Nigeria’s stock market has taken a beating as the country continues to struggle with an uncertain economic situation amid low oil prices. In the first two weeks of the year, the stock market lost $10.5 billion as investors, wary of the what has been described as a heightened risk environment, are dumping stocks.

The stock market opened the year at $49 billion (pdf) but has lost 21% of its value since then —about the same value of losses recorded between May and December 2015. Put another way, with president Buhari now having been in office for 30 weeks, the stock market has lost as much value in the last two weeks as it did in Buhari’s first 28 weeks in charge.

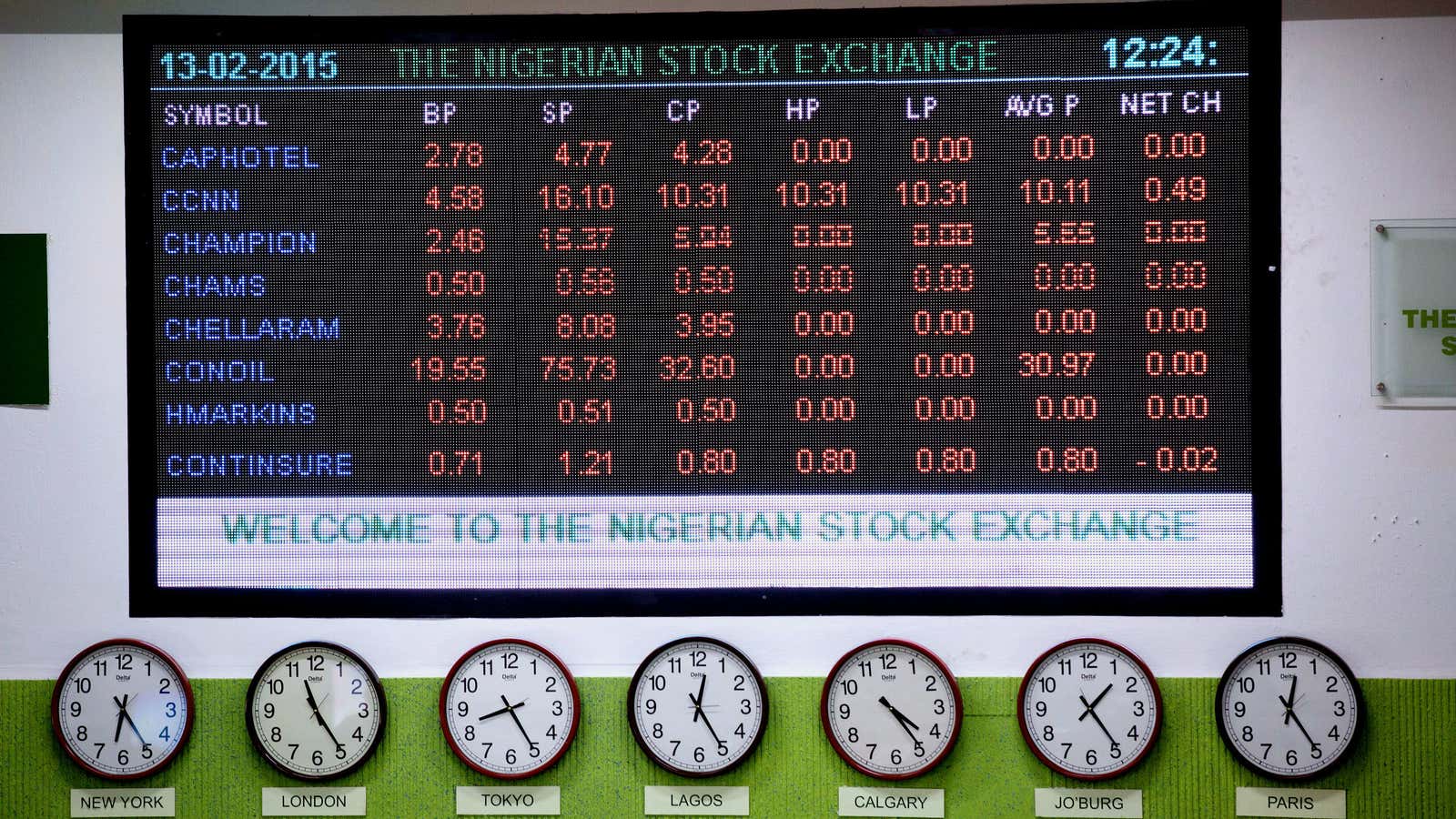

Last Tuesday (Jan. 13), the market fell to its lowest point in three years. Financial services and the consumer good sectors have been worst hit as the market slide continued through the week forcing the stock exchange to introduce circuit breakers. Still, no-one is quite sure how much worse things might get. ”We are seeing the market dip in a very unusual manner. We keep speculating on where the bottom is, but with crude still tanking, it’s impossible to see this just yet,” says Tunji Andrews, analyst at TTAC Africa.

The stock market losses raise questions on Buhari’s handling of the economy since taking office. While he has made fighting corruption a clear priority, doubts persist over his expertise in regard to the economy. Those doubts have been made worse by a combination of various factors.

In reaction to dipping oil prices, Buhari’s government has responded with unconventional monetary policies such as restricting the use of Nigerian debit cards abroad. His government has also slapped heavy fines on foreign-owned businesses such as Guinness and MTN. Put together, these have resulted in weakening investor confidence in Africa’s largest economy meaning oil prices are probably not the only reason for the stock market crash. ”What we must understand is that, aside from falling oil prices, much of the [drop] off is due to poor investor confidence,” Andrews said. “You look everywhere and all you see is investment unfriendly policies and fines.”