One of Africa’s smallest economies is plugging social welfare gaps with digital cash transfers

The biggest fear for African countries as the Covid-19 pandemic loomed was the potential shock to under-equipped healthcare systems.

The biggest fear for African countries as the Covid-19 pandemic loomed was the potential shock to under-equipped healthcare systems.

Despite previous experiences with viral epidemics, there was an admission that a sharp spread of coronavirus cases could quickly see local health systems overwhelmed. But as countries on the continent, like counterparts elsewhere, responded to the outbreak with lockdowns and movement restrictions, the economic impact—particularly on vulnerable informal economy workers who depend on daily income for survival—also became apparent, especially given the broad lack of social safety nets.

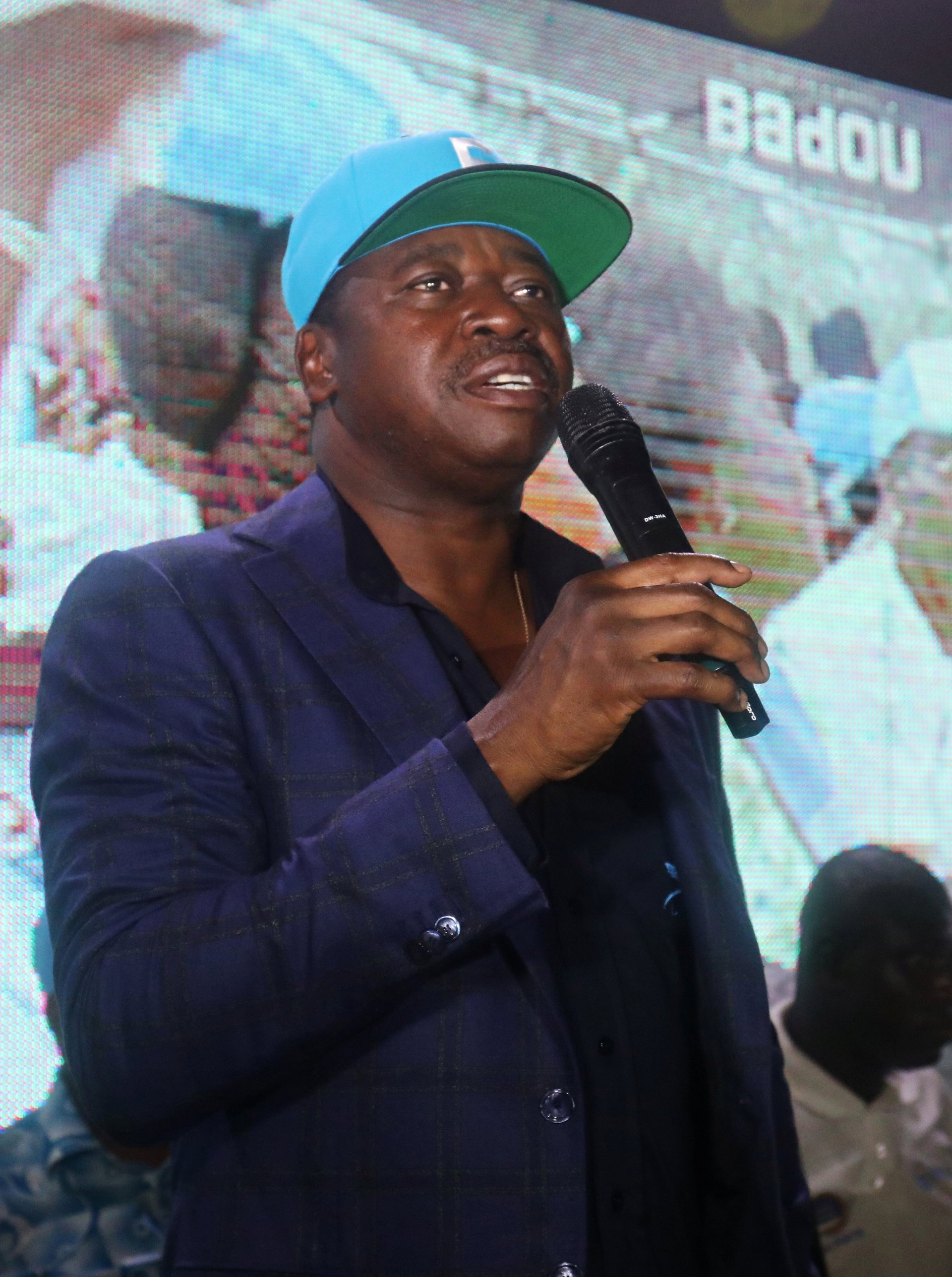

For its part, Togo has looked to solve that problem with Novissi, a digital cash transfer program that sends funds to citizens through mobile money. Togo’s president Faure Gnassingbé has said the scheme targets informal workers whose incomes were “disrupted” by lockdowns. As of mid-April, over 1.1 million Togolese citizens—13% of the population—had registered for Novissi with around 450,000 people (65% of which were women) proving eligible beneficiaries and receiving up to 35% of the minimum wage.

“The fact that Togo can do this, at scale and so quickly, shows the power of good digital technology to reinvent government services,” says Anit Mukherjee, policy fellow at the Center for Global Development and co-author of the Center’s recent report on state-powered digital payments schemes. “If countries can use digital systems and tools appropriately, they can also do what Togo did—it’s not rocket science. They just need to have the will,” he adds.

Togo, with a population of 8 million and a GDP of $5.4 billion in 2018, is classified as a low income country. With a gross national income per capita of just $660, Togo is well below the Sub Saharan Africa average of $1,520. But its mobile phone subscriber base has grown rapidly over the past decade to 6.14 million subscriptions in 2018, according to data from the International Telecommunication Union.

Although it has shown digital leadership for cash transfers, in the recent past president Gnassingbé’s administration has blocked social media apps like WhatsApp to curtail political activists who have challenged his rule. Gnassingbé took power in 2005, succeeding his father, Gnassingbé Eyadéma, who ruled the west African nation for 38 years. In spite of opposition protests, the country changed presidential term limits in 2017 and in February he won the election in a landslide for his fourth term as president.

Yet, in digitizing the process of finding, verifying and providing funds to segments of its population that are outside its formal economy, Togo is not only providing social relief but also crucially plugging major data gaps which typically exists in African countries.

A prominent example of this problem is seen in much larger West African neighbor Nigeria where data gaps mean the government’s social relief programs through the pandemic have been both inefficient and inadequate resulting in ordinary Nigerians increasingly having to step up and help. In fact, Nigeria has not held a national census in 14 years.

But Togo’s system isn’t without potential flaws as digitization, by itself, does not represent a silver bullet. “Digitized systems are built on existing systems and one has to be very careful when building a digital system to ensure that the shortcomings of the base systems are not reflected,” Mukherjee says. For instance, the Novissi scheme’s requirement of a voter’s card represents a limitation for eligible beneficiaries who do not participate in electoral processes.

And despite the clear utility of the program, there are also questions over its sustainability: the Novissi scheme paid out $4.3 million in its first week alone. But while the Togolese government has said payouts will only last as long the declared state of emergency, there is long-term potential for using the scheme, and aggregated data, for more targeted disbursements, including pensioners, Mukherjee says. “Right now, it is basically a blunt instrument but what can you do after fine-tuning it?”

Sign up to the Quartz Africa Weekly Brief here for news and analysis on African business, tech and innovation in your inbox