No region may be more affected by a financial meltdown in China than Africa. ”If China sneezes, Africa can now catch a cold,” researchers with the International Monetary Fund concluded last year.

Already, South Africa’s rand has hit its lowest level in 19 months and stocks declined 4%. In Zambia, a major copper producer for China, the kwacha has fallen to an all time low of 8.5750 versus the US dollar. If the meltdown is a sign that China’s long-expected economic slowdown is finally upon us, here is who will be hit the hardest:

Exporters

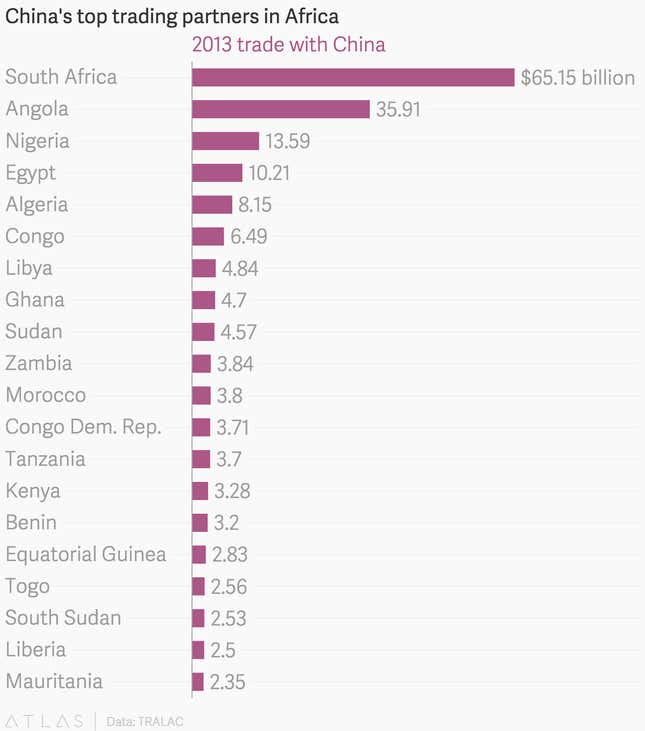

Trade between China and the continent totaled $220 billion last year, three times the trade between United States and Africa. The bulk of this trade is in raw materials like copper, iron ore, crude oil, and other commodities that China needed to fuel its growth. But countries like South Africa, Mauritius, and Ethiopia are also exporting finished goods like wine and apparel.

Given the fact that exports to China have accounted for 30% of the region’s total export growth between 2005 and 2012, it’s not hard to see why exports would suffer. A 1% decline in domestic investment growth would likely be accompanied with a 0.6 percentage-point decline in the region’s export growth, researchers from the IMF concluded in a 2013 paper (pdf).

For commodity exporters Angola, South Africa, the Republic of Congo, Equatorial Guinea, and the Democratic Republic of the Congo—the region’s top five exporters to China—a 1% decline will mean a 0.8 percentage-point decrease.

Tourism

Chinese tourists to the region are still few but their ranks are growing quickly. In Tanzania, the number of Chinese tourists grew 39% last year to more than 16,000 and is expected to grow another 40% this year. Kenya hopes to attract one million tourists this year, with new direct flights between Nairobi and Guangzhou. South Africa’s tourism sector has already suffered from a 32% drop in Chinese tourists after it unveiled new visa rules requiring birth certificates for any children under the age of 18.

The region needs Chinese tourists. The number of international tourists to Africa grew by only 2% last year, the weakest of any region, according to estimates by the World Tourism Organization.

Factories

Chinese companies are still building key infrastructure in African cities, like highways, railways, public transport, airports, as well as special economic zones, sports stadiums, and apartment blocks. They are also investing in needed industries, like manufacturing. In Ethiopia, where factory workers cost about a tenth of what they do in China, Chinese investors have started glass, shoe, and car production facilities. In Mali, the Chinese have funded sugar refineries and in Uganda, textile and steel factories.

Without Chinese investment and trade, African economies will have to make up for a shortfall in capital from abroad to complete these projects. “We find that Africa is highly vulnerable to China’s slowdown,” Oliver White, an economist with the London-based research firm, Fathom Consulting, told Deutsche Welle in April. His company forecasts the region will grow just 3% this year and 3.5% next year, compared to annual growth of an average of 5.5% between 2000 and 2007.