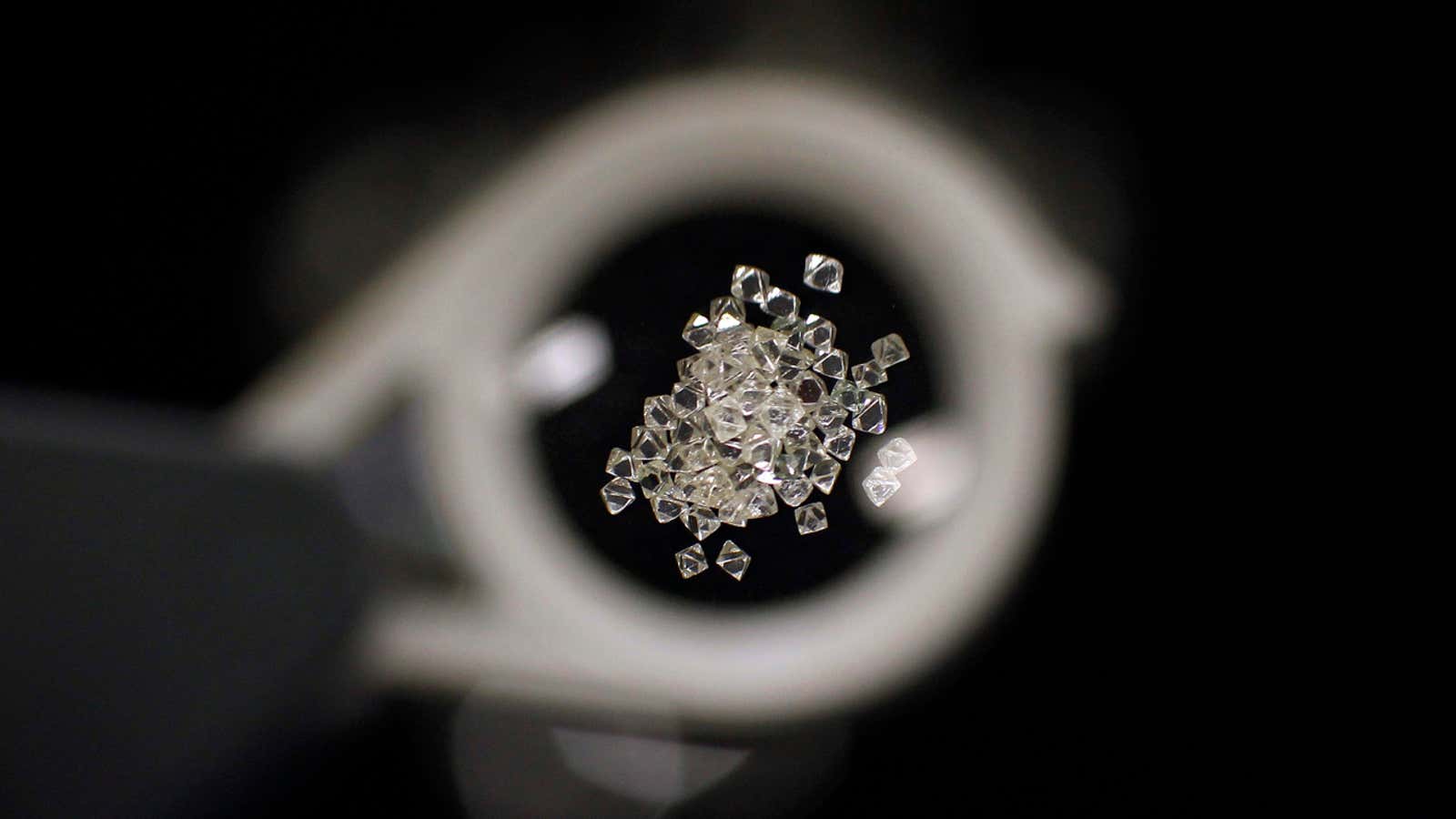

Lab-grown diamonds have the same atomic structure as mined diamonds, and can be virtually indistinguishable from natural ones—but because they aren’t mined, they are much cheaper to produce. The company’s Portland, Oregon facility will deliver about 500,000 carats in four years, after a $94 million investment.

Compared to the 33 million carats mined by De Beers in Botswana, South Africa, Namibia, and Canada, the synthetic diamond industry isn’t a threat to its traditional business model yet. The significance, however, of one of the world’s most iconic diamond producers moving to the lab is a hint of the direction of an industry that has been losing its sparkle.

De Beers’ identity as a company is rooted in the dig for diamonds. The company was founded by the politician and businessman Cecil Rhodes in 1888, following the accidental discovery of the 21.25-carat Eureka diamond and the ensuing rush to the South African town of Kimberley.

The decision to embrace man-made diamonds is part of De Beers trying to adjust to a changing diamond market around the world. While the growth in consumers buying gems in China and India could buoy falling sales, it’s no longer enough to rely on the romance of the stone to sell it.

And De Beers dismisses the idea that millennials don’t buy diamonds. Instead, the company has found (pdf) that in the US (where the range will first be launched), millennials as a market segment account for more than 60% of diamond jewelry purchases.

Rather than engagements or similar relationship milestones, De Beers found that when millennials buy diamonds it’s often as a gift to themselves, to celebrate moments like graduations. De Beers hopes that its diamonds ranging from $200 for 0.25 carats to $800 for one carat will appeal to this market.