Crypto struggles for legitimacy in Africa despite growing use

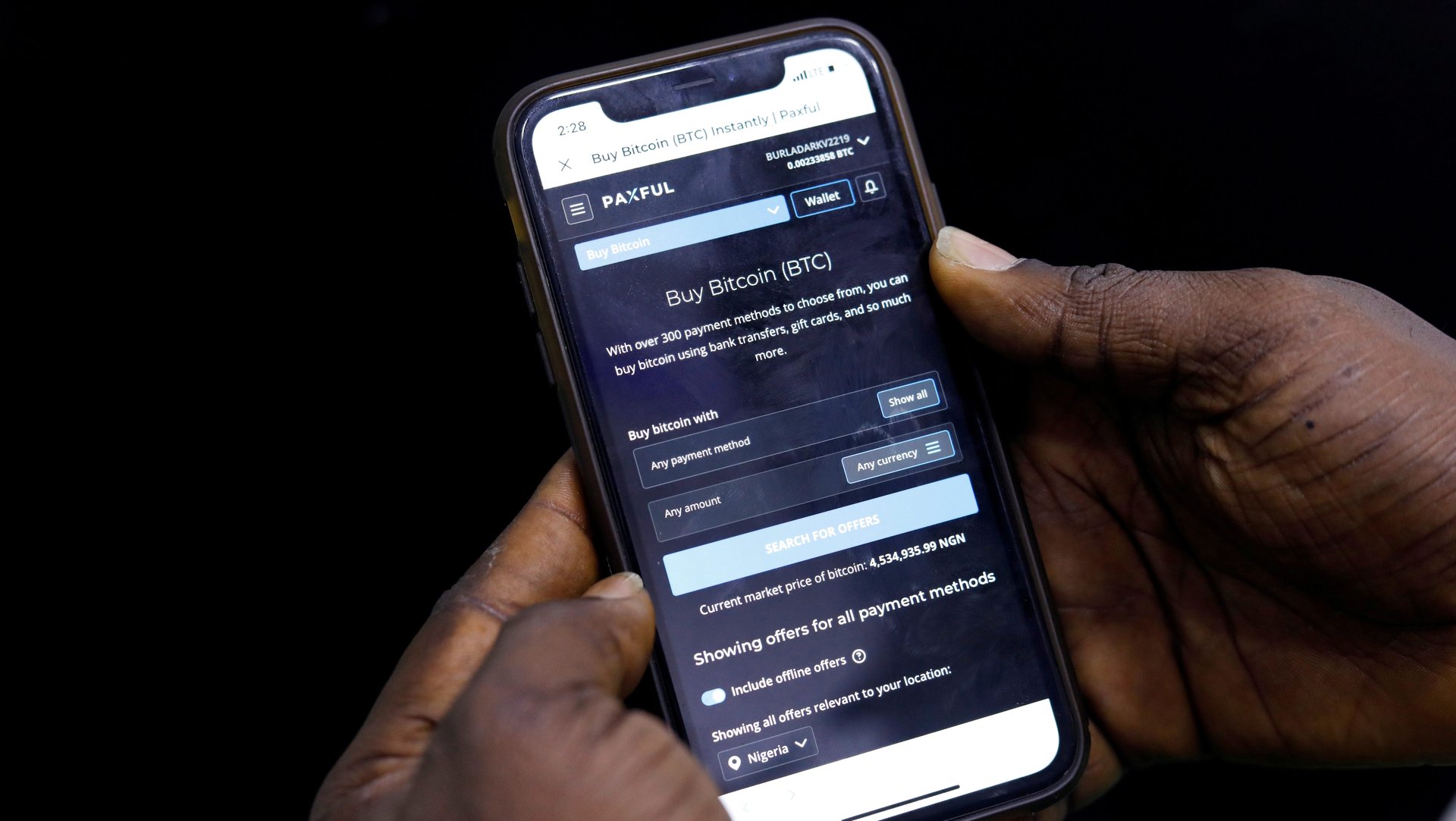

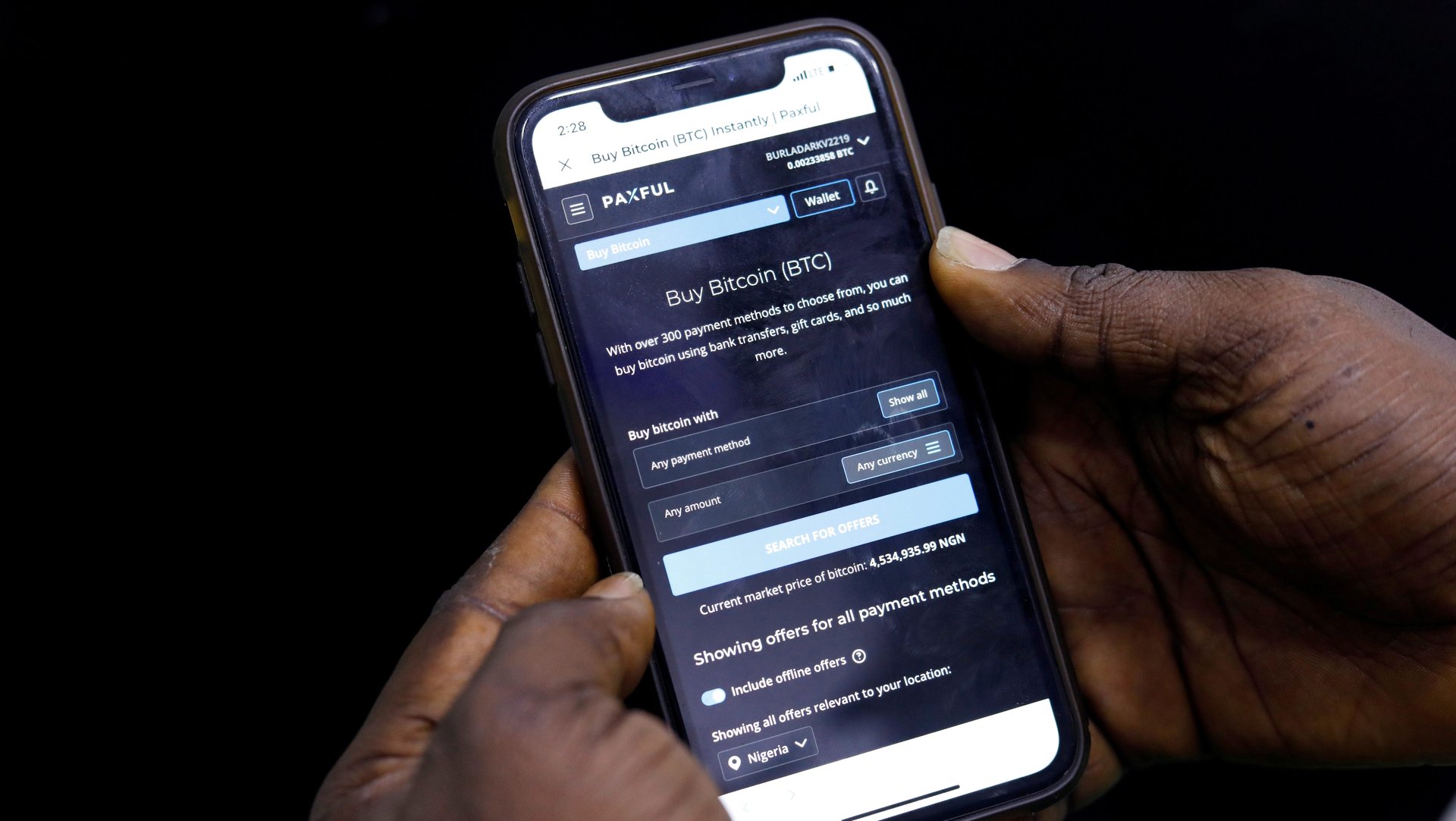

Cryptomania is sweeping the continent faster than anywhere in the world, with transaction volumes growing by 1,200% between July 2020 and 2021, according to Chainalysis, a blockchain data platform. In Nigeria, Africa’s largest economy, one in three people have already reported using crypto, making it one of the largest crypto market by users worldwide.

Cryptomania is sweeping the continent faster than anywhere in the world, with transaction volumes growing by 1,200% between July 2020 and 2021, according to Chainalysis, a blockchain data platform. In Nigeria, Africa’s largest economy, one in three people have already reported using crypto, making it one of the largest crypto market by users worldwide.

Last year, Kenya was ranked top globally in terms of peer to peer crypto trade, while Nigeria saw a meteoric rise in crypto use despite a ban. In Africa, the rapid adoption rates are being fueled by a young population that views virtual currencies as a safer counterbalance to their over-inflated fiat currencies.

But the old guard is not jumping on this bandwagon. The response from Africa’s governments has ranged from an indifferent “Wild West” absence of regulation to outright prohibitions that have proven ineffective in slowing trading.

Nowhere is this more apparent than Nigeria, whose central bank barred its financial institutions from enabling cryptocurrency transactions last year, joining 23 other African countries that have either implicit or total bans on trading (Africa accounts for more than half of countries that restrict the purchase of cryptocurrencies.)

Crypto regulation in many African countries is unfavorable

In a regulatory quagmire of apprehension and ambivalence, frontrunner countries like South Africa and Mauritius have demonstrated how a progressive stance toward cryptocurrency can create enormous benefits. It’s the type of regulatory approach that will eventually pique the interest of private sector institutional investors.

While many emerging markets governments will watch closely where the US and other early adopters shake out in creating a regulatory landscape, they may also avail themselves of the sandbox solutions springing up from financial service providers themselves.

For instance, many money transfer businesses, like Western Union, and remittance businesses such as World Remit, OFX, and Currencies Direct, have developed creative ways to complete the “know your customer” (KYC) checks without fixed addresses or tax returns.

Crypto use in Africa is rising despite regulatory challenges

Attempts by governments to curtail crypto have done nothing to slow down its growth. In Nigeria, a country of 200 million people with a median age of 18 years old, the youth have been innovative in creating financial products that address the problems of systemic volatility and insecurity associated with the naira (the currency is 10% weaker against the dollar since the ban).

Ironically, the fate of these young Nigerian crypto traders is in the hands of a 79-year-old former army general, President Muhammadu Buhari. In the age of Tiktok and the Metaverse, Buhari has been wary of the predilections of Nigeria’s youth.

Last June, shortly after Twitter deleted his comments threatening violence against Biafra insurgents in the southeast of the country, the government banned Twitter from the country entirely (it was reinstated seven months later). The crypto ban was brought about, in part, by reports that the protest movement against police brutality, EndSARS, had been partly funded through bitcoin transactions.

The elders in Nigeria’s government view cryptocurrency as a threat to stability. This reticence is felt similarly in America, but US regulators are looking at ways to facilitate a stable market rather than ban the new financial phenomenon. We can only hope emerging market leaders change their minds, because cryptomania is no passing phase.