US president Joe Biden is floating a “windfall tax” for oil companies after another quarter of record profits.

He called on oil and gas companies to direct their record profits towards increasing production and reducing costs for Americans in an address at the White House yesterday (Oct. 31). The fossil fuel companies haven’t yet announced plans to do either.

“If they don’t, they’re going to pay a higher tax on their excess profits, and face other restrictions,” he said. “It’s time for these companies to stop war profiteering.”

The harsh call to action comes just over a week before midterm elections, where voters, irked by high inflation and rising gas prices, will decide if Democrats retain control of the US Congress or not. If Republicans take charge, it’ll get harder for Biden to pass any more agenda items in his next two years in office, putting policies around the economy, abortion rights, immigration, and the economy in a flux.

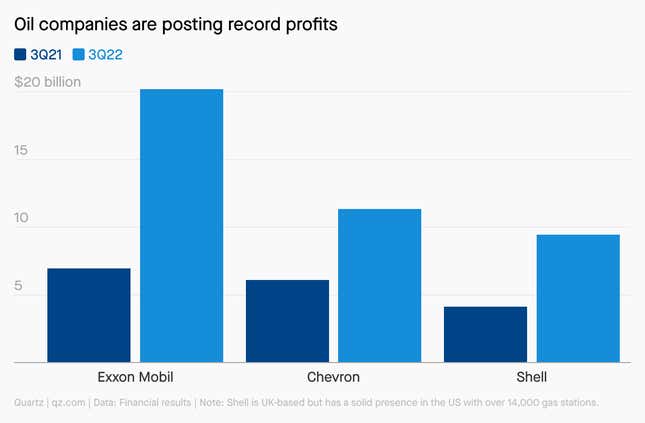

Charted: Oil companies’ earnings

The duty of “war profiteering” oil companies, in Biden’s words

“Oil companies’ record profits today are not because they’re doing something new or innovative. Their profits are a windfall of war—the windfall from the brutal conflict that’s ravaging Ukraine and hurting tens of millions of people around the globe. You know, at a time of war, any company receiving historic windfall profits like this has a responsibility to act beyond their narrow self-interest of its executives and shareholders.” —US president Joe Biden

Tackling America’s oil and gas crisis, by the digits

$100 billion: profits six major oil companies—Exxon Mobil, Chevron, Shell, BP, ConocoPhillips and TotalEnergy—have clocked in the last six months

$3.74: Average gas price per gallon in the US, according to the American Automobile Association

50 cents: how much gasoline prices would be down if oil companies passed on excess profits, according to Biden

180 million: barrels of oil Biden has already released from the US Strategic Petroleum Reserve between March and now, to temper prices. When OPEC+ nations slashed production, he said he wouldn’t shy away from expelling more

$30 billion: share buybacks through end of 2023 announced by Exxon in April

$15 billion: top end of Chevron’s annual share buyback after it was raised twice already

$4 billion: share buybacks initiated by Shell that will benefit shareholders

25%: the windfall tax the British government introduced in May with the intent to raise £5 billion ($5.76 billion) to offset the rising cost-of-living. The government is considering raising it to 30%

What is a windfall tax and how does it work?

A windfall tax is a higher one-time tax the government levies on an industry clocking unusual amounts of profit while economic conditions favor them. On paper, it is an effective way to alleviate some of the burden of the rising energy bills for households. And the behemoths in the oil industry can probably afford it given their history of high margins and negative taxes—yes, they sometimes get money back from the IRS thanks to tax breaks.

Biden isn’t the only one in favor of a one-time tax on obscenely high profits. In California, where gas prices are averaging a whopping $6.42 per gallon at pumps, governor Gavin Newsom has also castigated oil companies and called for a windfall tax. Earlier this year, senator Sheldon Whitehouse and representative Ro Khanna introduced a bill to “punish” Big Oil by levying 50% tax on profits earned above $66 per barrel.

One argument companies may use to push back against a windfall tax is that they’d have less funds left to amp up production and make low carbon investments. However, these companies already make very low commitments in this space. “If a windfall tax does have a significant impact on the bottom line of the Big Five then they should have to justify why low-carbon investments should be slashed instead of dividends, stock buybacks and executive compensation,” according to UK-based think tank Common Wealth.

But implementation can be tricky. A similar tax under the Jimmy Carter administration in 1980 actually pushed domestic prices up and production down. It was expensive to administration and revenues did not meet expectations.

In the UK, a windfall tax introduced in May has loopholes, giving tax relief for any new investment. Shell did not pay any windfall tax this quarter because, despite global profits of $9.5 billion, its UK entity did not make any due, in part, to investments in North Sea drilling. BP, which reported $8.2 billion in profits today, is expected to pay about $800 million.

Related stories

🤨 Gas prices are so high they’re making governments suspicious