How Africa’s top handset maker designs phone cameras calibrated for darker skin tones

For Chinese phone manufacturer Transsion, localization isn’t just a marketing strategy: it’s the secret ingredient that has placed it ahead of all its competitors in Africa. The company has bet on African consumers by making affordable handsets with advanced features using an aggressive distribution network.

For Chinese phone manufacturer Transsion, localization isn’t just a marketing strategy: it’s the secret ingredient that has placed it ahead of all its competitors in Africa. The company has bet on African consumers by making affordable handsets with advanced features using an aggressive distribution network.

The Shenzhen-based firm has risen as a dark horse in the mobile hardware market by instituting “micro innovations” propitious to its African customers including multiple SIM slots, long battery life, as well as user-friendly designs that support local languages like Swahili or Ethiopia’s Amharic. But one feature that has distinguished its devices is their camera-centric nature and their ability to calibrate exposures for darker skin tones.

As its key focus market, Transsion has thousands of employees across Africa, working in production lines in its Ethiopian factory and as in-design and user interface personnel in Kenya and Nigeria. After conducting an in-depth analysis of consumers’ photo habits and needs, the company found photo quality was important to not just younger consumers but increasingly wider age demographics. Phone cameras, especially front camera exposure, was the first feature customers inspected when considering buying a new mobile phone.

“We discovered ways to optimize photos, such as improving users’ eyes, nose, skin color, and quality, which helps our users take a clearer, more natural, and more beautiful photo,” says Robin Wang, the general manager of Transsion’s hardware center.

In a continent with crawling electrification rates, Wang says the phones are designed to reflect darker complexions at night or in environments with little light. As part of their customization, the phones comprise “a custom front camera light for low-light environments, which localizes and enhances the color and brightness of the light, and an optimized photo effect to help users take bright and clear photos even in low-light conditions.”

The adjustments are applied to both front and back cameras too, even though the firm is more adamant about improving the photo effects on selfies.

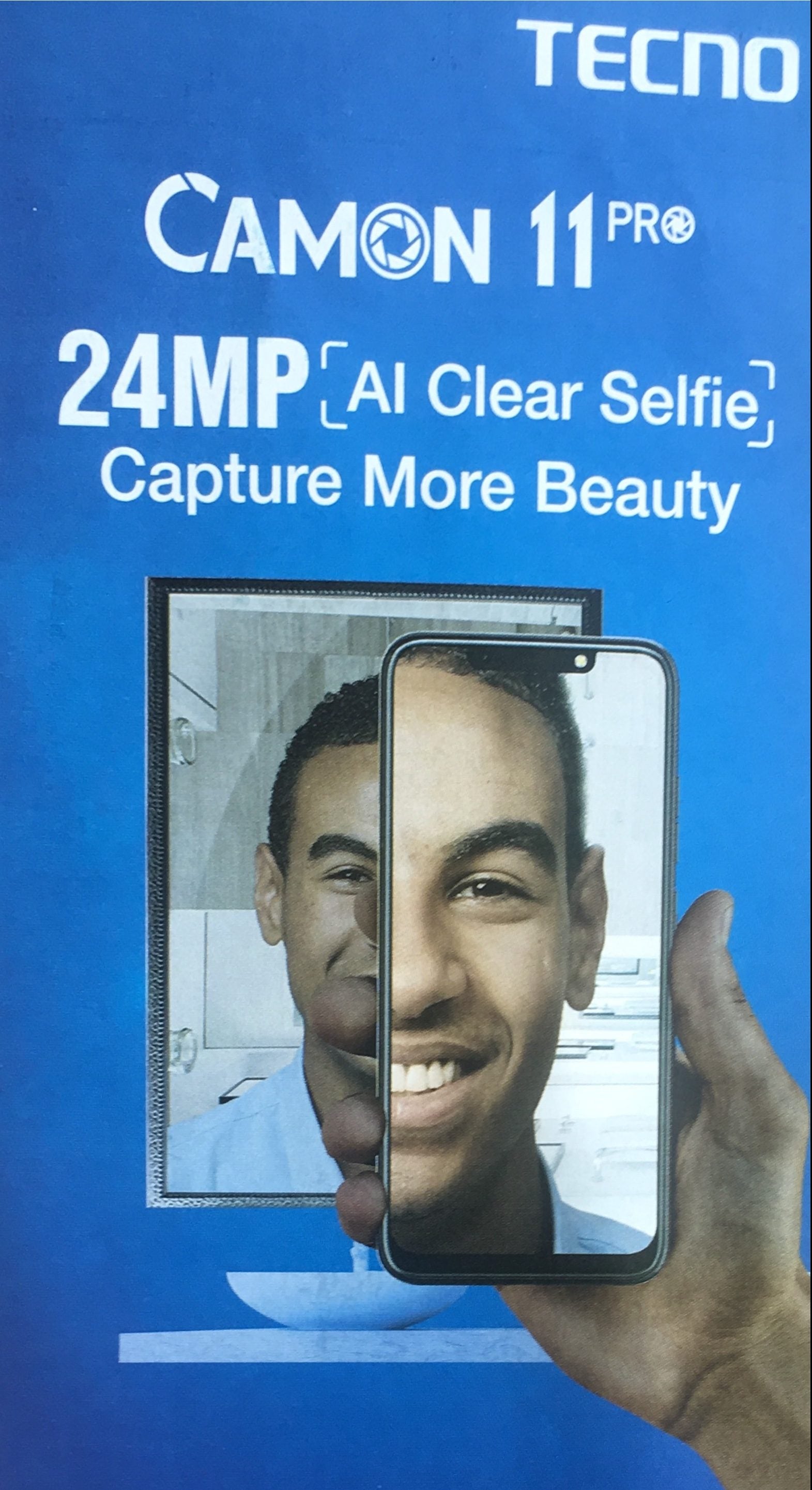

These skin modifications are present in almost all Transsion phone brands but are special to its camera-focused brands such as Tecno’s CAMON series, Infinix’s S selfie series, and Itel S brand. For instance, the CAMON, short for “camera monster,” has a dual rear camera with quad flash that can help take a lighter and smoother photo. Because the cameras mainly use artificial intelligence-powered imaging technology, it can also help optimize and process portrait photos.

These price points for these smartphones range from $60 to around $250 for higher-end products like the Tecno Phantom.

In April, Tecno launched the third installment of its camera-centric smartphone series SPARK. Transsion said the camera on these phones could cover 18 face dimensions to enable 3D face fine-tuning, besides enhancing hair contrast, color saturation, and eyelid extension. The company said the cameras were a “by-product of a rigorous research of massive human faces” too; Wang confirmed they did study the “skin color, skin quality, and facial features” of Africans as part of the phone’s development.

Transsion isn’t however doing these developments just in Africa. As an emerging markets-focused manufacturer, it has developed unique features like oil-resistant fingerprint recognition in nations like India where it has grown as an increasingly competitive player.

Yet its focus on the needs of African consumers comes as the battle to control Africa’s mobile hardware market gathers pace. Even as the race takes on a pell-mell nature, entrepreneurs, multinationals, governments, and telecom companies from Egypt to Kenya and South Africa have all announced plans to make an African phone for African users in Africa.

Just last month, the pan-African investment group Mara launched a new, high-spec, made-in-Rwanda smartphone aimed at primarily serving African markets. Telcos like Orange and MTN have also launched smart feature phones with “light” operating systems to help gain more customers and close the digital divide.

Transsion is also deepening its reach in Africa as brands like Samsung and Huawei ramp up their presence and production. As subscriber penetration grows, smartphone adoption in Africa is expected to more than double from 36% in 2018 to 66% in 2025.